Related Research Articles

Marquess of Queensberry is a title in the Peerage of Scotland. The title has been held since its creation in 1682 by a member of the Douglas family. The Marquesses also held the title of Duke of Queensberry from 1684 to 1810, when it was inherited by the Duke of Buccleuch.

Duke of Buccleuch, formerly also spelt Duke of Buccleugh, is a title in the Peerage of Scotland created twice on 20 April 1663, first for James Scott, 1st Duke of Monmouth, and second suo jure for his wife Anne Scott, 4th Countess of Buccleuch. Monmouth, the eldest illegitimate son of King Charles II, was attainted after rebelling against his uncle King James II and VII, but his wife's title was unaffected and passed on to their descendants, who have successively borne the surnames Scott, Montagu-Scott, Montagu Douglas Scott and Scott again. In 1810, the 3rd Duke of Buccleuch inherited the Dukedom of Queensberry, also in the Peerage of Scotland, thus separating that title from the Marquessate of Queensberry.

The title Duke of Queensberry was created in the Peerage of Scotland on 3 February 1684 along with the subsidiary title Marquess of Dumfriesshire for the 1st Marquess of Queensberry. The Dukedom was held along with the Marquessate of Queensberry until the death of the 4th Duke in 1810, when the Marquessate was inherited by Sir Charles Douglas of Kelhead, 5th Baronet, while the Dukedom was inherited by the 3rd Duke of Buccleuch. Since then the title of Duke of Queensberry has been held by the Dukes of Buccleuch.

Earl of March is a title that has been created several times, respectively, in the Peerage of Scotland and the Peerage of England. The title derives from the "marches" or borderlands between England and either Wales or Scotland, and it was held by several great feudal families which owned lands in those districts. Later, however, the title came to be granted as an honorary dignity, and ceased to carry any associated power in the marches.

Clan Scott is a Scottish clan and is recognised as such by the Lord Lyon King of Arms. Historically the clan was based in the Scottish Borders.

Henry Scott, 3rd Duke of Buccleuch and 5th Duke of Queensberry KG FRSE was a Scottish nobleman and long-time friend of Sir Walter Scott. He is the paternal 3rd great-grandfather of Princess Alice, Duchess of Gloucester, and the maternal 4th great-grandfather of Prince William of Gloucester and Prince Richard, Duke of Gloucester.

Charles Douglas, 3rd Duke of Queensberry, 2nd Duke of Dover, was a Scottish nobleman, extensive landowner, Privy Counsellor and Vice Admiral of Scotland.

Charles William Henry Montagu-Scott, 4th Duke of Buccleuch and 6th Duke of Queensberry, KT, styled Earl of Dalkeith until 1812, was a British landowner, amateur cricketer and Tory politician.

Clan Douglas is an ancient clan or noble house from the Scottish Lowlands.

William Henry Walter Montagu Douglas Scott, 6th Duke of Buccleuch and 8th Duke of Queensberry, was a Scottish Member of Parliament and peer. He was the paternal grandfather of Princess Alice, Duchess of Gloucester, as well as a maternal great-grandfather of Prince William of Gloucester and Prince Richard, Duke of Gloucester, and a great-great-grandfather of Sarah, Duchess of York.

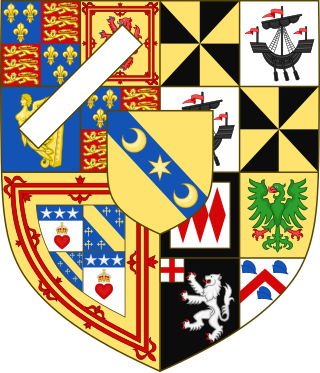

Richard Walter John Montagu Douglas Scott, 10th Duke of Buccleuch and 12th Duke of Queensberry,, styled as Lord Eskdaill until 1973 and as Earl of Dalkeith from 1973 until 2007, is a Scottish landholder and peer. He is the Duke of Buccleuch and Queensberry, as well as Chief of Clan Scott. He is a descendant of James, Duke of Monmouth, the eldest illegitimate son of Charles II and his mistress, Lucy Walter, and more remotely in a direct male line from Alan of Dol, who arrived in Britain in 1066 with William the Conqueror.

