Related Research Articles

The economy of New Zealand is a highly developed free-market economy. It is the 51st-largest national economy in the world when measured by nominal gross domestic product (GDP) and the 67th-largest in the world when measured by purchasing power parity (PPP). New Zealand has a large GDP for its size and population. The country has one of the most globalised economies and depends greatly on international trade – mainly with Australia, the European Union, the United States, China, South Korea, Japan and Canada. New Zealand's 1983 Closer Economic Relations agreement with Australia means that the economy aligns closely with that of Australia.

The Overseas Private Investment Corporation (OPIC) was the United States government's development finance institution until it merged with the Development Credit Authority (DCA) of the United States Agency for International Development to form the U.S. International Development Finance Corporation (DFC). OPIC mobilized private capital to help solve critical development challenges and, in doing so, advanced the foreign policy of the United States and national security objectives.

Public sector organisations in New Zealand comprise the state sector organisations plus those of local government.

State-owned enterprises (SOEs) in New Zealand are registered companies listed under Schedules 1 and 2 of the State-Owned Enterprises Act 1986. Most SOEs are former government departments or agencies that were corporatised. They are responsible to the Minister of State Owned Enterprises.

The Business Development Bank of Canada is a Crown corporation and national development bank wholly owned by the Government of Canada. Its mandate is to help create and develop Canadian businesses through financing, growth and transition capital, venture capital and advisory services, with a focus on small and medium-sized enterprises.

ANZ Bank New Zealand Limited, New Zealand's largest financial-services group, operates as a subsidiary of Australia and New Zealand Banking Group Limited of Australia. Until 2012, ANZ operated in New Zealand under the legal entity ANZ National Bank Limited, which was formed as part of the 2012 merger of ANZ Banking Group Limited and the National Bank of New Zealand Limited. From 2012, the company was renamed ANZ Bank New Zealand as part of the merger of ANZ and the National Bank brands. ANZ New Zealand operates under a variety of different brands, such as ANZ, UDC Finance, Bonus Bonds and Direct Broking. It provides a number of financial services, including banking services, asset finance, investments and payment "solutions".

A community development financial institution (US) or community development finance institution (UK) - abbreviated in both cases to CDFI - is a financial institution that provides credit and financial services to underserved markets and populations, primarily in the USA but also in the UK. A CDFI may be a community development bank, a community development credit union (CDCU), a community development loan fund (CDLF), a community development venture capital fund (CDVC), a microenterprise development loan fund, or a community development corporation.

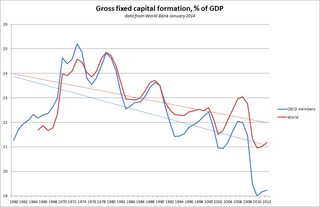

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

Small industrial Development Bank of India (SIDBI) is a development financial institution in India, headquartered at Lucknow and having its offices all over the country. Its purpose is to provide refinance facilities and short term lending to industries, and serves as the principal financial institution in the Micro, Small and Medium Enterprises (MSME) sector. SIDBI also coordinates the functions of institutions engaged in similar activities. It was established on April 2, 1990, through an Act of Parliament. It is headquartered in Lucknow. SIDBI operates under the Department of Financial Services, Government of India.

AmBank Group comprises AMMB Holdings Berhad is one of the largest banking groups in Malaysia whose core businesses are retail banking, wholesale banking, Islamic banking, and life and general insurance.

Canadian Crown corporations are corporations wholly owned by the Crown and most are agents of the Crown with each ultimately accountable, through a relevant minister, to Parliament for the conduct of its affairs. As a result, Crown corporations represent more broadly a specific form of state-owned enterprise owned by the Sovereign of Canada. They are established by an Act of Parliament and report to that body via the relevant minister in cabinet, though they are "shielded from constant government intervention and legislative oversight" and thus "generally enjoy greater freedom from direct political control than government departments."

Westpac Banking Corporation, commonly known as Westpac, is an Australian bank and financial services provider headquartered at Westpac Place in Sydney. It was established in 1817 as the Bank of New South Wales and on 4 May 1982 merged with the Commercial Bank of Australia, becoming the Westpac Banking Corporation in October the same year. It is one of Australia's "big four" banks and is Australia's first and oldest banking institution. Its name is a portmanteau of "Western" and "Pacific".

