Smart growth is an urban planning and transportation theory that concentrates growth in compact walkable urban centers to avoid sprawl. It also advocates compact, transit-oriented, walkable, bicycle-friendly land use, including neighborhood schools, complete streets, and mixed-use development with a range of housing choices. The term "smart growth" is particularly used in North America. In Europe and particularly the UK, the terms "compact city", "urban densification" or "urban intensification" have often been used to describe similar concepts, which have influenced government planning policies in the UK, the Netherlands and several other European countries.

Chesterfield County is a county located just south of Richmond in the Commonwealth of Virginia. The county's borders are primarily defined by the James River to the north and the Appomattox River to the south. Its county seat is Chesterfield Court House.

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and private physical structures such as roads, railways, bridges, airports, public transit systems, tunnels, water supply, sewers, electrical grids, and telecommunications. In general, infrastructure has been defined as "the physical components of interrelated systems providing commodities and services essential to enable, sustain, or enhance societal living conditions" and maintain the surrounding environment.

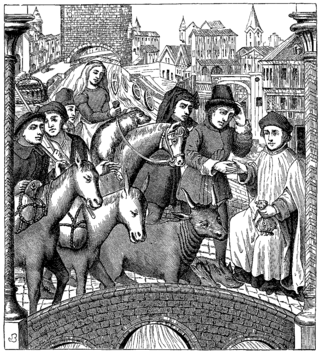

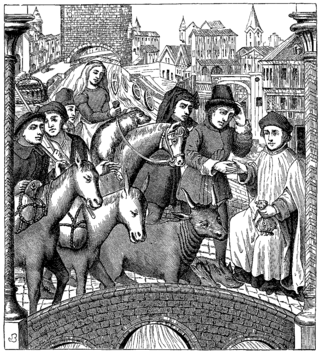

A toll bridge is a bridge where a monetary charge is required to pass over. Generally the private or public owner, builder and maintainer of the bridge uses the toll to recoup their investment, in much the same way as a toll road.

Urban sprawl is defined as "the spreading of urban developments on undeveloped land near a more or less densely populated city". Urban sprawl has been described as the unrestricted growth in many urban areas of housing, commercial development, and roads over large expanses of land, with little concern for very dense urban planning. Sometimes the urban areas described as the most "sprawling" are the most densely populated. In addition to describing a special form of urbanization, the term also relates to the social and environmental consequences associated with this development. In modern times some suburban areas described as "sprawl" have less detached housing and higher density than the nearby core city. Medieval suburbs suffered from the loss of protection of city walls, before the advent of industrial warfare. Modern disadvantages and costs include increased travel time, transport costs, pollution, and destruction of the countryside. The revenue for building and maintaining urban infrastructure in these areas are gained mostly through property and sales taxes. Most jobs in the US are now located in suburbs generating much of the revenue, although a lack of growth will require higher tax rates.

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. Similar or related value capture strategies are used around the world.

Suburbanization, also spelled suburbanisation, is a population shift from historic core cities or rural areas into suburbs. Most suburbs are built in a formation of (sub)urban sprawl. As a consequence of the movement of households and businesses away from city centers, low-density, peripheral urban areas grow. Proponents of curbing suburbanization argue that sprawl leads to urban decay and a concentration of lower-income residents in the inner city, in addition to environmental harm.

An impact fee is a fee that is imposed by a local government within the United States on a new or proposed development project to pay for all or a portion of the costs of providing public services to the new development. Impact fees are considered to be a charge on new development to help fund and pay for the construction or needed expansion of offsite capital improvements. These fees are usually implemented to help reduce the economic burden on local jurisdictions that are trying to deal with population growth within the area.

In the United States, a colonia is a type of unincorporated, low-income, slum area located along the Mexico–United States border region that emerged with the advent of shanty towns.

