Related Research Articles

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In Anglo-American common law, the party who entrusts the right is known as the "settlor", the party to whom the right is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property itself is known as the "corpus" or "trust property". With the strategic and legal use of Trusts, individuals can ensure that their children and grandchildren or chosen beneficiaries are able to benefit completely from the inheritance they want them to receive.

A power of attorney (POA) or letter of attorney is a written authorization to represent or act on another's behalf in private affairs, business, or some other legal matter. The person authorizing the other to act is the principal, grantor, or donor. The one authorized to act is the agent, attorney, or in some common law jurisdictions, the attorney-in-fact.

Trustee is a legal term which, in its broadest sense, is a synonym for anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility to transfer the title of ownership to the person named as the new owner, in a trust instrument, called a beneficiary. A trustee can also refer to a person who is allowed to do certain tasks but not able to gain income, although that is untrue. Although in the strictest sense of the term a trustee is the holder of property on behalf of a beneficiary, the more expansive sense encompasses persons who serve, for example, on the board of trustees of an institution that operates for a charity, for the benefit of the general public, or a person in the local government.

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties. Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for example, a corporate trust company or the trust department of a bank, acts in a fiduciary capacity to another party, who, for example, has entrusted funds to the fiduciary for safekeeping or investment. Likewise, financial advisers, financial planners, and asset managers, including managers of pension plans, endowments, and other tax-exempt assets, are considered fiduciaries under applicable statutes and laws. In a fiduciary relationship, one person, in a position of vulnerability, justifiably vests confidence, good faith, reliance, and trust in another whose aid, advice, or protection is sought in some matter. In such a relation, good conscience requires the fiduciary to act at all times for the sole benefit and interest of the one who trusts.

A fiduciary is someone who has undertaken to act for and on behalf of another in a particular matter in circumstances which give rise to a relationship of trust and confidence.

Gross negligence is the "lack of slight diligence or care" or "a conscious, voluntary act or omission in reckless disregard of a legal duty and of the consequences to another party." In some jurisdictions a person injured as a result of gross negligence may be able to recover punitive damages from the person who caused the injury or loss.

In tort law, the standard of care is the only degree of prudence and caution required of an individual who is under a duty of care.

The Hague Convention on the Law Applicable to Trusts and on their Recognition, or Hague Trust Convention is a multilateral treaty developed by the Hague Conference on Private International Law on the Law Applicable to Trusts. It concluded on 1 July 1985, entered into force 1 January 1992, and is as of September 2017 ratified by 14 countries. The Convention uses a harmonised definition of a trust, which is the subject of the convention, and sets Conflict rules for resolving problems in the choice of the applicable law. The key provisions of the Convention are:

Bartlett v Barclays Bank Trust Co Ltd [1980] 1 Ch 515 in an English trusts law case. In it Brightman J gave a comprehensive discussion of the duties of trustees in connection with companies whose shares are part of the trust property. Although it is common to hear lawyers refer to "the rule in Bartlett v Barclays Bank", the case only restated law that had been accepted since Speight v Gaunt.

A trust instrument is an instrument in writing executed by a settlor used to constitute a trust. Trust instruments are generally only used in relation to an inter vivos trust; testamentary trusts are usually created under a will.

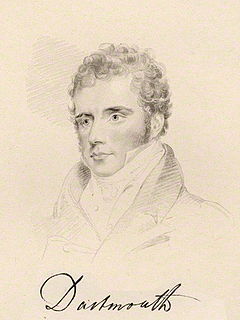

Howe v Earl of Dartmouth (1802) 7 Ves 137 is an English trusts law case. It laid down the rule of equity in relation to the duties of a trustee in relation to a trust fund where there are successive interests in relation to the trust fund, and seeks to strike a fair balance between the rights of the life tenant and the remainderman. It is one of a number of highly technical common law rules which causes considerable angst where wills and trusts have not been professionally prepared.

In trust law, a protector is a person appointed under the trust instrument to direct or restrain the trustees in relation to their administration of the trust.

United States trust law is the body of law regulating the legal instrument for holding wealth known as a trust.

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit. Trusts were a creation of the English law of property and obligations, and share a subsequent history with countries across the Commonwealth and the United States. Trusts developed when claimants in property disputes were dissatisfied with the common law courts and petitioned the King for a just and equitable result. On the King's behalf, the Lord Chancellor developed a parallel justice system in the Court of Chancery, commonly referred as equity. Historically, trusts have mostly been used where people have left money in a will, or created family settlements, charities, or some types of business venture. After the Judicature Act 1873, England's courts of equity and common law were merged, and equitable principles took precedence. Today, trusts play an important role in financial investment, especially in unit trusts and in pension trusts. Although people are generally free to set the terms of trusts in any way they like, there is a growing body of legislation to protect beneficiaries or regulate the trust relationship, including the Trustee Act 1925, Trustee Investments Act 1961, Recognition of Trusts Act 1987, Financial Services and Markets Act 2000, Trustee Act 2000, Pensions Act 1995, Pensions Act 2004 and Charities Act 2011.

Bristol and West Building Society v Mothew [1996] EWCA Civ 533 is a leading English fiduciary law and professional negligence case, concerning a solicitor's duty of care and skill, and the nature of fiduciary duties. The case is globally cited for its definition of a fiduciary and the circumstances in which a fiduciary relationship arises.

An Investment policy statement (IPS) is a document, generally between an investor and the assisting investment manager, recording the agreements the two parties come to with regards to issues relating to how the investor's money is to be managed. In other cases, an IPS may also be created by an investment committee to help establish and record its own policies in order to assist in future decision-making or to help maintain consistency of its policies by future committee members or to clarify expectations for prospective money managers who may be hired by the committee.

Learoyd v Whiteley[1887] UKHL 1 is an English trusts law case, concerning the duty of care owed by a trustee when exercising the power of investment.

The Trustee Act 2000 is an Act of the Parliament of the United Kingdom that regulates the duties of trustees in English trust law. Reform in these areas had been advised as early as 1982, and finally came about through the Trustee Bill 2000, based on the Law Commission's 1999 report "Trustees' Powers and Duties", which was introduced to the House of Lords in January 2000. The bill received the Royal Assent on 23 November 2000 and came into force on 1 February 2001 through the Trustee Act 2000 (Commencement) Order 2001, a Statutory Instrument, with the Act having effect over England and Wales.

Speight v Gaunt [1883] UKHL 1 is an English trusts law case, concerning the extent of the duty of care owed by a fiduciary.

Nestle v National Westminster Bank plc [1992] EWCA Civ 12 is an English trusts law case concerning the duty of care when a trustee is making an investment.

Cowan v Scargill [1985] Ch 270 is an English trusts law case, concerning the scope of discretion of trustees to make investments for the benefit of their members. It held that trustees cannot ignore the financial interests of the beneficiaries.

References

- ↑ "Section 77". Restatement of Trusts (Third ed.). American Law Institute. p. 81.