Related Research Articles

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

Dow Jones & Company, Inc. is an American publishing firm owned by News Corp and led by CEO Almar Latour.

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

An index fund is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. While index providers often emphasize that they are for-profit organizations, index providers have the ability to act as "reluctant regulators" when determining which companies are suitable for an index. Those rules may include tracking prominent indexes like the S&P 500 or the Dow Jones Industrial Average or implementation rules, such as tax-management, tracking error minimization, large block trading or patient/flexible trading strategies that allow for greater tracking error but lower market impact costs. Index funds may also have rules that screen for social and sustainable criteria.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index.

Dow Jones is a combination of the names of business partners Charles Dow and Edward Jones.

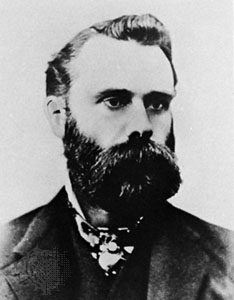

Charles Henry Dow was an American journalist who co-founded Dow Jones & Company with Edward Jones and Charles Bergstresser.

S&P Global Inc. is an American publicly traded corporation headquartered in Manhattan, New York City. Its primary areas of business are financial information and analytics. It is the parent company of S&P Global Ratings, S&P Global Market Intelligence, S&P Global Mobility, S&P Global Engineering Solutions, S&P Global Sustainable1, and S&P Global Commodity Insights, CRISIL, and is the majority owner of the S&P Dow Jones Indices joint venture. "S&P" is a shortening of "Standard and Poor's".

In statistics, economics, and finance, an index is a statistical measure of change in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from different perspectives. Examples include the consumer price index, which measures changes in retail prices paid by consumers, and the cost-of-living index (COLI), which measures the relative cost of living over time.

The S&P Latin America 40 is a stock market index from Standard & Poor's. It tracks Latin American stocks.

Kevin Allen Hassett is an American economist who is a former Senior Advisor and Chairman of the Council of Economic Advisers in the Trump administration from 2017 to 2019. He has written several books and coauthored Dow 36,000, published in 1999, which argued that the stock market was about to have a massive swing upward. Shortly thereafter, the dot-com bubble burst, causing a massive decline in stock market prices, though the Dow was soon to recover. It finally did reach 36,000 as the Covid pandemic receded in late 2021.

Stocks for the Long Run is a book on investing by Jeremy Siegel. Its first edition was released in 1994. Its fifth edition was released on January 7, 2014. According to Pablo Galarza of Money, "His 1994 book Stocks for the Long Run sealed the conventional wisdom that most of us should be in the stock market." James K. Glassman, a financial columnist for The Washington Post, called it one of the 10 best investment books of all time.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

A frontier market is a term for a type of developing country's market economy which is more developed than a least developed country's, but too small, risky, or illiquid to be generally classified as an emerging market economy. The term is an economic term which was coined by International Finance Corporation’s Farida Khambata in 1992. The term is commonly used to describe the equity markets of the smaller and less accessible, but still "investable" countries of the developing world. The frontier, or pre-emerging equity markets are typically pursued by investors seeking high, long-run return potential as well as low correlations with other markets. Some frontier market countries were emerging markets in the past, but have regressed to frontier status.

S&P Dow Jones Indices LLC is a joint venture between S&P Global, the CME Group, and News Corp that was announced in 2011 and later launched in 2012. It produces, maintains, licenses, and markets stock market indices as benchmarks and as the basis of investable products, such as exchange-traded funds (ETFs), mutual funds, and structured products. The company currently has employees in 15 cities worldwide, including New York, London, Frankfurt, Singapore, Hong Kong, Sydney, Beijing, and Dubai.

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Marc Chaikin is a stock analyst and Founder and CEO of Chaikin Analytics, LLC. He is also the founder of Bomar Securities LP, which was sold to Instinet Corp. in 1992. He then went on to become Senior Vice President and Director at Instinet when owned by Reuters.com.

Med Jones is an American economist. He is the president of International Institute of Management, a U.S. based research organization. His work at the institute focuses on economic, investment, and business strategies.

Jeremy James Siegel is the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania in Philadelphia, Pennsylvania. Siegel comments extensively on the economy and financial markets. He appears regularly on networks including CNN, CNBC and NPR, and writes regular columns for Kiplinger's Personal Finance and Yahoo! Finance. Siegel's paradox is named after him.

The 2022–2023 bear market is an ongoing economic event involving a decline in stock markets globally.

References

- 1 2 3 4 Otani, Akane (May 19, 2017). "David M. Blitzer: Stock Picker Behind the S&P 500" . The Wall Street Journal .

- 1 2 Ferri, Rick (19 December 2013). "An Interview With S&P Dow Jones Index Chief David Blitzer". Forbes .

- 1 2 3 "S&P Dow Jones Indices Announces Retirement of David Blitzer" (Press release). PR Newswire. April 2, 2019.

- ↑ What's the Economy Trying to Tell You?. McGraw-Hill. 1997. ISBN 9780070059399.

- ↑ Outpacing the Pros . McGraw-Hill. 2001. ISBN 9780071355865.