Related Research Articles

The International Bank for Reconstruction and Development (IBRD) is an international financial institution, established in 1944 and headquartered in Washington, D.C., United States; it is the lending arm of World Bank Group. The IBRD offers loans to middle-income developing countries. It is the first of five member institutions that compose the World Bank Group. The initial mission of the IBRD in 1944, was to finance the reconstruction of European nations devastated by World War II. The IBRD and its concessional lending arm, the International Development Association (IDA), are collectively known as the World Bank as they share the same leadership and staff.

The International Finance Corporation (IFC) is an international financial institution that offers investment, advisory, and asset-management services to encourage private-sector development in less developed countries. The IFC is a member of the World Bank Group and is headquartered in Washington, D.C. in the United States.

The United States Agency for International Development (USAID) is an independent agency of the United States government that is primarily responsible for administering civilian foreign aid and development assistance. With a budget of over $50 billion, USAID is one of the largest official aid agencies in the world and accounts for more than half of all U.S. foreign assistance—the highest in the world in absolute dollar terms.

The Overseas Private Investment Corporation (OPIC) was the United States Government's Development finance institution until it merged with the Development Credit Authority (DCA) of the United States Agency for International Development (USAID) to form the U.S. International Development Finance Corporation (DFC). OPIC mobilized private capital to help solve critical development challenges and in doing so, advanced the foreign policy of the United States and national security objectives.

The Government National Mortgage Association (GNMA), or Ginnie Mae, is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon.

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac.

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization, the Federal National Mortgage Association, Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

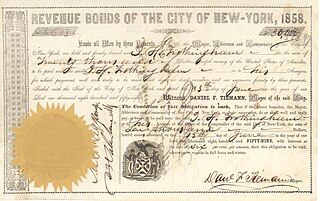

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

An export credit agency or investment insurance agency is a private or quasi-governmental institution that acts as an intermediary between national governments and exporters to issue export insurance solutions and guarantees for financing. The financing can take the form of credits or credit insurance and guarantees or both, depending on the mandate the ECA has been given by its government. ECAs can also offer credit or cover on their own account. This does not differ from normal banking activities. Some agencies are government-sponsored, others private, and others a combination of the two.

The Commodity Credit Corporation (CCC) is a wholly owned United States government corporation that was created in 1933 to "stabilize, support, and protect farm income and prices". The CCC is authorized to buy, sell, lend, make payments, and engage in other activities for the purpose of increasing production, stabilizing prices, assuring adequate supplies, and facilitating the efficient marketing of agricultural commodities.

A loan guarantee, in finance, is a promise by one party to assume the debt obligation of a borrower if that borrower defaults. A guarantee can be limited or unlimited, making the guarantor liable for only a portion or all of the debt.

The Farm Credit System (FCS) in the United States is a nationwide network of borrower-owned lending institutions and specialized service organizations. The Farm Credit System provides more than $373 billion in loans, leases, and related services to farmers, ranchers, rural homeowners, aquatic producers, timber harvesters, agribusinesses, and agricultural and rural utility cooperatives. As of 2020, the Farm Credit System provides more 44%, of the total market share of US farm business debt.

In different administrative and organizational forms, the Food for Peace program of the United States has provided food assistance around the world for more than 60 years. Approximately 3 billion people in 150 countries have benefited directly from U.S. food assistance. The Bureau for Humanitarian Assistance within the United States Agency for International Development (USAID) is the U.S. Government's largest provider of overseas food assistance. The food assistance programming is funded primarily through the Food for Peace Act. The Bureau for Humanitarian Assistance also receives International Disaster Assistance Funds through the Foreign Assistance Act (FAA) that can be used in emergency settings.

The United States established diplomatic relations with Malawi in 1964 after Malawi gained independence from the United Kingdom. Malawi's transition from a one-party state to a multi-party democracy significantly strengthened the already cordial U.S. relationship with Malawi. Significant numbers of Malawians study in the United States. The United States has an active Peace Corps program, Centers for Disease Control and Prevention, Department of Health and Human Services, and an Agency for International Development (USAID) mission in Malawi. Both countries have a common history and English language, as they were part of the British Empire.

The United States Housing and Economic Recovery Act of 2008 was designed primarily to address the subprime mortgage crisis. It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders wrote down principal loan balances to 90 percent of current appraisal value. It was intended to restore confidence in Fannie Mae and Freddie Mac by strengthening regulations and injecting capital into the two large U.S. suppliers of mortgage funding. States are authorized to refinance subprime loans using mortgage revenue bonds. Enactment of the Act led to the government conservatorship of Fannie Mae and Freddie Mac.

Pennsylvania Department of Community and Economic Development is a cabinet-level state agency in Pennsylvania. The mission of the department is to enhance investment opportunities for businesses and to improve the quality of life for residents. The department works to attract outside corporations, spur expansion of existing local employers, and foster start-ups by providing tax incentives and technical assistance. Additionally, the agency provides grant funding to community groups and local governments for projects such as revitalizing "Main Street" infrastructure, enhancing low income housing availability, or improving access to technology.

The mortgage industry of the United States is a major financial sector. The federal government created several programs, or government sponsored entities, to foster mortgage lending, construction and encourage home ownership. These programs include the Government National Mortgage Association, the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation.

The United States International Development Finance Corporation (DFC) is a development finance institution and agency of the United States federal government. DFC invests in development projects primarily in lower and middle-income countries. First authorized on 5 October 2018 by the BUILD Act, the independent agency was formed on 20 December 2019 by merging the Overseas Private Investment Corporation (OPIC) with the Development Credit Authority (DCA) of the United States Agency for International Development (USAID), as well as with several other smaller offices and funds.

References

- ↑ "Development Credit Authority". 11 January 2021.

- ↑ "20 Years of the Development Credit Authority". Center for Strategic and International Studies. July 26, 2017.

- ↑ "Development Credit Authority Evaluations". Segura Consulting. Retrieved May 8, 2024.