John Charles Montagu Douglas Scott, 7th Duke of Buccleuch and 9th Duke of Queensberry,, styled The Honourable John Montagu Douglas Scott until 1884, Lord John Montagu Douglas Scott between 1884 and 1886 and Earl of Dalkeith until 1914 was a British Member of Parliament and peer. He was the father of Princess Alice, Duchess of Gloucester, and the maternal grandfather of Prince William of Gloucester, and Prince Richard, Duke of Gloucester.

Neale, James, Fordyce and Down was a London banking house, established in 1757 by Henry Neale, William James, Alexander Fordyce and Richard Down. Its collapse in June 1772 precipitated a major banking crisis which included the collapse of almost every private bank in Scotland, and a liquidity crisis in the two major banking centres of the world, London and Amsterdam. The bank had been speculating by shorting East India Company stock on a massive scale, and apparently using customer deposits to cover losses.

The British credit crisis of 1772–1773, also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. It has been described as the first modern banking crisis faced by the Bank of England. New colonies, as Adam Smith observed, had an insatiable demand for capital. Accompanying the more tangible evidence of wealth creation was a rapid expansion of credit and banking, leading to a rash of speculation and dubious financial innovation. In today's language, they bought shares on margin.

Montagu Douglas Scott, or simply Scott, is the surname of an aristocratic family in the United Kingdom, founded initially in the 15th century as Clan Scott. In the 17th century, James Scott, 1st Duke of Monmouth, eldest illegitimate son of Charles II, King of England, Scotland and Ireland, who would lead the Monmouth Rebellion married Anne Scott, 1st Duchess of Buccleuch. The family name was briefly Montagu-Scott, before the 5th Duke adopted its current form. It is one of only a handful of families in the English-speaking world to have an unhyphenated triple-barrelled name.

Alexander Fordyce was an eminent Scottish banker, centrally involved in the bank run on Neale, James, Fordyce and Down which led to the credit crisis of 1772. He fled abroad and was declared bankrupt, but in time he used the profits from other investments to cover the losses.

Sir William Douglas, 4th Baronet was a Scottish politician who sat in the British House of Commons from 1768 to 1780, representing the constituency of Dumfries Burghs.

Events from the year 1772 in Scotland.

Tyler Beck Goodspeed is an American economist and economic historian who was the acting chairman of the Council of Economic Advisers from June 2020 to January 2021. He resigned from his position on January 7 in the wake of the 2021 storming of the United States Capitol.

The Tayside Meal Mobs were episodes of civil unrest caused by the poverty of the people of Dundee in 1772 and 1773.

References

- 1 2 3 "Robert Burns Country: The Burns Encyclopedia: Douglas, Heron & Company". Robertburns.org. Retrieved 2013-09-04.

- 1 2 3 "Douglas, Heron and Company - Archives Hub".

- 1 2 "Memoirs of a banking house". National Library of Scotland. p. 42. Retrieved 2018-01-21.

- ↑ "States of the affairs of Messrs Douglas, Heron, and company, at August 1773, when they finally gave up business". National Library of Scotland. Archived from the original on 2018-01-22. Retrieved 2018-01-21.

- ↑ Goodspeed 2016.

- ↑ Perman, Ray (2019). The Rise and Fall of the City of Money. Birlinn. p. 88. ISBN 9781780276236.

- ↑ Kerr, Andrew William (1908). History of Banking in Scotland (2nd ed.). London: A. & C. Black. p. 109.

- ↑ "Douglas Heron Bank". www.carothers-carruthers.com. Archived from the original on 2017-09-15. Retrieved 2018-01-21.

- ↑ The Tayside Meal Riots, S G E Lythe