Labour economics, or labor economics, seeks to understand the functioning and dynamics of the markets for wage labour. Labour is a commodity that is supplied by labourers, usually in exchange for a wage paid by demanding firms. Because these labourers exist as parts of a social, institutional, or political system, labour economics must also account for social, cultural and political variables.

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. Minimum wage policies can vary significantly between countries or even within a country, with different regions, sectors, or age groups having their own minimum wage rates. These variations are often influenced by factors such as the cost of living, regional economic conditions, and industry-specific factors.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, the unit price for a particular good or other traded item in a perfectly competitive market, will vary until it settles at the market-clearing price, where the quantity demanded equals the quantity supplied such that an economic equilibrium is achieved for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy. While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

In economics, elasticity measures the responsiveness of one economic variable to a change in another. For example, if the price elasticity of the demand of a good is −2, then a 10% increase in price will cause the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and the other one is elastic demand and supply.

The price elasticity of supply is a measure used in economics to show the responsiveness, or elasticity, of the quantity supplied of a good or service to a change in its price. Price elasticity of supply, in application, is the percentage change of the quantity supplied resulting from a 1% change in price. Alternatively, PES is the percentage change in the quantity supplied divided by the percentage change in price.

In economics, the Hicks–Marshall laws of derived demand assert that, other things equal, the own-wage elasticity of demand for a category of labor is high under the following conditions:

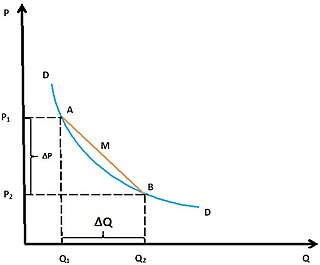

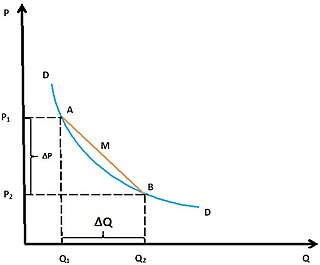

In mathematics and economics, the arc elasticity is the elasticity of one variable with respect to another between two given points. It is the ratio of the percentage change of one of the variables between the two points to the percentage change of the other variable. It contrasts with the point elasticity, which is the limit of the arc elasticity as the distance between the two points approaches zero and which hence is defined at a single point rather than for a pair of points.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency. The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes. That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

Arnold Carl Harberger is an American economist. His approach to the teaching and practice of economics is to emphasize the use of analytical tools that are directly applicable to real-world issues. His influence on academic economics is reflected in part by the widespread use of the term "Harberger triangle" to refer to the standard graphical depiction of the efficiency cost of distortions of competitive equilibrium.

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desire to purchase and the ability to pay for a commodity.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention.

The Frisch elasticity of labor supply captures the elasticity of hours worked to the wage rate, given a constant marginal utility of wealth. Marginal utility is constant for risk-neutral individuals according to microeconomics. In other words, the Frisch elasticity measures the substitution effect of a change in the wage rate on labor supply. This concept was proposed by the economist Ragnar Frisch after whom the elasticity of labor supply is named.

The neoclassical synthesis (NCS), or neoclassical–Keynesian synthesis is an academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936) with neoclassical economics.

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity to have market power over all sellers as the only purchaser of a good or service. This is a similar power to that of a monopolist, which can influence the price for its buyers in a monopoly, where multiple buyers have only one seller of a good or service available to purchase from.

Global workforce refers to the international labor pool of workers, including those employed by multinational companies and connected through a global system of networking and production, foreign workers, transient migrant workers, remote workers, those in export-oriented employment, contingent workforce or other precarious work. As of 2012, the global labor pool consisted of approximately 3 billion workers, around 200 million unemployed.

The Theory of Wages is a book by the British economist John Hicks, published in 1932. It has been described as a classic microeconomic statement of wage determination in competitive markets. It anticipates a number of developments in distribution and growth theory and remains a standard work in labour economics.

In the United States, despite the efforts of equality proponents, income inequality persists among races and ethnicities. Asian Americans have the highest median income, followed by White Americans, Hispanic Americans, African Americans, and Native Americans. A variety of explanations for these differences have been proposed—such as differing access to education, two parent home family structure, high school dropout rates and experience of discrimination and deep-seated and systemic anti-Black racism—and the topic is highly controversial.

According to Marxist–Leninist theory, the Soviet working class was supposed to be the Soviet Union's ruling class during its transition from the socialist stage of development to full communism. According to Andy Blunden, its influence over production and policies diminished as the Soviet Union's existence progressed.

Optimal labour income tax is a sub-area of optimal tax theory which refers to the study of designing a tax on individual labour income such that a given economic criterion like social welfare is optimized.