Related Research Articles

The Kyoto Protocol (Japanese: 京都議定書, Hepburn: Kyōto Giteisho) was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that global warming is occurring and that human-made CO2 emissions are driving it. The Kyoto Protocol was adopted in Kyoto, Japan, on 11 December 1997 and entered into force on 16 February 2005. There were 192 parties (Canada withdrew from the protocol, effective December 2012) to the Protocol in 2020.

Emissions trading is a market-based approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS). One prominent example is carbon emission trading for CO2 and other greenhouse gases which is a tool for climate change mitigation. Other schemes include sulfur dioxide and other pollutants.

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

The Clean Development Mechanism (CDM) is a United Nations-run carbon offset scheme allowing countries to fund greenhouse gas emissions-reducing projects in other countries and claim the saved emissions as part of their own efforts to meet international emissions targets. It is one of the three Flexible Mechanisms defined in the Kyoto Protocol. The CDM, defined in Article 12 of the Protocol, was intended to meet two objectives: (1) to assist non-Annex I countries achieve sustainable development and reduce their carbon footprints; and (2) to assist Annex I countries in achieving compliance with their emissions reduction commitments.

Carbon offsetting is a trading mechanism that allows entities such as governments, individuals, or businesses to compensate for (i.e. “offset”) their greenhouse gas emissions by supporting projects that reduce, avoid, or remove emissions elsewhere. In other words, carbon offsets focus on offsetting emissions through investments in emission reduction projects. When an entity invests in a carbon offsetting program, it receives carbon credits, i.e "tokens" used to account for net climate benefits from one entity to another. A carbon credit or offset credit can be bought or sold after certification by a government or independent certification body. One carbon offset or credit represents a reduction, avoidance or removal of one tonne of carbon dioxide or its carbon dioxide-equivalent (CO2e).

The European Union Emissions Trading System is a carbon emission trading scheme which began in 2005 and is intended to lower greenhouse gas emissions by the European Union countries. Cap and trade schemes limit emissions of specified pollutants over an area and allow companies to trade emissions rights within that area. The EU ETS covers around 45% of the EUs greenhouse gas emissions.

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to emissions trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower the overall costs of achieving its emissions targets. These mechanisms enable Parties to achieve emission reductions or to remove carbon from the atmosphere cost-effectively in other countries. While the cost of limiting emissions varies considerably from region to region, the benefit for the atmosphere is in principle the same, wherever the action is taken.

The energy policy of Australia is subject to the regulatory and fiscal influence of all three levels of government in Australia, although only the State and Federal levels determine policy for primary industries such as coal. Federal policies for energy in Australia continue to support the coal mining and natural gas industries through subsidies for fossil fuel use and production. Australia is the 10th most coal-dependent country in the world. Coal and natural gas, along with oil-based products, are currently the primary sources of Australian energy usage and the coal industry produces over 30% of Australia's total greenhouse gas emissions. In 2018 Australia was the 8th highest emitter of greenhouse gases per capita in the world.

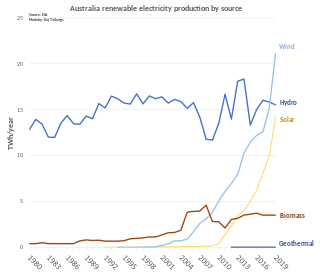

Renewable energy in Australia includes wind power, hydroelectricity, solar photovoltaics, heat pumps, geothermal, wave and solar thermal energy.

Carbon pricing is a method for nations to address climate change. The cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the combustion of coal, oil and gas – the main driver of climate change. The method is widely agreed and considered to be efficient. Carbon pricing seeks to address the economic problem that emissions of CO2 and other greenhouse gases (GHG) are a negative externality – a detrimental product that is not charged for by any market.

The Carbon Pollution Reduction Scheme was a cap-and-trade emissions trading scheme for anthropogenic greenhouse gases proposed by the Rudd government, as part of its climate change policy, which had been due to commence in Australia in 2010. It marked a major change in the energy policy of Australia. The policy began to be formulated in April 2007, when the federal Labor Party was in Opposition and the six Labor-controlled states commissioned an independent review on energy policy, the Garnaut Climate Change Review, which published a number of reports. After Labor won the 2007 federal election and formed government, it published a Green Paper on climate change for discussion and comment. The Federal Treasury then modelled some of the financial and economic impacts of the proposed CPRS scheme.

