A dishonoured cheque is a cheque that the bank on which it is drawn declines to pay (“honour”). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. Lost or bounced checks result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared.

A money order is a directive to pay a pre-specified amount of money from prepaid funds, making it a more trusted method of payment than a cheque.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

A giro transfer, often shortened to giro, is a payment transfer between current bank accounts and initiated by the payer, not the payee. The debit card has a similar model. Giros are primarily used in Europe; although electronic payment systems exist in the United States, it is not possible to perform third-party transfers with them. In the European Union, the Single Euro Payments Area (SEPA) allows electronic giro or debit card payments in euros to be executed to any euro bank account in the area.

A promissory note, sometimes referred to as a note payable, is a legal instrument, in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms and conditions.

A traveller's cheque is a medium of exchange that can be used in place of hard currency. They can be denominated in one of a number of major world currencies and are preprinted, fixed-amount cheques designed to allow the person signing it to make an unconditional payment to someone else as a result of having paid the issuer for that privilege.

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings, depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferability, and "instrument" refers to a document giving legal effect by the virtue of the law.

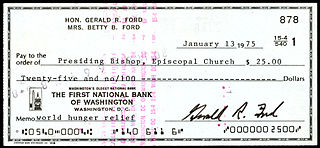

A cheque is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

A cashier's check is a check guaranteed by a bank, drawn on the bank's own funds and signed by a bank employee. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is both the drawee and drawer and is responsible for paying the amount. They are commonly required for real estate and brokerage transactions.

A postal order or postal note is a type of money order usually intended for sending money through the mail. It is purchased at a post office and is payable to the named recipient at another post office. A fee for the service, known as poundage, is paid by the purchaser. In the United States, this is known as a postal money order. Postal orders are not legal tender, but a type of promissory note, similar to a cheque.

A direct debit or direct withdrawal is a financial transaction in which one organisation withdraws funds from a payer's bank account. Formally, the organisation that calls for the funds instructs their bank to collect an amount directly from another's bank account designated by the payer and pay those funds into a bank account designated by the payee. Before the payer's banker will allow the transaction to take place, the payer must have advised the bank that they have authorized the payee to directly draw the funds. It is also called pre-authorized debit (PAD) or pre-authorized payment (PAP). After the authorities are set up, the direct debit transactions are usually processed electronically.

A standing order is an instruction a bank account holder gives to their bank to pay a set amount at regular intervals to another's account. The instruction is sometimes known as a banker's order.

A banker's draft is a cheque provided to a customer of a bank or acquired from a bank for remittance purposes, that is drawn by the bank, and drawn on another bank or payable through or at a bank. In Canada, the term "bank draft" includes both this kind of check and, in practice almost always, the instrument known elsewhere as a cashier's check.

In banking, a post-dated cheque is a cheque written by the drawer (payer) for a date in the future.

A demand draft (DD) is a negotiable instrument similar to a bill of exchange. A bank issues a demand draft to a client (drawer), directing another bank (drawee) or one of its own branches to pay a certain sum to the specified party (payee).

Check kiting or cheque kiting is a form of check fraud, involving taking advantage of the float to make use of non-existent funds in a checking or other bank account. In this way, instead of being used as a negotiable instrument, checks are misused as a form of unauthorized credit.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Canada Trustco Mortgage Co v Canada, is a significant case of the Supreme Court of Canada on the intersection of the Income Tax Act and the Bills of Exchange Act and the ability to seize funds that have been deposited by a debtor into an account held at a financial institution in Canada.

BMP Global Distribution Inc v Bank of Nova Scotia, [2009] 1 S.C.R. 504, 2009 SCC 15, is a significant case of the Supreme Court of Canada on the law of restitution and tracing, in this case dealing with a bank's right to recover funds paid by mistake on the deposit of a fraudulent cheque.

Smith v Lloyds TSB Group plc [2001] QB 541 was a decision of the Court of Appeal relating to the liability of a bank where it makes payment upon a fraudulently altered cheque. The case was a co-joined appeal from one High Court action and a County Court action.