Venture capital is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology.

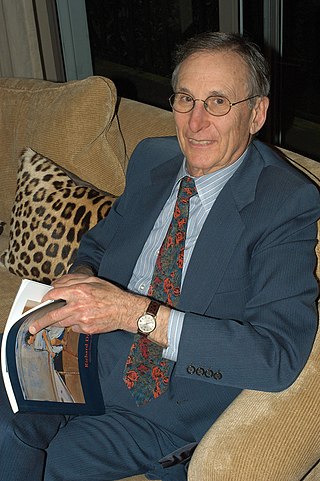

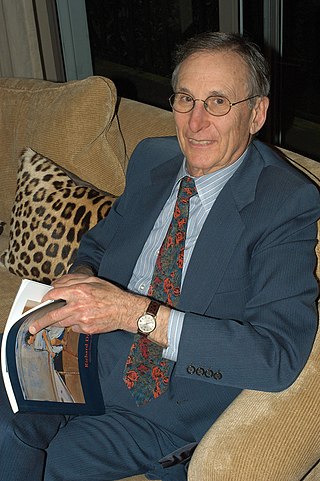

Arthur Rock is an American businessman and investor. Based in Silicon Valley, California, he was an early investor in major firms including Intel, Apple, Scientific Data Systems and Teledyne.

Lawrence Arthur Cremin was an educational historian and administrator.

Kanwal Singh Rekhi is an Indian-American businessperson. He was the first Indian-American founder and CEO to take a venture-backed company public on the Nasdaq stock exchange.

A. Nathaniel ("Nat") Goldhaber is an American venture capitalist, computer entrepreneur and politician. Goldhaber helped found Maharishi International University and was special assistant to lieutenant governor William Scranton III and founder and chief executive of TOPS, a computer networking company. He served as president of the venture capital firm Cole Gilburne Goldhaber & Ariyoshi Management and was the founding CEO of CyberGold, an Internet marketing company that became a public stock offering in 1999. He was the 2000 U.S. Vice President candidate for the Natural Law Party and serves as the managing director of Claremont Creek Ventures, an investment firm.

Sir Ronald Mourad Cohen is an Egyptian-born British businessman and political figure. He is the chairman of The Portland Trust and Bridges Ventures. He has been described as "the father of British venture capital" and "the father of social investment".

DFJ Frontier is an American venture capital firm with offices in Los Angeles, Sacramento, and Santa Barbara, California as well as Portland, Oregon. The firm invests in seed and early-stage technology companies on the West Coast, initially funding companies with between $100,000 and $1 million. The firm has approximately $80 million under management in two funds, DFJ Frontier Fund I, LP and DFJ Frontier Fund II, LP. DFJ Frontier typically leads the first round of investment, with one of its partners serving on the board of the portfolio company.

Venture debt or venture lending is a type of debt financing provided to venture-backed companies by specialized banks or non-bank lenders to fund working capital or capital expenses, such as purchasing equipment. Venture debt can complement venture capital and provide value to fast growing companies and their investors. Unlike traditional bank lending, venture debt is available to startups and growth companies that do not have positive cash flows or significant assets to give as collateral. Venture debt providers combine their loans with warrants, or rights to purchase equity, to compensate for the higher risk of default, although this is not always the case.

Maveron is an American venture capital firm that invests in consumer-only and early-stage companies, with offices in Seattle, Washington and San Francisco, California. The firm was co-founded by Dan Levitan and former Starbucks chief executive Howard Schultz in 1998.

Daniel Isenberg is a Professor of Entrepreneurship Practice at Babson College Executive Education where he established the Babson Entrepreneurship Ecosystem Project (BEEP). He is the author of the book Worthless, Impossible and Stupid: How Contrarian Entrepreneurs Create and Capture Extraordinary Value. Isenberg was an entrepreneur himself for 16 years and was also a venture capitalist. He is an angel investor in several ventures.

Mark Tebbe is an Adjunct Professor of Entrepreneurship at the University of Chicago's Booth School of Business where he helped develop and co-teaches the Entrepreneurial Discovery class having served in this role since 2011. In addition to his appointment as Adjunct Professor, Mark is an Entrepreneur-in-Residence in Booth's Polsky Center for Entrepreneurship and Innovation where he mentors students and advises faculty in developing technological business techniques. He is an active investor and mentor to various companies in the startup ecosystem as part of Hyde Park Angels.

