Related Research Articles

Gentrification is the process of changing the character of a neighborhood through the influx of more affluent residents and investment. There is no agreed-upon definition of gentrification. In public discourse, it has been used to describe a wide array of phenomena, usually in a pejorative connotation.

Homelessness in Canada was not a social problem until the 1980s. The Canadian government housing policies and programs in place throughout the 1970s were based on a concept of shelter as a basic need or requirement for survival and of the obligation of government and society to provide adequate housing for everyone. Public policies shifted away from rehousing in the 1980s in wealthy Western countries like Canada, which led to a de-housing of households that had previously been housed. By 1987, when the United Nations established the International Year of Shelter for the Homeless (IYSH), homelessness had become a serious social problem in Canada. The report of the major 1987 IYSH conference held in Ottawa said that housing was not a high priority for government, and this was a significant contributor to the homelessness problem. While there was a demand for adequate and affordable housing for low income Canadian families, government funding was not available. In the 1980s a "wider segment of the population" began to experience homelessness for the first time – evident through their use of emergency shelters and soup kitchens. Shelters began to experience overcrowding, and demand for services for the homeless was constantly increasing. A series of cuts were made to national housing programs by the federal government through the mid-1980s and in the 1990s. While Canada's economy was robust, the cuts continued and in some cases accelerated in the 1990s, including cuts to the 1973 national affordable housing program. The government solution for homelessness was to create more homeless shelters and to increase emergency services. In the larger metropolitan areas like Toronto the use of homeless shelters increased by 75% from 1988 to 1998. Urban centres such as Montreal, Laval, Vancouver, Edmonton, and Calgary all experienced increasing homelessness.

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related field of housing economics is narrower in scope, concentrating on residential real estate markets, while the research on real estate trends focuses on the business and structural changes affecting the industry. Both draw on partial equilibrium analysis, urban economics, spatial economics, basic and extensive research, surveys, and finance.

The affordability of housing in the UK reflects the ability to rent or buy property. There are various ways to determine or estimate housing affordability. One commonly used metric is the median housing affordability ratio; this compares the median price paid for residential property to the median gross annual earnings for full-time workers. According to official government statistics, housing affordability worsened between 2020 and 2021, and since 1997 housing affordability has worsened overall, especially in London. The most affordable local authorities in 2021 were in the North West, Wales, Yorkshire and The Humber, West Midlands and North East.

Affordable housing is housing which is deemed affordable to those with a household income at or below the median as rated by the national government or a local government by a recognized housing affordability index. Most of the literature on affordable housing refers to mortgages and a number of forms that exist along a continuum – from emergency homeless shelters, to transitional housing, to non-market rental, to formal and informal rental, indigenous housing, and ending with affordable home ownership.

Charles Leadbeater, also known as Charlie Leadbeater, is a British author and former advisor to Tony Blair.

Poverty in the United Kingdom is the condition experienced by the portion of the population of the United Kingdom that lacks adequate financial resources for a certain standard of living, as defined under the various measures of poverty.

Median household disposable income in the UK was £29,400 in the financial year ending (FYE) 2019, up 1.4% (£400) compared with growth over recent years; median income grew by an average of 0.7% per year between FYE 2017 and FYE 2019, compared with 2.8% between FYE 2013 and FYE 2017.

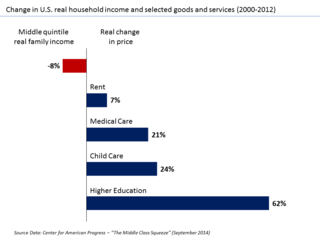

The middle-class squeeze refers to negative trends in the standard of living and other conditions of the middle class of the population. Increases in wages fail to keep up with inflation for middle-income earners, leading to a relative decline in real wages, while at the same time, the phenomenon fails to have a similar effect on the top wage earners. People belonging to the middle class find that inflation in consumer goods and the housing market prevent them from maintaining a middle-class lifestyle, undermining aspirations of upward mobility.

