See also

- Stimulus (economics)

- For government spending as stimulus, see fiscal policy

- For an increase in money designed to speed growth, see monetary policy

Economic stimulus payment or economic impact payment may refer to several tax rebates, tax credits, tax deductions and grants from the federal government of the United States:

A stimulus is something that causes a physiological response. It may refer to:

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Additionally, it is designed to try to keep GDP growth at 2%–3% percent and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

In economics, the fiscal multiplier is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending. When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in aggregate output that is a multiple of the initial change.

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

EIP may refer to:

Helicopter money is a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap. Although the original idea of helicopter money describes central banks making payments directly to individuals, economists have used the term "helicopter money" to refer to a wide range of different policy ideas, including the "permanent" monetization of budget deficits – with the additional element of attempting to shock beliefs about future inflation or nominal GDP growth, in order to change expectations. A second set of policies, closer to the original description of helicopter money, and more innovative in the context of monetary history, involves the central bank making direct transfers to the private sector financed with base money, without the direct involvement of fiscal authorities. This has also been called a citizens' dividend or a distribution of future seigniorage.

The Economic Stimulus Act of 2008 was an Act of Congress providing for several kinds of economic stimuli intended to boost the United States economy in 2008 and to avert a recession, or ameliorate economic conditions. The stimulus package was passed by the U.S. House of Representatives on January 29, 2008, and in a slightly different version by the U.S. Senate on February 7, 2008. The Senate version was then approved in the House the same day. It was signed into law on February 13, 2008, by President George W. Bush with the support of both Democratic and Republican lawmakers. The law provides for tax rebates to low- and middle-income U.S. taxpayers, tax incentives to stimulate business investment, and an increase in the limits imposed on mortgages eligible for purchase by government-sponsored enterprises. The total cost of this bill was projected at $152 billion for 2008.

The American Recovery and Reinvestment Act of 2009 (ARRA), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the Great Recession, the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy.

Bryan Pape was a senior lecturer at the University of New England, New South Wales, Australia and a former office holder and member of the National Party of Australia, who in Pape v Commissioner of Taxation lost his challenge to the constitutional legality of the Kevin Rudd Government's proposed $7.7 billion tax bonus payments as part of the $42 billion economic stimulus package in the High Court of Australia.

In economics, stimulus refers to attempts to use monetary policy or fiscal policy to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing.

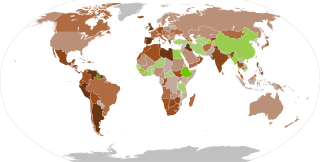

Beginning in 2008 many nations of the world enacted fiscal stimulus plans in response to the Great Recession. These nations used different combinations of government spending and tax cuts to boost their sagging economies. Most of these plans were based on the Keynesian theory that deficit spending by governments can replace some of the demand lost during a recession and prevent the waste of economic resources idled by a lack of demand. The International Monetary Fund recommended that countries implement fiscal stimulus measures equal to 2% of their GDP to help offset the global contraction. In subsequent years, fiscal consolidation measures were implemented by some countries in an effort to reduce debt and deficit levels while at the same time stimulating economic recovery.

A carbon fee and dividend or climate income is a system to reduce greenhouse gas emissions and address climate change. The system imposes a carbon tax on the sale of fossil fuels, and then distributes the revenue of this tax over the entire population as a monthly income or regular payment.

The Economic Stimulus Appropriations Act of 1977 was a stimulus package enacted by the 95th Congress and signed into law by President Jimmy Carter on 13 May 1977. Developed in response to the longest and deepest economic recession post World War II, the primary objective of the stimulus package was to provide the economy with a boost.

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300 billion in one-time cash payments to individual people who submit a tax return in America, $260 billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350 billion in funding, $500 billion in loans for corporations, and $339.8 billion to state and local governments.

The economic impact of the COVID-19 pandemic in India has been largely disruptive. India's growth in the fourth quarter of the fiscal year 2020 went down to 3.1% according to the Ministry of Statistics. The Chief Economic Adviser to the Government of India said that this drop is mainly due to the coronavirus pandemic effect on the Indian economy. Notably, India had also been witnessing a pre-pandemic slowdown, and according to the World Bank, the current pandemic has "magnified pre-existing risks to India's economic outlook".

The Health and Economic Recovery Omnibus Emergency Solutions Act, or Heroes Act, was proposed legislation acting as a $3 trillion stimulus package in response to the COVID-19 pandemic, intended to supplement the earlier CARES Act stimulus package. The bill for this Act of Congress was proposed by Representative Nita Lowey, a Democrat from New York, on May 12, 2020, and was passed by the United States House of Representatives by a vote of 208–199 on May 15, 2020.

The federal government of the United States initially responded to the COVID-19 pandemic in the country with various declarations of emergency, some of which led to travel and entry restrictions and the formation of the White House Coronavirus Task Force. As the pandemic progressed in the U.S. and globally, the U.S. government began issuing recommendations regarding the response by state and local governments, as well as social distancing measures and workplace hazard controls. State governments play a primary role in adopting policies to address the pandemic. Following the closure of most businesses throughout a number of U.S. states, President Donald Trump announced the mobilization of the National Guard in the most affected areas.

Green recovery packages are proposed environmental, regulatory, and fiscal reforms to rebuild prosperity in the wake of an economic crisis, such as the COVID-19 pandemic or the Global Financial Crisis (GFC). They pertain to fiscal measures that intend to recover economic growth while also positively benefitting the environment, including measures for renewable energy, efficient energy use, nature-based solutions, sustainable transport, green innovation and green jobs, amongst others.

The Consolidated Appropriations Act, 2021 is a $2.3 trillion spending bill that combines $900 billion in stimulus relief for the COVID-19 pandemic in the United States with a $1.4 trillion omnibus spending bill for the 2021 federal fiscal year and prevents a government shutdown. The bill is one of the largest spending measures ever enacted, surpassing the $2.2 trillion CARES Act, enacted in March 2020. The legislation is the first bill to address the pandemic since April 2020. According to the Senate Historical Office, at 5,593 pages, the legislation is the longest bill ever passed by Congress.

The American Rescue Plan Act of 2021, also called the COVID-19 Stimulus Package or American Rescue Plan, is a US$1.9 trillion economic stimulus bill passed by the 117th United States Congress and signed into law by President Joe Biden on March 11, 2021, to speed up the country's recovery from the economic and health effects of the COVID-19 pandemic and the ongoing recession. First proposed on January 14, 2021, the package builds upon many of the measures in the CARES Act from March 2020 and in the Consolidated Appropriations Act, 2021, from December.