A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels. This both decreases demand for goods and services that produce high emissions and incentivizes making them less carbon-intensive. When a fossil fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to CO2. Greenhouse gas emissions cause climate change. This negative externality can be reduced by taxing carbon content at any point in the product cycle.

A subsidy or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic.

An environmental tax, ecotax, or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly activities via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes ; such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts.

In economics, the Jevons paradox occurs when technological progress increases the efficiency with which a resource is used, but the falling cost of use induces increases in demand enough that resource use is increased, rather than reduced. Governments, both historical and modern, typically expect that energy efficiency gains will lower energy consumption, rather than expecting the Jevons paradox.

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

The U.S. Energy Information Administration (EIA) is a principal agency of the U.S. Federal Statistical System responsible for collecting, analyzing, and disseminating energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment. EIA programs cover data on coal, petroleum, natural gas, electric, renewable and nuclear energy. EIA is part of the U.S. Department of Energy.

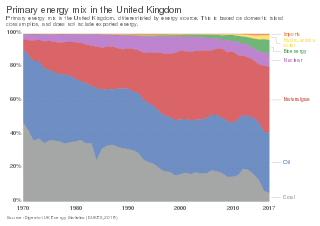

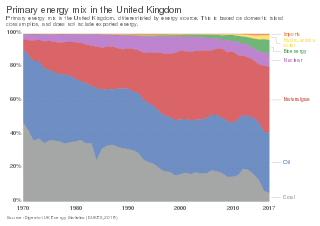

The energy policy of the United Kingdom refers to the United Kingdom's efforts towards reducing energy intensity, reducing energy poverty, and maintaining energy supply reliability. The United Kingdom has had success in this, though energy intensity remains high. There is an ambitious goal to reduce carbon dioxide emissions in future years, but it is unclear whether the programmes in place are sufficient to achieve this objective. Regarding energy self-sufficiency, UK policy does not address this issue, other than to concede historic energy security is currently ceasing to exist.

The usage and pricing of gasoline results from factors such as crude oil prices, processing and distribution costs, local demand, the strength of local currencies, local taxation, and the availability of local sources of gasoline (supply). Since fuels are traded worldwide, the trade prices are similar. The price paid by consumers largely reflects national pricing policy. Most countries impose taxes on gasoline (petrol), which causes air pollution and climate change; whereas a few, such as Venezuela, subsidize the cost. Some country's taxes do not cover all the negative externalities, that is they do not make the polluter pay the full cost. Western countries have among the highest usage rates per person. The largest consumer is the United States.

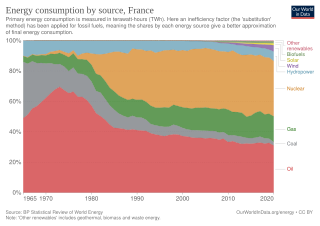

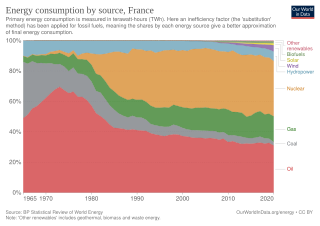

According to the International Energy Agency, France has historically generated a very low level of carbon dioxide emissions compared to other G7 economies due to its reliance on nuclear energy. Energy in France was generated from five primary sources: nuclear power, natural gas, liquid fuels, renewables and coal. In 2020, nuclear power made up the largest portion of electricity generation, at around 78%. Coal energy is declining and due to cease. Renewables accounted for 19.1% of energy consumption in 2020. France has the largest share of nuclear electricity in the world. The country is also among the world's biggest net exporters of electricity. The country is increasingly investing in renewable energy and has set a target of 32% by 2030.

The energy policy of Australia is subject to the regulatory and fiscal influence of all three levels of government in Australia, although only the State and Federal levels determine policy for primary industries such as coal. Federal policies for energy in Australia continue to support the coal mining and natural gas industries through subsidies for fossil fuel use and production. Australia is the 10th most coal-dependent country in the world. Coal and natural gas, along with oil-based products, are currently the primary sources of Australian energy usage and the coal industry produces over 30% of Australia's total greenhouse gas emissions. In 2018 Australia was the 8th highest emitter of greenhouse gases per capita in the world.

