Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

Private equity (PE) is stock in a private company that does not offer stock to the general public. In the field of finance, private equity is offered instead to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage, "private equity" can refer to these investment firms, rather than the companies in which they invest.

Rahm Israel Emanuel is an American politician and diplomat currently serving as United States ambassador to Japan. A member of the Democratic Party, he represented Illinois in the United States House of Representatives for three terms from 2003 to 2009. He was the White House Chief of Staff from 2009 to 2010 under President Barack Obama and served as mayor of Chicago from 2011 to 2019.

Steven Lawrence Rattner is an American investor, media commentator, and former journalist. He is currently chairman and chief executive officer of Willett Advisors, the private investment firm that manages billionaire former New York mayor Michael Bloomberg's personal and philanthropic assets. He began his career as an economic reporter for The New York Times before moving to a career in investment banking at Lehman Brothers, Morgan Stanley, and Lazard Freres & Co., where he rose to deputy chairman and deputy chief executive officer. He then became a managing principal of the Quadrangle Group, a private equity investment firm that specialized in the media and communications industries.

Jill Stewart was the Managing Editor at LA Weekly and laweekly.com. At LA Weekly, she oversaw a team of print and digital journalists who pursue the newspaper's brand of digital hyper-localism and analytical, print journalism. She also oversaw the newspaper's video team and video productions.

Omni La Costa Resort & Spa is a luxury resort hotel in Carlsbad, California. It opened in 1965. The resort is known for its golf courses; it commonly hosts professional golf and tennis tournaments. Tournaments at the resort were hosted starting in the late 1960s, including many PGA Tour events and tennis events such as the Southern California Open. Omni La Costa Resort & Spa is a member of Historic Hotels of America and has hosted La Costa Film Festival. It is owned by Omni Hotels & Resorts, based in Dallas, Texas.

Oaktree Capital Management, Inc. is an American global asset management firm specializing in alternative investment strategies. As of September 30, 2024, the company managed $205 billion for its clientele.

Goldman Sachs Asset Management Private Equity is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally. The group, which is based in New York City, was founded in 1986.

In finance, the private-equity secondary market refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private-equity funds as well as hedge funds can be more complex and labor-intensive.

Platinum Equity, LLC is an American private equity investment firm founded by Tom Gores in 1995, headquartered in Beverly Hills, California. The firm focuses on leveraged buyout investments of established companies in the U.S., Europe and Asia.

Campbell Lutyens is an independent private markets advisory firm exclusively focused on primary fundraising, secondary transactions and GP capital advisory services in the private equity, private debt, infrastructure and sustainable investing markets. The firm has offices in London, New York City, Paris, Chicago, Los Angeles, Charlotte, Hong Kong and Singapore and comprises a team of over 200 professionals representing over 40 nationalities.

Andrew Hauptman is an American business executive, philanthropist, and civic leader. Hauptman co-founded the investment firm Andell Holdings which he has helmed since its inception in 1998 and has grown into one of the leading family office entities in the nation.

AlpInvest Partners is a global private equity asset manager which is a subsidiary of The Carlyle Group, a global private equity firm.

FFL Partners, LLC, previously known as Friedman Fleischer & Lowe, is an American private equity firm, founded in 1997 by Tully Friedman, Spencer Fleischer, David Lowe, and Christopher Masto. The firm makes investments primarily through leveraged buyouts and growth capital investments and is focused on investing in the U.S. middle-market.

The 2009 California's 32nd congressional district special election was held July 14, 2009, to fill the vacancy in California's 32nd congressional district. The election was won by Democrat Judy Chu, who became the first Chinese American woman elected to serve in Congress.

The LA Art Show is an international encyclopedic art exhibition which was originally conceived by the Fine Art Dealers Association (FADA). The show annually takes place in Los Angeles, typically in January/February, and is now a seminal part of Los Angeles Arts Month. It is the largest and most comprehensive contemporary art fair on the West Coast.

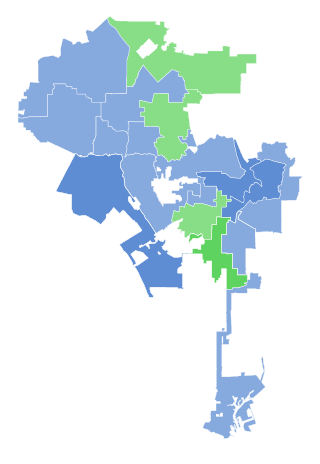

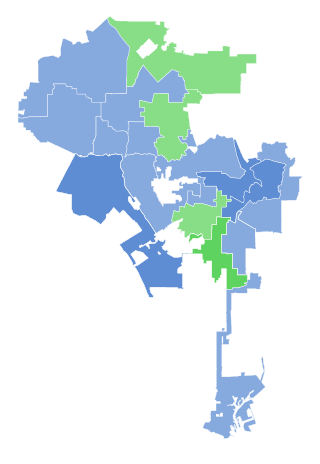

The 2013 Los Angeles mayoral election was held on March 5, 2013, to elect the mayor of Los Angeles. No candidate received a majority of the primary votes to be elected outright, and the top two finishers, Eric Garcetti and Wendy Greuel advanced to a runoff vote. On May 21, 2013, Garcetti was elected mayor with a majority of the votes in the runoff.

Chase Beeler is an American former professional football player who was a center for the St. Louis Rams of the National Football League (NFL). He played college football for the Stanford Cardinal, earning consensus All-American honors in 2010. The San Francisco 49ers signed him as an undrafted free agent in 2011. He is currently a principal with the private equity firm, Altamont Capital Partners.

Guosen Securities Company Limited is a Chinese state-owned financial services company headquartered in Shenzhen, China, with more than 70 branches and 11,500 employees nationwide. It has offices in 47 major cities in China including Shenzhen, Beijing, Guangzhou, Foshan, Nanjing, Shanghai, Tianjin and Hong Kong. Guosen Securities provides sales and trading, investment banking, research, asset management, private equity, and other financial services with both institutional and retail clients in China and Hong Kong. It also operates a trading platform called GuoXin TradingStation.