Related Research Articles

Robert Ward Vishny is an American economist and is the Myron S. Scholes Distinguished Service Professor of Finance at the University of Chicago Booth School of Business. He was the Eric J. Gleacher Distinguished Service Professor of Finance at the University of Chicago Booth School of Business.

David Hirshleifer is an American economist. He is a professor of finance and currently holds the Merage chair in Business Growth at the University of California at Irvine. As of 2018 he became President-Elect of the American Finance Association. In 2017, he was elected as Vice President of the American Finance Association (AFA) and assigned as Research Associate to National Bureau of Economic Research. He was previously a professor at the University of Michigan, Ohio State University, and UCLA. His research is mostly related to behavioral finance and informational cascades. In 2007, he was on the Top 100 list of most cited economist by Web of Science's Most-Cited Scientists in Economics & Business.

Jeffrey D. Gramlich is a professor of accounting, a Howard D. and B. Phyllis Hoops Endowed Chair in Accounting, and a director of the Hoops Institute of Taxation Research and Policy at Washington State University (WSU). Previously, Gramlich served as the L.L. Bean/Lee Surace Endowed Chair at the University of Southern Maine. He has been a guest professor at Copenhagen Business School on several occasions. Earlier in his academic career he was a professor at the University of Hawaii's Shidler College of Business Administration.

Michael Mikhail is the dean of the College of Business Administration at the University of Illinois at Chicago. Prior to assuming his role as dean in 2012, Mikhail was the KPMG Professor, and Director of the School of Accountancy at Arizona State University. At ASU, he was named a DC 100 Distinguished Scholar.

Raymond J. (Ray) Ball is a researcher and educator in accounting and financial economics. He is the Sidney Davidson Distinguished Service Professor of Accounting in the University of Chicago’s Booth School of Business. He has published foundational research on the economics of financial reporting and financial markets.

Joel M. Stern was chairman and chief executive officer of Stern Value Management, formerly Stern Stewart & Co, and the creator and developer of economic value added. He was a recognised authority on financial economics, corporate performance measurement, corporate valuation and incentive compensation and was a pioneer and leading advocate of the concept of shareholder value. He was also active in academia, and in the media.

Douglas Warren Diamond is an American economist. He is currently the Merton H. Miller Distinguished Service Professor of Finance at the University of Chicago Booth School of Business, where he has taught since 1979. Diamond specializes in the study of financial intermediaries, financial crises, and liquidity. He is a former president of the American Finance Association (2003) and the Western Finance Association (2001-02).

Ole-Kristian Hope is a Norwegian economist, and Professor of Accounting at the Rotman School of Management, particularly known for his work on accounting standards and disclosure practices.

An earnings surprise, or unexpected earnings, in accounting, is the difference between the reported earnings and the expected earnings of an entity. Measures of a firm's expected earnings, in turn, include analysts' forecasts of the firm's profit and mathematical models of expected earnings based on the earnings of previous accounting periods.

Marianne Bertrand is a Belgian economist who currently works as Chris P. Dialynas Professor of Economics at the University of Chicago's Booth School of Business. Bertrand belongs to the world's most prominent labour economists in terms of research, which has been awarded the 2004 Elaine Bennett Research Prize and the 2012 Sherwin Rosen Prize for Outstanding Contributions in the Field of Labor Economics.She is a research fellow of the National Bureau of Economic Research, and the IZA Institute of Labor Economics.

Christian Leuz is a German business economist, specializing in finance, accounting, and institutional economics. He is the Charles F. Pohl Distinguished Service Professor of Accounting and Finance at the University of Chicago Booth School of Business.

Shivaram Rajgopal is an Indian-American academic. He is currently the Kester and Byrnes Professor of Accounting and Auditing at Columbia University, where he served as Vice Dean of Research from 2017 to 2019. Previously, he was a faculty member at Duke University, Emory University, and the University of Washington. Professor Rajgopal is a Chartered Accountant from India and got his Ph.D. from the University of Iowa.

Darren T. Roulstone is John W. Berry, Sr. Fund for Faculty Excellence Professor of Accounting at Fisher College of Business at the Ohio State University in Columbus, Ohio, and has been director of its Accounting and Management Information Systems PhD program since 2008. His current research interests are textual analysis of firms’ financial disclosures and how investors acquire accounting information.

Jonathan L. Rogers is an American accounting scholar who holds the Tisone Endowed Chair of Accounting at the University of Colorado-Boulder's Leeds School of Business.

Catherine M. Schrand is an American academic and the Celia Z. Moh Professor of Accounting at the Wharton School at the University of Pennsylvania.

Joshua Ronen is an American editor, author, academic, accountant, and researcher. He is a professor of accounting at New York University Stern School of Business and co-editor of the "Journal of Law, Finance, and Accounting"

Ehsan H. Feroz is a Bangladeshi-born Muslim American professor, researcher, and an author. He is a tenured full professor of accounting at the University of Washington Tacoma’s Milgard School of Business and served as the Director of the Master of Accounting Program.

Sarah Louise Zechman is the Tisone Memorial Fellow Professor at the Leeds School of Business, University of Colorado Boulder.

Siew Hong Teoh is the Lee and Seymour Graff Endowed Professor of accounting at UCLA Anderson School of Management. She is on the editorial board of the Accounting Review and the Review of Accounting Studies.

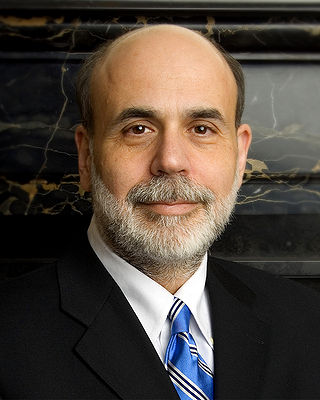

The 2022 Nobel Memorial Prize in Economic Sciences was divided equally between the American economists Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig "for research on banks and financial crises" on 10 October 2022. The award was established in 1968 by an endowment "in perpetuity" from Sweden's central bank, Sveriges Riksbank, to commemorate the bank's 300th anniversary. Laureates in the Memorial Prize in Economics are selected by the Royal Swedish Academy of Sciences. The Nobel Committee announced the reason behind their recognition, stating:

"This year’s laureates in the Economic Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig, have significantly improved our understanding of the role of banks in the economy, particularly during financial crises. An important finding in their research is why avoiding bank collapses is vital."

References

- ↑ Skinner, Douglas J. (1 November 1997). "Earnings disclosures and stockholder lawsuits". Journal of Accounting and Economics. 23 (3): 249–282. doi:10.1016/S0165-4101(97)00010-4. hdl: 2027.42/36116 .

- ↑ Monga, Vipal (11 May 2011). "Google's Mysterious Retroactive Charge". Wall Street Journal.

- ↑ Silverman, Rachel Feintzeig and Rachel Emma (22 July 2013). "Earnings Calls Take On Whiff of Showbiz". Wall Street Journal.

- ↑ "Maloney calls on SEC to end outrageous policy that allows inside investors early access to public filings". Congresswoman Carolyn Maloney. 28 October 2014.