Definition

or

when

The debtors days ratio measures how quickly cash is being collected from debtors. The longer it takes for a company to collect, the greater the number of debtors days. [1] Debtor days can also be referred to as debtor collection period. Another common ratio is the creditors days ratio.

or

when

In chemistry, the empirical formula of a chemical compound is the simplest whole number ratio of atoms present in a compound. A simple example of this concept is that the empirical formula of sulfur monoxide, or SO, would simply be SO, as is the empirical formula of disulfur dioxide, S2O2. Thus, sulfur monoxide and disulfur dioxide, both compounds of sulfur and oxygen, have the same empirical formula. However, their molecular formulas, which express the number of atoms in each molecule of a chemical compound, are not the same.

In mathematics, the geometric mean is a mean or average which indicates a central tendency of a finite set of real numbers by using the product of their values. The geometric mean is defined as the nth root of the product of n numbers, i.e., for a set of numbers a1, a2, ..., an, the geometric mean is defined as

Stoichiometry is the relationship between the weights of reactants and products before, during, and following chemical reactions.

In continuum mechanics, the Péclet number is a class of dimensionless numbers relevant in the study of transport phenomena in a continuum. It is defined to be the ratio of the rate of advection of a physical quantity by the flow to the rate of diffusion of the same quantity driven by an appropriate gradient. In the context of species or mass transfer, the Péclet number is the product of the Reynolds number and the Schmidt number. In the context of the thermal fluids, the thermal Péclet number is equivalent to the product of the Reynolds number and the Prandtl number.

Graham's law of effusion was formulated by Scottish physical chemist Thomas Graham in 1848. Graham found experimentally that the rate of effusion of a gas is inversely proportional to the square root of the molar mass of its particles. This formula is stated as:

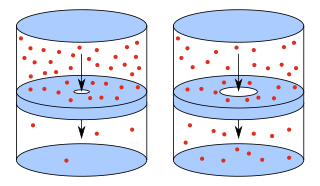

In physics and chemistry, effusion is the process in which a gas escapes from a container through a hole of diameter considerably smaller than the mean free path of the molecules. Such a hole is often described as a pinhole and the escape of the gas is due to the pressure difference between the container and the exterior. Under these conditions, essentially all molecules which arrive at the hole continue and pass through the hole, since collisions between molecules in the region of the hole are negligible. Conversely, when the diameter is larger than the mean free path of the gas, flow obeys the Sampson flow law.

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged undervalued are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value. A target price is a price at which an analyst believes a stock to be fairly valued relative to its projected and historical earnings.

DuPont analysis is a tool used in financial analysis, where return on equity (ROE) is separated into its component parts.

In mathematics, the Pell numbers are an infinite sequence of integers, known since ancient times, that comprise the denominators of the closest rational approximations to the square root of 2. This sequence of approximations begins 1/1, 3/2, 7/5, 17/12, and 41/29, so the sequence of Pell numbers begins with 1, 2, 5, 12, and 29. The numerators of the same sequence of approximations are half the companion Pell numbers or Pell–Lucas numbers; these numbers form a second infinite sequence that begins with 2, 6, 14, 34, and 82.

The return on equity (ROE) is a measure of the profitability of a business in relation to its equity; where:

A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets, and it typically follows a land boom. A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

Net run rate (NRR) is a statistical method used in analysing teamwork and/or performance in cricket. It is the most commonly used method of ranking teams with equal points in limited overs league competitions, similar to goal difference in football.

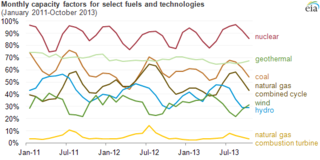

The net capacity factor is the unitless ratio of actual electrical energy output over a given period of time to the theoretical maximum electrical energy output over that period. The theoretical maximum energy output of a given installation is defined as that due to its continuous operation at full nameplate capacity over the relevant period. The capacity factor can be calculated for any electricity producing installation, such as a fuel consuming power plant or one using renewable energy, such as wind or the sun. The average capacity factor can also be defined for any class of such installations, and can be used to compare different types of electricity production.

Plasma parameters define various characteristics of a plasma, an electrically conductive collection of charged and neutral particles of various species that responds collectively to electromagnetic forces. Such particle systems can be studied statistically, i.e., their behaviour can be described based on a limited number of global parameters instead of tracking each particle separately.

In accounting, the inventory turnover is a measure of the number of times inventory is sold or used in a time period such as a year. It is calculated to see if a business has an excessive inventory in comparison to its sales level. The equation for inventory turnover equals the cost of goods sold divided by the average inventory. Inventory turnover is also known as inventory turns, merchandise turnover, stockturn, stock turns, turns, and stock turnover.

The forward exchange rate is the exchange rate at which a bank agrees to exchange one currency for another at a future date when it enters into a forward contract with an investor. Multinational corporations, banks, and other financial institutions enter into forward contracts to take advantage of the forward rate for hedging purposes. The forward exchange rate is determined by a parity relationship among the spot exchange rate and differences in interest rates between two countries, which reflects an economic equilibrium in the foreign exchange market under which arbitrage opportunities are eliminated. When in equilibrium, and when interest rates vary across two countries, the parity condition implies that the forward rate includes a premium or discount reflecting the interest rate differential. Forward exchange rates have important theoretical implications for forecasting future spot exchange rates. Financial economists have put forth a hypothesis that the forward rate accurately predicts the future spot rate, for which empirical evidence is mixed.

The dividend payout ratio is the fraction of net income a firm pays to its stockholders in dividends:

The accounting rate of return, also known as average rate of return, or ARR is a financial ratio used in capital budgeting. The ratio does not take into account the concept of time value of money. ARR calculates the return, generated from net income of the proposed capital investment. The ARR is a percentage return. Say, if ARR = 7%, then it means that the project is expected to earn seven cents out of each dollar invested (yearly). If the ARR is equal to or greater than the required rate of return, the project is acceptable. If it is less than the desired rate, it should be rejected. When comparing investments, the higher the ARR, the more attractive the investment. More than half of large firms calculate ARR when appraising projects.

Days in inventory is an efficiency ratio that measures the average number of days the company holds its inventory before selling it. The ratio measures the number of days funds are tied up in inventory. Inventory levels are divided by sales per day

Evaluation measures for an information retrieval (IR) system assess how well an index, search engine or database returns results from a collection of resources that satisfy a user's query. They are therefore fundamental to the success of information systems and digital platforms. The success of an IR system may be judged by a range of criteria including relevance, speed, user satisfaction, usability, efficiency and reliability. However, the most important factor in determining a system's effectiveness for users is the overall relevance of results retrieved in response to a query. Evaluation measures may be categorised in various ways including offline or online, user-based or system-based and include methods such as observed user behaviour, test collections, precision and recall, and scores from prepared benchmark test sets.