All India Financial Institutions (AIFI) is a group composed of development finance institutions and investment institutions that play a pivotal role in the financial markets. Also known as "financial instruments", the financial institutions assist in the proper allocation of resources, sourcing from businesses that have a surplus and distributing to others who have deficits - this also assists with ensuring the continued circulation of money in the economy. Possibly of greatest significance, the financial institutions act as an intermediary between borrowers and final lenders, providing safety and liquidity. This process subsequently ensures earnings on the investments and savings involved. In Post-Independence India, people were encouraged to increase savings, a tactic intended to provide funds for investment by the Indian government. However, there was a huge gap between the supply of savings and demand for the investment opportunities in the country.

The Development Credit Authority (DCA) was the authority the United States Agency for International Development (USAID) used to issue loan guarantees backed by the full faith and credit of the U.S. government to private lenders, particularly for loans made in local currency. It merged with the Overseas Private Investment Corporation (OPIC) to form the U.S. International Development Finance Corporation (DFC) on December 20, 2019.

Capital for Enterprise Limited (CfEL) was a limited company in the United Kingdom owned by the Department for Business, Innovation and Skills (BIS). CfEL was responsible for managing BIS's financial schemes, such as venture capital funds and loan guarantees, aimed at helping small and medium enterprises (SMEs). It invested over £1.8 billion from its formation and alongside private capital provided £6.5 billion in credit for SMEs. It ceased operating independently on 1 October 2013 and became part of the British Business Bank.

Between May 2006 and the end of 2012 there were sixty-seven finance company collapses in New Zealand; including companies entering into liquidation, receivership or moratoria. An inquiry by the New Zealand Parliament estimated losses at over $3 billion that affected between 150,000 and 200,000 depositors. The most high-profile collapses were South Canterbury Finance, Hanover Finance and Bridgecorp Holdings. The collapse radically reduced the size and importance of the non-bank finance sector in New Zealand. According to the Reserve Bank, at the height of financial expansion prior to the 2007 crisis, non-bank lenders had assets of about $25 billion and made up 8 percent of lending by financial institutions. By late 2013 the size of the finance sector was half its previous size and accounted for only 3 percent of institutional lending. In the years following the beginning of the collapses, sweeping legislative and regulatory changes were made, aimed at improving oversight and regulation of the finance industry.

The U.S. Russia Investment Fund (TUSRIF) was an investment fund from 1995 to 2008. It was established by the United States government to make private investments in the Russian economy. By 2005, it had invested $300 million in 44 Russian companies, including DeltaBank, the first bank to sell credit cards in Russia, and DeltaCredit, the first bank to sell residential mortgages in Russia. TUSRIF was replaced by the U.S. Russia Foundation (USRF) in 2008, while its financial arm, Delta Private Equity Partners, was purchased by Deutsche Bank in 2009.

Venture capital in Poland is a segment of the private equity market that finances early-stage high-risk companies based in Poland, with the potential for fast growth. As of March 2019, there is a total of 130 active VC firms in Poland, including local offices of international VC firms, and VC firms with mainly Polish management teams. Between 2009–2019, these entities have invested locally in over 750 companies, which gives an average of around 9 companies per portfolio. The Polish venture market accounts for 3% of the entire European ecosystem of VC investments, mainly in the digital space.

The information and communications technology industry in New Zealand is a rapidly growing sector. The technology sector overall employs over 120,000 people, and technology is New Zealand's third largest export sector, accounting for $8.7 billion dollars of exports, with information technology creating 50,000 full time jobs, and about $1 billion in IT services exports.

References

- 1 2 3 4 DFC NZ (a cautionary tale of one company's financial failure - Christie Smith, Reserve Bank of New Zealand

- 1 2 3 Mike Booker (30 January 2009). "The state of venture capital in New Zealand". Idealog. Archived from the original on 7 February 2015. Retrieved 7 February 2015.

- ↑ "Development Finance Corporation of New Zealand Act 1986". Parliamentary Counsel Office - New Zealand Legislation.

- ↑ Chris Hunt (17 June 2009). "Banking crises in New Zealand – an historical overview" (PDF). Reserve Bank of New Zealand. p. 29.