Related Research Articles

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place.

In law, conveyancing is the transfer of legal title of real property from one person to another, or the granting of an encumbrance such as a mortgage or a lien. A typical conveyancing transaction has two major phases: the exchange of contracts and completion.

An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties. Examples include an account established by a broker for holding funds on behalf of the broker's principal or some other person until the consummation or termination of a transaction; or, a trust account held in the borrower's name to pay obligations such as property taxes and insurance premiums. The word derives from the Old French word escroue, meaning a scrap of paper or a scroll of parchment; this indicated the deed that a third party held until a transaction was completed.

This aims to be a complete list of the articles on real estate.

From a legal point of view, a contract is an institutional arrangement for the way in which resources flow, which defines the various relationships between the parties to a transaction or limits the rights and obligations of the parties.

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system, numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the amount of cash customers may withdraw, either by a imposing a hard limit or by scheduling quick deliveries of cash, encouraging high-return term deposits to reduce on-demand withdrawals or suspending withdrawals altogether.

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter.

Fire safety is the set of practices intended to reduce destruction caused by fire. Fire safety measures include those that are intended to prevent the ignition of an uncontrolled fire and those that are used to limit the spread and impact of a fire.

A real estate contract is a contract between parties for the purchase and sale, exchange, or other conveyance of real estate. The sale of land is governed by the laws and practices of the jurisdiction in which the land is located. Real estate called leasehold estate is actually a rental of real property such as an apartment, and leases cover such rentals since they typically do not result in recordable deeds. Freehold conveyances of real estate are covered by real estate contracts, including conveying fee simple title, life estates, remainder estates, and freehold easements. Real estate contracts are typically bilateral contracts and should have the legal requirements specified by contract law in general and should also be in writing to be enforceable.

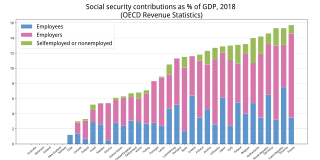

Social insurance is a form of social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of social assistance, individuals' claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the individuals are then paid benefits in the future.

A good faith estimate, referred to as a GFE, was a standard form that had to be provided by a mortgage lender or broker in the United States to a consumer, as required by the Real Estate Settlement Procedures Act (RESPA). Since August 2015, GFE has been replaced by a loan estimate form, serving the same purpose but following slightly different guidelines set by CFPB, so as to reduce consumer confusion. A good faith estimate is a standard form intended to be used to compare different offers from different lenders or brokers. The estimate must include an itemized list of fees and costs associated with the loan and must be provided within 3 business days of applying for a loan. Since RESPA does not apply to Business Purpose Loans, no GFE is provided in those transactions.

Parametric insurance is a non-traditional insurance product that offers pre-specified payouts based upon a trigger event. Trigger events depend on the nature of the parametric policy and can include environmental triggers such as wind speed and rainfall measurements, business-related triggers such as foot traffic, and more. Examples of current parametric products include the Caribbean Catastrophe Risk Insurance Facility (CCRIF), the African Risk Capacity (ARC), and the protection of coral reefs in the state of Quintana Roo in Mexico.

Catastrophe bonds are risk-linked securities that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake.

An incident is an event that could lead to loss of, or disruption to, an organization's operations, services or functions. Incident management (IcM) is a term describing the activities of an organization to identify, analyze, and correct hazards to prevent a future re-occurrence. These incidents within a structured organization are normally dealt with by either an incident response team (IRT), an incident management team (IMT), or Incident Command System (ICS). Without effective incident management, an incident can disrupt business operations, information security, IT systems, employees, customers, or other vital business functions.

Alternative risk transfer is the use of techniques other than traditional insurance and reinsurance to provide risk-bearing entities with coverage or protection. The field of alternative risk transfer grew out of a series of insurance capacity crises in the 1970s through 1990s that drove purchasers of traditional coverage to seek more robust ways to buy protection.

Industry loss warranties (ILWs), are a type of reinsurance contract used in the insurance industry through which one party will purchase protection based on the total loss arising from an event to the entire insurance industry above a certain trigger level rather than their own losses.

The Defense Base Act (DBA) is an extension of the federal workers' compensation program that covers longshoremen and harbor workers, the Longshore and Harbor Workers' Compensation Act 33 U.S.C. §§ 901–950. The DBA covers persons employed at United States defense bases overseas. The DBA is designed to provide medical treatment and compensation to employees of defense contractors injured in the scope and course of employment. The DBA is administered by the United States Department of Labor.

Dive planning is the process of planning an underwater diving operation. The purpose of dive planning is to increase the probability that a dive will be completed safely and the goals achieved. Some form of planning is done for most underwater dives, but the complexity and detail considered may vary enormously.

Diving safety is the aspect of underwater diving operations and activities concerned with the safety of the participants. The safety of underwater diving depends on four factors: the environment, the equipment, behaviour of the individual diver and performance of the dive team. The underwater environment can impose severe physical and psychological stress on a diver, and is mostly beyond the diver's control. Equipment is used to operate underwater for anything beyond very short periods, and the reliable function of some of the equipment is critical to even short-term survival. Other equipment allows the diver to operate in relative comfort and efficiency, or to remain healthy over the longer term. The performance of the individual diver depends on learned skills, many of which are not intuitive, and the performance of the team depends on competence, communication, attention and common goals.

References

- ↑ Green, James F. (2007). CCH Accounting for Derivatives and Hedging 2008. CCH. pp. 215–219. ISBN 978-0-8080-9100-4.