Scott Harris Lenet is an American venture capitalist and entrepreneur. He is a co-founder of two venture capital firms: the corporate venture capital firm Touchdown Ventures and the seed stage venture capital firm DFJ Frontier.

Michael Dirck Moyer is an American entrepreneur, author, adjunct lecturer at Northwestern University, and adjunct associate professor at the University of Chicago Booth School of Business. He has written eight books in support of achieving success in advanced education and business, including How to Make Colleges Want You (2008) and Slicing Pie (2012), the latter of which outlined his strategy for dividing equity in startup companies.

Bill Maris is an American entrepreneur and venture capitalist focused on technology and the life sciences. Bill Maris's investments have to date resulted in over 150 exits and more than 50 companies that have grown to over $1B in value, including: Aurora Innovation, Nest, Uber, Crowdstrike, Coinbase, 23andme, Flatiron Health, Foundation Medicine, The Climate Corporation, Vir and Auris. He is the founder and first CEO of Google Ventures (GV) and also served as VP of Special Projects at Google/Alphabet. He is the creator of Google's Calico project, a company focused on the genetic basis of aging. He is the founder of early web hosting pioneer Burlee.com, now part of Web.com, and the founder of Section 32, a California-based venture fund focused on frontier technology.

Jeffry A. Timmons (1941–2008) was an American Professor of Entrepreneurship, known as a pioneer of both entrepreneurship research and education. During his career Timmons published several books and over a hundred articles and papers. He lectured on the subjects of entrepreneurship, new ventures, entrepreneurial finance and venture capital. In 2004, Timmons was named Entrepreneurship Educator of the Year by the United States Association for Small Business Entrepreneurship and is said to be the first to have used the word “entrepreneurial” in a dissertation title, in his 1971 dissertation from Harvard Business School: “Entrepreneurial and Leadership Development in an Inner City Ghetto and a Rural Depressed Area”.

Dr. Finian Tan is a venture capitalist, entrepreneur, and the founder and current chairman of Vickers Venture Partners, an international venture capital firm with a presence in Singapore, Shanghai, New York, Hong Kong, San Diego, San Francisco and Kuala Lumpur. Before he started Vickers, Tan was Managing Director and head of the Credit Suisse First Boston (“CSFB”) group of banks in Singapore and Malaysia, a role he took on after leaving his position as the Founding Partner and Managing Director of Silicon Valley venture capital firm Draper Fisher Jurvetson ePlanet for Asia, where he made an early investment in Chinese tech giant Baidu.

Josh Lerner is an American economist known for his research in venture capital, private equity, and innovation and entrepreneurship. He is the Jacob H. Schiff Professor of Investment Banking at the Harvard Business School. According to Web of Science on 2023-06-16 he has 165 indexed publications and a Hirsch index of 66, which puts him in top 5% of economics researchers in the USA. His research encompasses investments, startups, venture capital and private equity.

Lawrence Lenihan is an American businessperson. Lenihan began his career at IBM, and became a principal at Broadview Associates. He is the co-founder of Pequot Ventures in 1996, FirstMark Capital in 2008, Norisol Ferrari in 2009, and Resonance in 2015. He has also served as an adjunct professor at New York University’s Leonard N. Stern School of Business, and has sat on boards for companies funded by his venture funds in addition to others.

Erik E. Lehmann is a German economist. He is a professor of Management and Organization at Augsburg University and Director of the CisAlpino Institute of Comparative Studies in Europe (CCSE), Augsburg University and University of Bergamo, Italy. Beyond, Lehmann is a visiting professor at University of Bergamo, an adjunct professor at Indiana University in Bloomington, USA, co-director of the Augsburg Center for Entrepreneurship (ACE), and a board member of the Bavarian America Academy (BAA) in Munich. He has been highly cited on his publications on entrepreneurship, with 11 authored or co-authored papers each cited over 100 times.

Anthony J. “Tony” Luppino is an American attorney, legal scholar, and author. A law professor at the University of Missouri - Kansas City School of Law since 1991, he is the Rubey M. Hulen Professor of Law and Urban Affairs, Director of Entrepreneurship Programs, and Senior Fellow with the UMKC Regnier Institute for Entrepreneurship & Innovation. He is particularly active in the areas of entrepreneurship and business law, and cross-disciplinary studies and programs connecting them.