The Great Recession was a period of marked general decline observed in national economies globally, i.e. a recession, that occurred in the late 2000s. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

In the United States, subsidized housing is administered by federal, state and local agencies to provide subsidized rental assistance for low-income households. Public housing is priced much below the market rate, allowing people to live in more convenient locations rather than move away from the city in search of lower rents. In most federally-funded rental assistance programs, the tenants' monthly rent is set at 30% of their household income. Now increasingly provided in a variety of settings and formats, originally public housing in the U.S. consisted primarily of one or more concentrated blocks of low-rise and/or high-rise apartment buildings. These complexes are operated by state and local housing authorities which are authorized and funded by the United States Department of Housing and Urban Development (HUD). In 2020, there were one million public housing units. In 2022, about 5.2 million American households received some form of federal rental assistance.

The Australian property market comprises the trade of land and its permanent fixtures located within Australia. The average Australian property price grew 0.5% per year from 1890 to 1990 after inflation, however rose from 1990 to 2017 at a faster rate. House prices in Australia receive considerable attention from the media and the Reserve Bank and some commentators have argued that there is an Australian property bubble.

Housing inequality is a disparity in the quality of housing in a society which is a form of economic inequality. The right to housing is recognized by many national constitutions, and the lack of adequate housing can have adverse consequences for an individual or a family. The term may apply regionally, temporally or culturally. Housing inequality is directly related to racial, social, income and wealth inequality. It is often the result of market forces, discrimination and segregation.

Affordable housing in Canada refers to living spaces that are deemed financially accessible to households with a median household income. Housing affordability is generally measured based on a shelter-cost-to-income ratio (STIR) of 30% by the Canada Mortgage and Housing Corporation (CMHC), the national housing agency of Canada. It encompasses a continuum ranging from market-based options like affordable rental housing and affordable home ownership, to non-market alternatives such as government-subsidized housing.

Centre for London is London's dedicated think tank. Based in the UK, it undertakes research and organises events aimed at developing new solutions to the capital's critical challenges. The Centre, which is politically independent, advocates for a fair and prosperous global city.

Housing in the United Kingdom represents the largest non-financial asset class in the UK; its overall net value passed the £5 trillion mark in 2014. Housing includes modern and traditional styles. About 30% of homes are owned outright by their occupants, and a further 40% are owner-occupied on a mortgage. About 18% are social housing of some kind, and the remaining 12% are privately rented.

Family homelessness refers to a family unit who do not have access to long term accommodation due to various circumstances such as socioeconomic status, access to resources and relationship breakdowns. In some Western countries, such as the United States, family homelessness is a new form of poverty, and a fast growing group of the homelessness population. Some American researchers argue that family homelessness is the inevitable result of imbalanced “low-income housing ratio” where there are more low-income households than there are low-cost housing units. A study in 2018 projected a total of 56,342 family households were recognized as homeless. Roughly 16,390 of these people were living in a place not meant for human habitation. It is believed that homeless families make up about a third of the United States’ population, with generally women being the lead of the household.

Affordable housing is housing that is deemed affordable to those with a median household income as rated by the national government or a local government by a recognized housing affordability index. A general rule is no more than 30% of gross monthly income should be spent on housing, to be considered affordable as the challenges of promoting affordable housing varies by location.

Housing in the United States comes in a variety of forms and tenures. The rate of homeownership in the United States, as measured by the fraction of units that are owner-occupied, was 64% as of 2017. This rate is less than the rates in other large countries such as China (90%), Russia (89%) Mexico (80%), or Brazil (73%).

Since late 2021, the prices for many essential goods in the United Kingdom began increasing faster than household incomes, resulting in a fall in real incomes. The phenomenon has been termed a cost-of-living crisis. This is caused in part by a rise in inflation in both the UK and the world in general, as well as the economic impact of issues such as the COVID-19 pandemic, Russia's invasion of Ukraine, and Brexit. While all in the UK are affected by rising prices, it most substantially affects low-income persons. The British government has responded in various ways such as grants, tax rebates, and subsidies to electricity and gas suppliers.

References

- ↑ Urwin, Rosamund. "Endies, Laggies and YoPros – Meet the capital's new youth tribes". Evening Standard. Retrieved 22 September 2014.

- 1 2 Leadbeater, Charles. "Hollow Promise: How London Fails People on Modest Incomes and What Should Be Done About It". Centre for London.

- ↑ Philip, Ripley. "Meet the 'Endies' – city dwellers who are too poor to have fun". Independent. Retrieved 16 September 2014.

- ↑ Wallop, Harry. "Yuppies flash the cash, but today's Endies have to watch their pennies". Telegraph. Archived from the original on 16 September 2014. Retrieved 16 September 2014.