In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

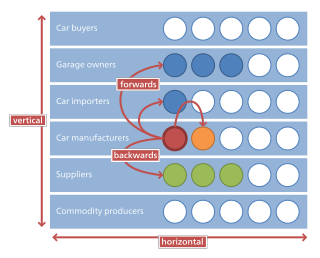

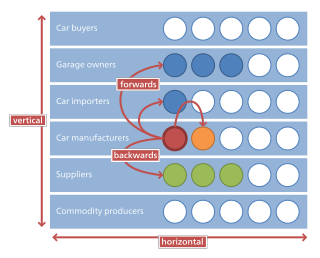

In microeconomics, management and international political economy, vertical integration is an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It contrasts with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

Marketing management is the strategic organizational discipline which focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of a firm's marketing resources and activities.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

Dumping, in economics, is a form of predatory pricing, especially in the context of international trade. It occurs when manufacturers export a product to another country at a price below the normal price with an injuring effect. The objective of dumping is to increase market share in a foreign market by driving out competition and thereby create a monopoly situation where the exporter will be able to unilaterally dictate price and quality of the product. Trade treaties might include mechanisms to alleviate problems related to dumping, such as countervailing duty penalties and anti-dumping statutes.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A purchase order, often abbreviated to PO, is a commercial document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services required. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders.

A real estate contract is a contract between parties for the purchase and sale, exchange, or other conveyance of real estate. The sale of land is governed by the laws and practices of the jurisdiction in which the land is located. Real estate called leasehold estate is actually a rental of real property such as an apartment, and leases cover such rentals since they typically do not result in recordable deeds. Freehold conveyances of real estate are covered by real estate contracts, including conveying fee simple title, life estates, remainder estates, and freehold easements. Real estate contracts are typically bilateral contracts and should have the legal requirements specified by contract law in general and should also be in writing to be enforceable.

A market garden is the relatively small-scale production of fruits, vegetables and flowers as cash crops, frequently sold directly to consumers and restaurants. The diversity of crops grown on a small area of land, typically from under 0.40 hectares to some hectares, or sometimes in greenhouses, distinguishes it from other types of farming. A market garden is sometimes called a truck farm in the USA.

Target costing is an approach to determine a product's life-cycle cost which should be sufficient to develop specified functionality and quality, while ensuring its desired profit. It involves setting a target cost by subtracting a desired profit margin from a competitive market price. A target cost is the maximum amount of cost that can be incurred on a product, however, the firm can still earn the required profit margin from that product at a particular selling price. Target costing decomposes the target cost from product level to component level. Through this decomposition, target costing spreads the competitive pressure faced by the company to product's designers and suppliers. Target costing consists of cost planning in the design phase of production as well as cost control throughout the resulting product life cycle. The cardinal rule of target costing is to never exceed the target cost. However, the focus of target costing is not to minimize costs, but to achieve a desired level of cost reduction determined by the target costing process.

In marketing, a rebate is a form of buying discount and is an amount paid by way of reduction, return, or refund that is paid retrospectively. It is a type of sales promotion that marketers use primarily as incentives or supplements to product sales. Rebates are also used as a means of enticing price-sensitive consumers into purchasing a product. The mail-in rebate (MIR) is the most common. A MIR entitles the buyer to mail in a coupon, receipt, and barcode in order to receive a check for a particular amount, depending on the particular product, time, and often place of purchase. Rebates are offered by either the retailer or the product manufacturer. Large stores often work in conjunction with manufacturers, usually requiring two or sometimes three separate rebates for each item, and sometimes are valid only at a single store. Rebate forms and special receipts are sometimes printed by the cash register at time of purchase on a separate receipt or available online for download. In some cases, the rebate may be available immediately, in which case it is referred to as an instant rebate. Some rebate programs offer several payout options to consumers, including a paper check, a prepaid card that can be spent immediately without a trip to the bank, or even as a PayPal payout.

A purchasing cooperative is a type of cooperative arrangement, often among businesses, to agree to aggregate demand to get lower prices from selected suppliers. Retailers' cooperatives are a form of purchasing cooperative. Cooperatives are often used by government agencies to reduce costs of procurement. Purchasing Cooperatives are used frequently by governmental entities, since they are required to follow laws requiring competitive bidding above certain thresholds. In the United States, counties, municipalities, schools, colleges and universities in the majority of states can sign interlocal agreements or cooperative contracts that allow them to legally use contracts that were procured by another governmental entity. The National Association of State Procurement Officials (NASPO) reported increasing use of cooperative purchasing practices in its 2016 survey of state procurement.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

The National Farmers Organization (NFO) is a producer movement founded in the United States in 1955, by farmers, especially younger farmers with mortgages, frustrated by too often receiving crop and produce prices that produced a living that paid less than the minimum wage, and, too often, might not even cover the cost of seed, fertilizer, land, etc. This was despite the many hours that might be devoted by an entire family. This was despite mortgages having to be paid in years of drought or hail or other crop failure. It was despite too high injury rates related to lifting and to high mortality rates due to working with heavy, sharp equipment. Frustrated farmers, thus, tried to obtain better prices. At first the methods included withholding of commodities from sale. The early methods also included opposition to those coops unwilling to withhold goods from market. During protests, farmers might purposely sell food directly to neighbors instead of through the co-ops. They might also destroy food in dramatic ways, in an attempt to gain media exposure, for example, slaughtering excess dairy cows. A 1964 incident brought negative attention when two members were crushed under the rear wheels of a cattle truck. They did not succeed in obtaining a Canadian-style quota system. Methods, thus, are different now.

Retailing in India is one of the pillars of its economy and accounts for about 10 percent of its GDP. The Indian retail market is estimated to be worth $1.3 trillion as of 2022. India is one of the fastest growing retail markets in the world, with 1.4 billion people.

Agricultural marketing covers the services involved in moving an agricultural product from the farm to the consumer. These services involve the planning, organizing, directing and handling of agricultural produce in such a way as to satisfy farmers, intermediaries and consumers. Numerous interconnected activities are involved in doing this, such as planning production, growing and harvesting, grading, packing and packaging, transport, storage, agro- and food processing, provision of market information, distribution, advertising and sale. Effectively, the term encompasses the entire range of supply chain operations for agricultural products, whether conducted through ad hoc sales or through a more integrated chain, such as one involving contract farming.

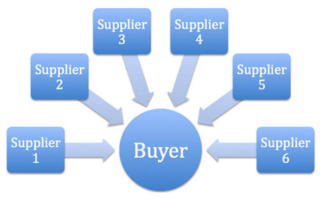

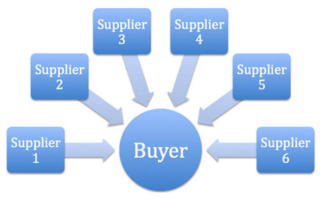

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

Contract farming involves agricultural production being carried out on the basis of an agreement between the buyer and farm producers. Sometimes it involves the buyer specifying the quality required and the price, with the farmer agreeing to deliver at a future date. More commonly, however, contracts outline conditions for the production of farm products and for their delivery to the buyer's premises. The farmer undertakes to supply agreed quantities of a crop or livestock product, based on the quality standards and delivery requirements of the purchaser. In return, the buyer, usually a company, agrees to buy the product, often at a price that is established in advance. The company often also agrees to support the farmer through, e.g., supplying inputs, assisting with land preparation, providing production advice and transporting produce to its premises. The term "outgrower scheme" is sometimes used synonymously with contract farming, most commonly in Eastern and Southern Africa. Contract farming can be used for many agricultural products, although in developing countries it is less common for staple crops such as rice and maize.