Danske Bank, formerly known as the National Irish Bank, is a bank operating in the Republic of Ireland. The bank is a subsidiary of the Danske Bank Group which is headquartered in Copenhagen.

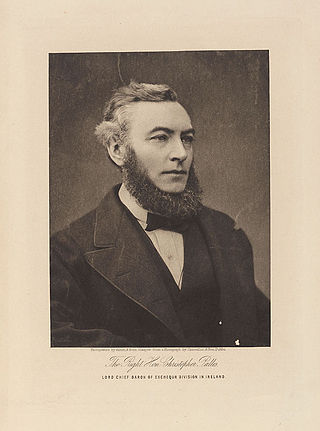

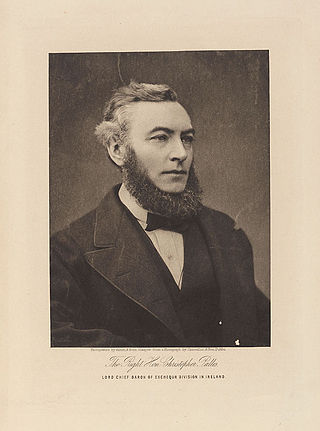

Christopher Palles was an Irish barrister, Solicitor-General, Attorney-General and a judge for over 40 years. His biographer, Vincent Thomas Hyginus Delany, described him as "the greatest of the Irish judges". He served as the last Lord Chief Baron of the Exchequer from 1874 until his retirement from the bench in 1916.

The rule against foreign revenue enforcement, often abbreviated to the revenue rule, is a general legal principle that the courts of one country will not enforce the tax laws of another country. The rule is part of the conflict of laws rules developed at common law, and forms part of the act of state doctrine.

Moylist Construction Limited v Doheny, [2016] IESC 9, [2016] 2 IR 283 was an Irish Supreme Court case in which the Supreme Court confirmed the Irish courts’ jurisdiction to strike out (dismiss) weak cases—those it considered “bound to fail."

Irish Life and Permanent plc v Dunne, [2015] IESC 46, [2016] 1 IR 92, was an Irish Supreme Court case in which the Supreme Court clarified the impact of a lender failing to comply with the Code of Conduct on Mortgage Arrears 2010 on that lender's right to obtain an order of possession of mortgaged property.

Adam v The Minister for Justice, Equality and Law Reform [2001] IESC 38 is a reported decision of the Irish Supreme Court, in which the Court, in affirming High Court orders to strike out two judicial review proceedings as frivolous, held that, to challenge the decision of a public authority, one must attempt to rely on proved individual circumstances.

Nottinghamshire County Council v B[2011] IESC 48; [2013] 4 IR 662 was an Irish Supreme Court case in which the Supreme Court refused to overturn an order of the High Court returning children of married parents from England to that jurisdiction, following a request by the English courts under the Hague Convention on the Civil Aspects of International Child Abduction 1980.

Sivsivadze v Minister for Justice[2015] IESC 53; [2015] 2 ILRM 73; [2016] 2 IR 403 was an Irish Supreme Court case in which the Supreme Court dismissed a challenge to the constitutionality of section 3(1) of the Immigration Act 1999, under which the Minister for Justice order the deportation of a non-national for an indefinite period.

Dunne v Director of Public Prosecutions, [2002] 2 IR 305; [2002] IESC 27; [2002] 2 ILRM 241, is a reported Irish Supreme Court case in which the Court held that fair procedure imposes a duty on the prosecution to seek out and preserve all evidence that has a bearing or a potential bearing on the issue of guilt or innocence.

Dekra Eireann Teo v Minister of Environment, [2003] 2 IR 270; [2003] 2 ILRM 210; [2003] IESC 25 is an Irish Supreme Court case in which it was decided that the earliest opportunity to apply for a review of a decision made by the court arises within the three-month period after the decision is made, and that courts have no power to extend that time. The Court held that a key feature of both European law and court rules is the policy of urgency.

