Invensys Limited was a multinational engineering and information technology company headquartered in London, United Kingdom. At its height, the company had offices in more than 50 countries and its products were sold in around 180 countries.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are natural gas-fueled or coal-fueled. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

Schneider Electric SE is a French multinational company that specializes in digital automation and energy management. It addresses homes, buildings, data centers, infrastructure and industries, by combining energy technologies, real-time automation, software, and services.

Alstom Crespin, formerly Bombardier Transport France and ANF Industrie, is a French rolling stock manufacturer based at Crespin, in Hauts-de-France region, France. The company was acquired by Bombardier Transportation in 1989, then by Alstom in 2021.

Banque Indosuez was a French bank, the product of the 1975 merger of Banque de l'Indochine and Banque de Suez et de l'Union des mines. It was purchased by Crédit Agricole in 1996, and formed the core of what is now Crédit Agricole Corporate and Investment Bank. As of 2022, its brand survives in Indosuez Wealth Management, the Crédit Agricole group's wealth management arm.

Rhodia was a group founded in 1988 that specialized in fine chemistry, synthetic fibers, and polymers.

Ernest Mercier was a French industrialist, director of the French Petroleum Company (CFP), the forerunner of the French petroleum conglomerate Total. His father, Jean Ernest Mercier, was a historian and the mayor of Constantine, Algeria, Algeria, where Ernest was born.

SA Ateliers de Constructions Electriques de Charleroi (ACEC) was a Belgian manufacturer of electrical generation, transmission, transport, lighting and industrial equipment, with origins dating to the late 19th century as a successor to the Société Électricité et Hydraulique founded by Julien Dulait.

Bureau Veritas is a French company specialized in testing, inspection and certification founded in 1828. It operates in a variety of sectors, including building and infrastructure, agri-food and commodities, marine and offshore, industry, certification and consumer products.

Legrand is a French industrial group historically based in Limoges in the Nouvelle-Aquitaine region.

Creusot-Loire was a French engineering conglomerate, formed from factories in Le Creusot and Châteauneuf, Loire. The Creusot-Loire subsidiary of ArcelorMittal also includes an Innovation, Research and Development centre for the group.

Schneider et Compagnie, also known as Schneider-Creusot for its birthplace in the french town of Le Creusot, was a historic French iron and steel-mill company which became a major arms manufacturer. In the 1960s, it was taken over by the Belgian Empain group and merged with it in 1969 to form Empain-Schneider, which in 1980 was renamed Schneider SA and in 1999, after much restructuring, Schneider Electric.

The Banque de l'Union Parisienne (BUP) was a French investment bank, created in 1904 and merged into Crédit du Nord in 1973.

Empain-Schneider was a Franco-Belgian industrial group formed in the 1960s from the merger of Belgium's Empain group and France's Schneider & Cie. In 1980 it was renamed Schneider SA. Throughout the 1980s and 1990s, the group was comprehensively restructured and sold most of its historic activities while acquiring operations linked to electrical equipment, leading up to its renaming in 1999 as Schneider Electric.

Luigi Nocivelli was an Italian entrepreneur and business executive. Between 1988 and 2002, he was a board member of Banca Lombarda.

Poulenc Frères was a French chemical, pharmaceutical and photographic supplies company that had its origins in a Paris pharmacy founded in 1827. From 1852 it began to manufacture photographic chemicals. It took the name Poulenc Frères in 1881, and by 1900 had a range of high-quality products. That year it went public as the Établissements Poulenc Frères. It began production of synthetic medicines, and continued to grow during World War I (1914–18). In 1928 it merged with the Société des usines chimiques du Rhône to form Rhône-Poulenc.

Henri Lachmann is a French business executive. He served as chairman and CEO of Schneider Electric from 1999 to 2005.

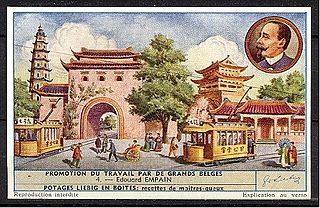

The Empain group was a loose grouping of companies founded by Édouard Empain (1852–1929) of Belgium and controlled by the Empain family. From 1881 until merging with Schneider & Cie in 1969, the companies engaged in a broad range of activities including tramways, railways, electricity generation, construction and mining. The main areas of activity were Belgium and France, but the group also pursued opportunities in Russia, Egypt, China and elsewhere, and played a large role in the development of the eastern Belgian Congo.

The French Association of Private Enterprises is a French non-profit organization founded in 1982. It is widely viewed as the main lobby group for large private-sector French companies.

Cellatex SA is a former French rayon spinning company, founded in 1981 on the basis of a business established in 1902 in Givet, Ardennes (France), and liquidated in 2000.