Related Research Articles

Long-Term Capital Management L.P. (LTCM) was a highly-leveraged hedge fund which was bailed out in 1998 to the tune of $3.6 billion by a group of 14 banks, in a deal brokered and put together by the U.S. Federal Reserve.

Myron Samuel Scholes is a Canadian-American financial economist. Scholes is the Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black–Scholes options pricing model. Scholes is currently the chairman of the Board of Economic Advisers of Stamos Capital Partners. Previously he served as the chairman of Platinum Grove Asset Management and on the Dimensional Fund Advisors board of directors, American Century Mutual Fund board of directors and the Cutwater Advisory Board. He was a principal and limited partner at Long-Term Capital Management and a managing director at Salomon Brothers. Other positions Scholes held include the Edward Eagle Brown Professor of Finance at the University of Chicago, senior research fellow at the Hoover Institution, director of the Center for Research in Security Prices, and professor of finance at MIT's Sloan School of Management. Scholes earned his PhD at the University of Chicago.

John William Meriwether is an American hedge fund executive.

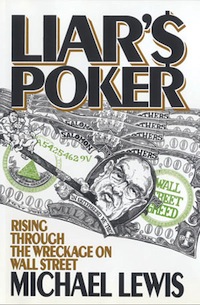

Liar's Poker is a non-fiction, semi-autobiographical book by Michael Lewis describing the author's experiences as a bond salesman on Wall Street during the late 1980s. First published in 1989, it is considered one of the books that defined Wall Street during the 1980s, along with Bryan Burrough and John Helyar's Barbarians at the Gate: The Fall of RJR Nabisco, and the fictional The Bonfire of the Vanities by Tom Wolfe. The book captures an important period in the history of Wall Street. Two important figures in that history feature prominently in the text, the head of Salomon Brothers' mortgage department Lewis Ranieri and the firm's CEO John Gutfreund.

Lazard Ltd is a financial advisory and asset management firm that engages in investment banking, asset management and other financial services, primarily with institutional clients. It is the world's largest independent investment bank, with principal executive offices in New York City, Paris and London.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Fixed-income arbitrage is a group of market-neutral-investment strategies that are designed to take advantage of differences in interest rates between varying fixed-income securities or contracts. Arbitrage in terms of investment strategy, involves buying securities on one market for immediate resale on another market in order to profit from a price discrepancy.

A private-equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years. At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional or asymmetric.

When Genius Failed: The Rise and Fall of Long-Term Capital Management is a book by Roger Lowenstein published by Random House on October 9, 2000. The book puts on an unauthorized account of the creation, early success, abrupt collapse, and rushed bailout of Long-Term Capital Management (LTCM). LTCM was a tightly-held American hedge fund founded in 1993 which commanded more than $100 billion in assets at its height, then collapsed abruptly in August/September 1998. Prompted by deep concerns about LTCM's thousands of derivative contracts, in order to avoid a panic by banks and investors worldwide, the Federal Reserve Bank of New York stepped in to organize a bailout with the various major banks at risk.

The following outline is provided as an overview of and topical guide to finance:

Thomas G. Maheras is a managing partner of Tegean Capital Management, LLC, a New York-based hedge fund founded in 2008.

JWM Partners LLC was a hedge fund started by John Meriwether after the collapse of Long Term Capital Management (LTCM) in 1998. LTCM was one of the most spectacular failures of Wall Street, leading to a bailout of around $4 billion that was provided by a consortium of Wall Street banks. Meriwether started the company with initial capital of $250 million with loyal quants and traders like Victor Haghani, Larry Hilibrand, Dick Leahy, Arjun Krishnamachar and Eric Rosenfeld. As of April 2008, the company had around $1.6 billion in management. Eric Rosenfeld left to start his own fund.

Victor Haghani is an Iranian-American founder of Elm Wealth, a research-driven wealth advisor and manager. Elm uses index-tracking funds to invest across the largest asset classes and tries to give its clients broad exposure to global economic growth at the lowest possible cost.

Chi-fu Huang is a private investor, a retired hedge fund manager, and a former finance academic. He has made contributions to the theory of financial economics, writing on dynamic general equilibrium theory, intertemporal utility theory, and the theory of individual consumption and portfolio decisions.

Kaveh Alamouti is an Iranian-British investment banker. Alamouti holds a BSc in Engineering from the Imperial College London, and an MBA and a PhD in Finance from the London Business School, where he went on to serve as a member of the Faculty of Finance and Accounting.

Craig Schiffer was the former Chief Executive Officer of the Americas of Dresdner Kleinwort, based in New York, from 2003 to 2006. In February 2009, Schiffer founded Sevara Partners LLC, a boutique financial advisory firm based in New York City which serves clients in the United States and Europe.

Sadeq Sayeed is a prominent Pakistani-born banker and businessman, known for his role behind Nomura's acquisition of the Europe, the Middle East and Africa (EMEA) businesses of Lehman Brothers in Oct 2008.

Richard Graham Leibovitch is a Canadian-American finance and real estate expert who is currently the managing partner of Arel Capital, a private equity real estate firm based in New York City. Prior to this, he was the chief investment officer and senior managing director of Gottex Fund Management, a fund-of-fund based in Lausanne, Switzerland.

Francis A. Longstaff is an American educator and pioneer in quantitative finance. He serves as the Allstate Professor of Insurance and Finance at the Anderson School of Management, University of California, Los Angeles, and the former Finance Area Chair.

References

- ↑ Sterling, Bruce (1992). The Hacker Crackdown . ISBN 0-553-56370-X.

- ↑ Barnett, Megan. "When Genius Fails Again, and Again". Upstart Business Journal. The Business Journals. Retrieved 14 December 2015.