Kelly v Trinity College Dublin[2007] IESC 61; [2007] 12 JIC 1411; is an Irish Supreme Court case in which the Court held that former employments or associations are insufficient, in the absence of other evidence, to disqualify a person from participating in disciplinary or similar tribunals related to that former employment.

Attorney General v Oldridge[2000] IESC 29; [2000] 4 IR 593 was an Irish Supreme Court case which examined "whether corresponding offenses to wire fraud existed in Irish law." The court found that although "wire fraud" did not exist in Irish law, the criminal activity was covered by existing fraud laws. The result of this decision was to broaden the use of fraud and specifically to rule that the charge of "conspiracy to defraud" is constitutional.

O'Connell & anor v The Turf Club, [2015] IESC 57, [2017] 2 IR 43 is an Irish Supreme Court case which explored the scope of judicial review in Ireland. It addressed whether the decisions of a sport's organizing body should be amenable to judicial review. In deciding that it was, this decision became a useful reminder that it is not only bodies created by statute, which are generally considered to be subject to public law, that are amenable to Judicial Review by the Courts.

DPP v Peter Cullen, [2014] IESC 7; [2014] 3 IR 30, was an Irish Supreme Court case in which the Court addressed the routine practice of An Garda Síochána of placing handcuffs after an arrest for drink driving. The court ruled that an arrest will be thrown out if it is shown that it was unnecessary to place handcuffs on the accused. There are certain circumstances that must be considered. For instance, whether the accused has a tendency for violence whilst intoxicated. The ruling raised the possibility that an invalidation of the arrest will also have an effect on the admissibility of the evidence.

Bank of Ireland v O'Donnell & ors[2015] IESC 90 is an Irish Supreme Court case that centred around whether the appellants had any right or capacity to bring a motion before the court. They wanted to seek an order of a stay on Mr Justice McGovern's order dated 24 July 2014. In their appeal, they referred to the principle of objective bias and Mr Justice McGovern's refusal to recuse himself. The Supreme Court rejected the application for a stay and held that the law regarding objective bias was clearly stated in the lower court.

Benedict McGowan and Others v Labour Court and Others [2013] 2 ILRM 276; [2013] IESC 21; [2013] 3 IR 718 is an Irish Supreme Court case, where an appeal was granted and the court made a declaration that the provisions of Part III of the Industrial Relations Act are invalid considering the provisions of Article 15.2.1 of the Constitution of Ireland. This court questioned the method by which wages and other benefits were set on a collective basis across numerous sectors.

Walsh v Jones Lang Lasalle Ltd [2017] IESC 38, is a decision of the Irish Supreme Court in which the court held that a purchaser bears the risk of reliance on erroneous information unless the vendor has clearly assumed responsibility for its accuracy. In reaching this decision, the court clarified the law in Ireland "in relation to the effect of statements disclaiming liability in actions claiming negligent misstatement."

Gerald J.P. Stephens v. Paul Flynn Ltd.[2008] IESC 4; [2008] 4 IR 31 was an Irish Supreme Court case in which the Court ruled that, absent special circumstances, a party's failure to deliver a statement of claim within a period of twenty months is inexcusable and will justify dismissal of the litigation.

Dunne v Minister for the Environment, Heritage and Local Government, [2007] IESC 60; [2008] 2 IR 775, is an Irish Supreme Court case concerning costs in public interest challenges. The Court allowed an appeal against the order for costs made in the High Court and also granted costs against the appellant for the unsuccessful appeal to the Supreme Court.

Bank of Ireland Mortgage Bank v Coleman[2009] IESC 38; [2009] 2 ILRM 363; [2009] 3 IR 699 is an Irish Supreme Court case in which the Court clarified the inherent jurisdiction of the court with respect of a solicitor's misconduct. The court also considered the remedies available where a solicitor is in breach of a solicitor's undertaking.