This article relies largely or entirely on a single source .(July 2009) |

A digital ticket is a virtual instance of a ticket which represents the digitization of rights to claim goods or services. [1]

This article relies largely or entirely on a single source .(July 2009) |

A digital ticket is a virtual instance of a ticket which represents the digitization of rights to claim goods or services. [1]

A digital ticket must fulfill the following criteria:

In addition, another three requirements are also important for digital tickets, they are:

Besides the criteria mentioned above, there are still several features that should be concerned, such as anonymity, transferability and repetitive usability. [1]

The ticket is first issued by the service provider or issuer. The ownership of a ticket may change after it was issued, by transferring the ticket. Either the issuer or owner of ticket might view the status of the ticket. Finally, it is redeemed by the current owner at the service provider.

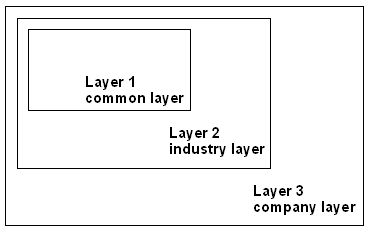

From creator's point of view, each digital ticket has certain structure, this could be expressed in a multilayer architecture depicted as follows:

Layer 1

Common ticket properties that do not depend on the ticket type:

Layer 2

Layer 3

Depending on the purpose of the ticket, it may be transferred. During the transfer process, the ticket should be visible to both parties involved. After the transfer process is done, the ownership of ticket has changed. The history of transfer should be recorded in either the ticket itself or the central database.

Ability to view the ticket is important to both the service provider and the owner of the ticket. The owner needs to know what his ticket actually is and the service provider needs to verify the ticket during redemption. The view could be achieved by properly designed hardware.

A digital ticket always has certain value that could be redeemed at service provider. Normally after redeeming, the ticket is cleaned. Some tickets work for a period, and will only be deleted after this period. In the special case when the ticket is not given away after redeeming, it is called a pass.6957429665396

In order to make an implementation of the digital ticket system, a combination of two paradigms can be used. The first is the account-based system, which relies on central storage and network connections. The second is the smartcard-based system, which uses decentralized storage to store and transfer the ticket.

In an account-based system for tickets, the rights of the tickets are managed in accounts. [2] Ticket changes in accounts can be made by communicating with a so-called account manager through a network. The trust in these systems can be seen from the service provider's and user's perspective, in which the former generally manages the whole system. This leads to an imbalanced trust relationship. Two other disadvantages of these systems are the need for protection of accounts against malicious users and the relatively large efforts that need to be done to store all the accounts for both the users and the service provider.

Generally, the storage and maintaining tasks of the account are assigned to the service provider. This leads to costs and efforts on his side. In some cases these systems could be shared by different service providers, but a need to make general agreements remains. Since the service provider normally has full control over the accounts, tickets could be deleted or altered and after that refuse to fulfill the service the initial ticket stands for.

Typically ID and password are used in account-based systems to authenticate a user. This does not prevent fraud by the service provider. Several digital-cash systems deal with this by having a secret key generated at the user's PC, which remains out of hands of the service provider. This, however, is not sufficient when tickets are redeemed at the real service provider.

Since the account management is completely in control of the service providers, unwanted actions such as copying tickets can easily be detected and traced back by them.

In smart card-based systems, tickets are stored on a smart card and are circulated by putting two smart cards in a reader and completing the transaction. The smart card itself takes care of the calculations that need to be done for safe transferring.

Tickets are stored on the smart cards. The smart cards can be provided by both the users and the service providers. The performance of current smart cards is limited, which makes asynchronous trading difficult. Different service providers are likely to use different standards, which makes it mandatory to have a different smart cards for different kinds of tickets. It is very useful to passengers.

A secret key can be implemented in the smart card, which makes it possible to carry the card around and redeem a ticket without using a network connection. When the service provider distributes and issues the private keys on these cards, fraud from malicious service providers is still an issue. This also makes it hard for different service providers to share a smart card.

Storage is generally maintained by the service provider. The smart card needs to be protected against multiplication. However, if the system is broken security is completely lost.

A telephone card, calling card or phonecard for short, is a credit card-size plastic or paper card, used to pay for telephone services. It is not necessary to have the physical card except with a stored-value system; knowledge of the access telephone number to dial and the PIN is sufficient. Standard cards which can be purchased and used without any sort of account facility give a fixed amount of credit and are discarded when used up; rechargeable cards can be topped up, or collect payment in arrears. The system for payment and the way in which the card is used to place a telephone call vary from card to card.

A smart card (SC), chip card, or integrated circuit card is a physical electronic authentication device, used to control access to a resource. It is typically a plastic credit card-sized card with an embedded integrated circuit (IC) chip. Many smart cards include a pattern of metal contacts to electrically connect to the internal chip. Others are contactless, and some are both. Smart cards can provide personal identification, authentication, data storage, and application processing. Applications include identification, financial, public transit, computer security, schools, and healthcare. Smart cards may provide strong security authentication for single sign-on (SSO) within organizations. Numerous nations have deployed smart cards throughout their populations.