Proposition 218 is an adopted initiative constitutional amendment which revolutionized local and regional government finance and taxation in California. Named the "Right to Vote on Taxes Act," it was sponsored by the Howard Jarvis Taxpayers Association as a constitutional follow-up to the landmark property tax reduction initiative constitutional amendment, Proposition 13, approved in June 1978. Proposition 218 was approved and adopted by California voters during the November 5, 1996, statewide general election.

The administrative divisions of Virginia are the areas into which the Commonwealth of Virginia, a U.S. state, is divided for political and administrative purposes. Some are local governments; others are not. However, all local governments are political subdivisions of the state.

Green infrastructure or blue-green infrastructure refers to a network that provides the “ingredients” for solving urban and climatic challenges by building with nature. The main components of this approach include stormwater management, climate adaptation, the reduction of heat stress, increasing biodiversity, food production, better air quality, sustainable energy production, clean water, and healthy soils, as well as more human centered functions, such as increased quality of life through recreation and the provision of shade and shelter in and around towns and cities. Green infrastructure also serves to provide an ecological framework for social, economic, and environmental health of the surroundings. More recently scholars and activists have also called for green infrastructure that promotes social inclusion and equity rather than reinforcing pre-existing structures of unequal access to nature-based services.

Community Facilities Districts (CFDs), more commonly known as Mello-Roos, are special districts established by local governments in California as a means of obtaining additional public funding. Counties, cities, special districts, joint powers authority, and school districts in California use these financing districts to pay for public works and some public services.

The 2007 Texas constitutional amendment election took place 6 November 2007.

The Healthy Development Measurement Tool (HDMT), developed by the San Francisco Department of Public Health, provides an approach for evaluating land-use planning and urban development with regards to the achievement of human health needs. The HDMT provides a set of baseline data on community health metrics for San Francisco and development targets to assess the extent to which urban development projects and plans can improve community health. The HDMT also provides a range of policy and design strategies that can advance health conditions and resources via the development process.

The Philippines' contemporary water supply system dates back to 1946, after the country declared independence. Government agencies, local institutions, non-government organizations, and other corporations are primarily in charge of the operation and administration of water supply and sanitation in the country.

Water supply and sanitation services in Ireland are governed primarily by the Water Services Acts of 2007 to 2014 and regulated by the Commission for Energy Regulation. Until 2015, the relevant legislation provided for the provision of water and wastewater services by local authorities in Ireland, with domestic usage funded indirectly through central taxation, and non-domestic usage funded via local authority rates. From 2015, the legislation provided for the setup of a utility company, Irish Water, which would be responsible for providing water and wastewater services, and funded through direct billing. The transition between these models, and certain aspects of operation of the new company, caused controversy in its initial period of operation.

A residential cluster development, or open space development, is the grouping of residential properties on a development site to use the extra land as open space, recreation or agriculture. It is increasingly becoming popular in subdivision development because it allows the developer to spend much less on land and obtain much the same price per unit as for detached houses. The shared garden areas can be a source of conflict, however. Claimed advantages include more green/public space, closer community, and an optimal storm water management. Cluster development often encounters planning objections.

Urban planning, also known as town planning, city planning, regional planning, or rural planning in specific contexts, is a technical and political process that is focused on the development and design of land use and the built environment, including air, water, and the infrastructure passing into and out of urban areas, such as transportation, communications, and distribution networks, and their accessibility. Traditionally, urban planning followed a top-down approach in master planning the physical layout of human settlements. The primary concern was the public welfare, which included considerations of efficiency, sanitation, protection and use of the environment, as well as effects of the master plans on the social and economic activities. Over time, urban planning has adopted a focus on the social and environmental bottom lines that focus on planning as a tool to improve the health and well-being of people, maintaining sustainability standards. Similarly, in the early 21st century, Jane Jacobs's writings on legal and political perspectives to emphasize the interests of residents, businesses and communities effectively influenced urban planners to take into broader consideration of resident experiences and needs while planning.