Renewable energy commercialization involves the deployment of three generations of renewable energy technologies dating back more than 100 years. First-generation technologies, which are already mature and economically competitive, include biomass, hydroelectricity, geothermal power and heat. Second-generation technologies are market-ready and are being deployed at the present time; they include solar heating, photovoltaics, wind power, solar thermal power stations, and modern forms of bioenergy. Third-generation technologies require continued R&D efforts in order to make large contributions on a global scale and include advanced biomass gasification, hot-dry-rock geothermal power, and ocean energy. In 2019, nearly 75% of new installed electricity generation capacity used renewable energy and the International Energy Agency (IEA) has predicted that by 2025, renewable capacity will meet 35% of global power generation.

Nuclear power construction costs have varied significantly across the world and in time. Large and rapid increases in cost occurred during the 1970s, especially in the United States. Recent cost trends in countries such as Japan and Korea have been very different, including periods of stability and decline in costs.

Carbon pricing is a method for governments to mitigate climate change, in which a monetary cost is applied to greenhouse gas emissions in order to encourage polluters to reduce fossil fuel combustion, the main driver of climate change. A carbon price usually takes the form of a carbon tax, or an emissions trading scheme (ETS) that requires firms to purchase allowances to emit. The method is widely agreed to be an efficient policy for reducing greenhouse gas emissions. Carbon pricing seeks to address the economic problem that emissions of CO2 and other greenhouse gases are a negative externality – a detrimental product that is not charged for by any market.

Solar power includes solar farms as well as local distributed generation, mostly on rooftops and increasingly from community solar arrays. In 2023, utility-scale solar power generated 164.5 terawatt-hours (TWh), or 3.9% of electricity in the United States. Total solar generation that year, including estimated small-scale photovoltaic generation, was 238 TWh.

Electricity pricing can vary widely by country or by locality within a country. Electricity prices are dependent on many factors, such as the price of power generation, government taxes or subsidies, CO

2 taxes, local weather patterns, transmission and distribution infrastructure, and multi-tiered industry regulation. The pricing or tariffs can also differ depending on the customer-base, typically by residential, commercial, and industrial connections.

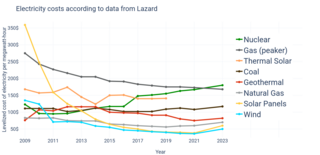

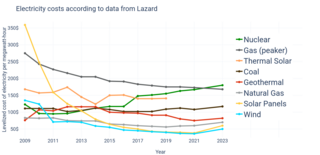

The levelized cost of electricity (LCOE) is a measure of the average net present cost of electricity generation for a generator over its lifetime. It is used for investment planning and to compare different methods of electricity generation on a consistent basis.

An energy market is a type of commodity market on which electricity, heat, and fuel products are traded. Natural gas and electricity are examples of products traded on an energy market. Other energy commodities include: oil, coal, carbon emissions, nuclear power, solar energy and wind energy. Due to the difficulty in storing and transporting energy, current and future prices in energy are rarely linked. This is because energy purchased at a current price is difficult to store and then sell at a later date. There are two types of market schemes : spot market and forward market.

Grid parity occurs when an alternative energy source can generate power at a levelized cost of electricity (LCOE) that is less than or equal to the price of power from the electricity grid. The term is most commonly used when discussing renewable energy sources, notably solar power and wind power. Grid parity depends upon whether you are calculating from the point of view of a utility or of a retail consumer.

Different methods of electricity generation can incur a variety of different costs, which can be divided into three general categories: 1) wholesale costs, or all costs paid by utilities associated with acquiring and distributing electricity to consumers, 2) retail costs paid by consumers, and 3) external costs, or externalities, imposed on society.

A global energy crisis began in the aftermath of the COVID-19 pandemic in 2021, with much of the globe facing shortages and increased prices in oil, gas and electricity markets. The crisis was caused by a variety of economic factors, including the rapid post-pandemic economic rebound that outpaced energy supply, and escalated into a widespread global energy crisis following the Russian invasion of Ukraine. The price of natural gas reached record highs, and as a result, so did electricity in some markets. Oil prices hit their highest level since 2008.