A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic Funds Transfer at Point Of Sale, abbreviated as EFTPOS, is the technical term referring to a type of payment transaction where electronic funds transfers (EFT) are processed at a point of sale (POS) system or payment terminal usually via payment methods such as payment cards. EFTPOS technology was developed during the 1980s.

Discounts and allowances are reductions to a basic price of goods or services.

Mastercard Inc. is an American multinational payment card services corporation headquartered in Purchase, New York. It offers a range of payment transaction processing and other related-payment services. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006.

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit. A subsequent innovation was "Cashback Bonus" on purchases.

A payment is the tender of something of value, such as money or its equivalent, by one party to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine.

Network for Electronic Transfers, colloquially known as NETS, is a Singaporean electronic payment service provider. Founded in 1986 by a consortium of local banks, it aims to establish the debit network and drive the adoption of electronic payments in Singapore. It is owned by DBS Bank, OCBC Bank and United Overseas Bank (UOB).

ATM usage fees are what many banks and interbank networks charge for the use of their automated teller machines (ATMs). In some cases, these fees are assessed solely for non-members of the bank; in other cases, they apply to all users. There is usually a higher fee for the use of White-label ATMs rather than bank-owned ATMs.

.rs is the Internet country code top-level domain (ccTLD) for Serbia. The domain name registry that operates it is the Serbian National Internet Domain Registry (RNIDS). The letters rs stand for Republika Srbija/Република Србија.

Serbian passport is the primary document of international travel issued to nationals of Serbia. Passports are issued and renewed by the Serbian Police on behalf of the Ministry of Internal Affairs or, if the citizen resides abroad, by the Serbian diplomatic missions. Besides serving as proof of identity and of citizenship, it facilitates the process of securing assistance from Serbian consular officials abroad, if needed.

Discover Financial Services is an American financial services company that owns and operates Discover Bank, an online bank that offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates the Discover and Pulse networks, and owns Diners Club International. Discover Card is the third largest credit card brand in the United States, when measured by cards in force, with nearly 50 million cardholders. Discover is currently headquartered in the Chicago suburb of Riverwoods, Illinois.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services, or withdraw cash, on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

Visitors to Serbia must obtain a visa from one of the Serbian diplomatic missions unless they are citizens of one of the visa-exempt countries.

RuPay is an Indian multinational financial services and payment service system, conceived and owned by the National Payments Corporation of India (NPCI). It was launched in 2012, to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments. RuPay facilitates electronic payments at almost all Indian banks and financial institutions. NPCI has partnered with Discover Financial and JCB to help the RuPay network gain international acceptance.

A surcharge, also known as checkout fee, is an extra fee charged by a merchant when receiving a payment by cheque, credit card, charge card or debit card which at least covers the cost to the merchant of accepting that means of payment, such as the merchant service fee imposed by a credit card company. Retailers generally incur higher costs when consumers choose to pay by credit card due to higher merchant service fees compared to traditional payment methods such as cash.

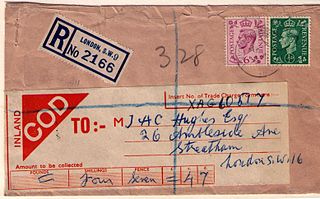

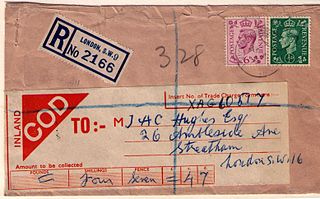

Cash on delivery (COD), sometimes called payment on delivery, cash on demand, payment on demand or collect on delivery is the sale of goods by mail order where payment is made on delivery rather than in advance. If the goods are not paid for, they are returned to the retailer. Originally, the term applied only to payment by cash but as other forms of payment have become more common, the word "cash" has sometimes been replaced with the word "collect" to include transactions by checks, money orders, credit cards or debit cards.

Apple Pay is a mobile payment service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web. Supported on iPhone, Apple Watch, iPad, Mac, and Vision Pro, Apple Pay digitizes and can replace a credit or debit card chip and PIN transaction at a contactless-capable point-of-sale terminal. It does not require Apple Pay–specific contactless payment terminals; it can work with any merchant that accepts contactless payments. It adds two-factor authentication via Touch ID, Face ID, Optic ID, PIN, or passcode. Devices wirelessly communicate with point of sale systems using near field communication (NFC), with an embedded secure element (eSE) to securely store payment data and perform cryptographic functions, and Apple's Touch ID and Face ID for biometric authentication.

MobiKwik is an Indian payment service provider founded in 2009 that provides a mobile phone-based payment system and digital wallet. Customers can add money to an online wallet that can be used for payments. In 2013 the Reserve Bank of India authorized the company's use of the MobiKwik wallet, and in May 2016 the company began providing small loans to consumers as part of its service.

Venmo is an American mobile payment service founded in 2009 and owned by PayPal since 2013. Venmo is aimed at users who wish to split their bills. Account holders can transfer funds to others via a mobile phone app; both the sender and receiver must live in the United States. Venmo also operates as a small social network, as users can observe other users' public transactions with posts and emoticons. In 2021, the company handled $230 billion in transactions and generated $850 million in revenue. Users can view transactions on the Venmo website but cannot complete transactions on the website.

Cash App is a digital wallet service for American consumers. Launched by Block, Inc. in 2013, it allows users to send, receive or save money, access a debit card, invest in stocks or bitcoin, apply for personal loans, and file taxes. As of 2024, Cash App reports 57 million users and $14.7 billion in annual revenue.