The Global Warming Pollution Reduction Act of 2007 (S. 309) was a bill proposed to amend the 1963 Clean Air Act, a bill that aimed to reduce emissions of carbon dioxide (CO2). U.S. Senator, Bernie Sanders (I-VT), introduced the resolution in the 110th United States Congress on January 16, 2007. The bill was referred to the Senate Committee on Environment and Public Works but was not enacted into law.

Carbon emission trading (also called carbon market, emission trading scheme (ETS) or cap and trade) is a type of emission trading scheme designed for carbon dioxide (CO2) and other greenhouse gases (GHG). It is a form of carbon pricing. Its purpose is to limit climate change by creating a market with limited allowances for emissions. This can lower competitiveness of fossil fuels and accelerate investments into low carbon sources of energy such as wind power and photovoltaics. Fossil fuels are the main driver for climate change. They account for 89% of all CO2 emissions and 68% of all GHG emissions.

ecosecurities is a company specialized in carbon markets and greenhouse gas (GHG) mitigation projects worldwide. ecosecurities specializes in sourcing, developing and financing projects on renewable energy, energy efficiency, forestry and waste management with a positive environmental impact.

The environmental effects of transport in Australia are considerable. Australia subsidizes fossil fuel energy, keeping prices artificially low and raising greenhouse gas emissions due to the increased use of fossil fuels as a result of the subsidies. The Australian Energy Regulator and state agencies such as the New South Wales' Independent Pricing and Regulatory Tribunal set and regulate electricity prices, thereby lowering production and consumer cost.

Greenhouse gas emissions by Australia totalled 533 million tonnes CO2-equivalent based on greenhouse gas national inventory report data for 2019; representing per capita CO2e emissions of 21 tons, three times the global average. Coal was responsible for 30% of emissions. The national Greenhouse Gas Inventory estimates for the year to March 2021 were 494.2 million tonnes, which is 27.8 million tonnes, or 5.3%, lower than the previous year. It is 20.8% lower than in 2005. According to the government, the result reflects the decrease in transport emissions due to COVID-19 pandemic restrictions, reduced fugitive emissions, and reductions in emissions from electricity; however, there were increased greenhouse gas emissions from the land and agriculture sectors.

The Asia-Pacific Emissions Trading Forum (AETF) was an information service and business network dealing with domestic and international developments in emissions trading policy in Australia and the Asia-Pacific region. The AETF was originally called the Australasian Emissions Trading Forum, and was founded in 1998 under the auspices of the Sydney Futures Exchange following a proposal from Beck Consulting Services. From 2001 until 2011 the AETF published the AETF Review, held regular member meetings and convened numerous events and conferences. The AETF Review was published six times per year and included original articles on emissions trading developments and related topics.

Tianjin Climate Exchange (TCX) is a domestic carbon market cap-and-trade scheme exchange. Jeff Huang is assistant chairman of Tianjin Climate Exchange and vice-president of Chicago Climate Exchange.

A carbon pricing scheme in Australia was introduced by the Gillard Labor minority government in 2011 as the Clean Energy Act 2011 which came into effect on 1 July 2012. Emissions from companies subject to the scheme dropped 7% upon its introduction. As a result of being in place for such a short time, and because the then Opposition leader Tony Abbott indicated he intended to repeal "the carbon tax", regulated organizations responded rather weakly, with very few investments in emissions reductions being made. The scheme was repealed on 17 July 2014, backdated to 1 July 2014. In its place the Abbott government set up the Emission Reduction Fund in December 2014. Emissions thereafter resumed their growth evident before the tax.

Green economy policies in Canada are policies that contribute to transitioning the Canadian economy to a more environmentally sustainable one. The green economy can be defined as an economy, "that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities." Aspects of a green economy would include stable growth in income and employment that is driven by private and public investment into policies and actions that reduce carbon emissions, pollution and prevent the loss of biodiversity.

References

- ↑ "Envex media centre". Archived from the original on 26 December 2008. Retrieved 8 December 2008.

- ↑ "ICE buys Climate Exchange". Reuters. 30 April 2010. Retrieved 18 June 2020.

- ↑ Carr signs up to Global Carbon Market, Sydney Morning Herald 19 Nov 2008