A stored-value card (SVC) is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. This means no network access is required by the payment collection terminals as funds can be withdrawn and deposited straight from the card. Like cash, payment cards can be used anonymously as the person holding the card can use the funds. They are an electronic development of token coins and are typically used in low-value payment systems or where network access is difficult or expensive to implement, such as parking machines, public transport systems, and closed payment systems in locations such as ships.

Suica is a prepaid rechargeable contactless smart card, electronic money used as a fare card on train lines in Japan, launched on November 18, 2001. The card can be used interchangeably with JR West's ICOCA in the Kansai region and San'yō region in Okayama, Hiroshima, and Yamaguchi prefectures, and also with JR Central's TOICA, JR Kyushu's SUGOCA, Nishitetsu's Nimoca, and Fukuoka City Subway's Hayakaken area in Fukuoka City and its suburb areas. The card is also increasingly being accepted as a form of electronic money for purchases at stores and kiosks, especially within train stations. As of 2018, JR East reports 69.4 million Suica UID's have been issued, usable at 476,300 point of sale locations, with 6.6 million daily transactions.

A ticket machine, also known as a ticket vending machine (TVM), is a vending machine that produces paper or electronic tickets, or recharges a stored-value card or smart card or the user's mobile wallet, typically on a smartphone. For instance, ticket machines dispense train tickets at railway stations, transit tickets at metro stations and tram tickets at some tram stops and in some trams. Token machines may dispense the ticket in the form of a token which has the same function as a paper or electronic ticket. The typical transaction consists of a user using the display interface to select the type and quantity of tickets and then choosing a payment method of either cash, credit/debit card or smartcard. The ticket(s) are then printed on paper and dispensed to the user, or loaded onto the user's smartcard or smartphone.

Digital gold currency is a form of electronic money based on mass units of gold. It is a kind of representative money, like a US paper gold certificate at the time that these were exchangeable for gold on demand. The typical unit of account for such currency is linked to grams or troy ounces of gold, although other units such as the gold dinar are sometimes used. DGCs are backed by gold through unallocated or allocated gold storage.

A gift card, also known as a gift certificate in North America, or gift voucher or gift token in the UK, is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

The EZ-Link card is a rechargeable contactless smart card and electronic money system that is primarily used as a payment method for public transport such as bus and rail lines in Singapore. A standard EZ-Link card is a credit-card-sized stored-value contact-less smart-card that comes in a variety of colours, as well as limited edition designs. It is sold by TransitLink Pte Ltd, a subsidiary of the Land Transport Authority (LTA), and can be used on travel modes across Singapore, including the Mass Rapid Transit (MRT), the Light Rail Transit (LRT), public buses which are operated by SBS Transit, SMRT Buses, Tower Transit Singapore and Go-Ahead Singapore, as well as the Sentosa Express.

Touch 'n Go is a contactless smart card system used for electronic payments in Malaysia. The system was introduced in 1997 and is widely used for toll payments on highways, public transportation, parking, and other services. The card is equipped with a radio-frequency identification (RFID) chip that allows users to make payments by simply tapping the card on a reader device. Touch 'n Go cards can be reloaded with funds either online or at designated reload kiosks. The system has become a popular and convenient way for Malaysians to make cashless transactions.

Online shopping is a form of electronic commerce which allows consumers to directly buy goods or services from a seller over the Internet using a web browser or a mobile app. Consumers find a product of interest by visiting the website of the retailer directly or by searching among alternative vendors using a shopping search engine, which displays the same product's availability and pricing at different e-retailers. As of 2020, customers can shop online using a range of different computers and devices, including desktop computers, laptops, tablet computers and smartphones.

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

An electronic identification ("eID") is a digital solution for proof of identity of citizens or organizations. They can be used to view to access benefits or services provided by government authorities, banks or other companies, for mobile payments, etc. Apart from online authentication and login, many electronic identity services also give users the option to sign electronic documents with a digital signature.

Mondex was a smart card electronic cash system, implemented as a stored-value card and owned by Mastercard.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

A card reader is a data input device that reads data from a card-shaped storage medium. The first were punched card readers, which read the paper or cardboard punched cards that were used during the first several decades of the computer industry to store information and programs for computer systems. Modern card readers are electronic devices that can read plastic cards embedded with either a barcode, magnetic strip, computer chip or another storage medium.

A contactless smart card is a contactless credential whose dimensions are credit card size. Its embedded integrated circuits can store data and communicate with a terminal via NFC. Commonplace uses include transit tickets, bank cards and passports.

Network for Electronic Transfers, colloquially known as NETS, is a Singaporean electronic payment service provider. Founded in 1986, by a consortium of local banks, it aims to establish the debit network and drive the adoption of electronic payments in Singapore. It is owned by DBS Bank, OCBC Bank and United Overseas Bank (UOB).

The Estonian identity card is a mandatory identity document for citizens of Estonia. In addition to regular identification of a person, an ID-card can also be used for establishing one's identity in electronic environment and for giving one's digital signature. Within Europe as well as French overseas territories and Georgia, the Estonian ID Card can be used by the citizens of Estonia as a travel document.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

The term digital card can refer to a physical item, such as a memory card on a camera, or, increasingly since 2017, to the digital content hosted as a virtual card or cloud card, as a digital virtual representation of a physical card. They share a common purpose: Identity Management, Credit card, Debit card or driver license. A non-physical digital card, unlike a Magnetic stripe card can emulate (imitate) any kind of card.