The euro is the official currency of 19 of the 27 member states of the European Union. This group of states is known as the eurozone or, officially, the euro area, and includes about 343 million citizens as of 2019. The euro, which is divided into 100 cents, is the second-largest and second-most traded currency in the international markets for the related different types of transactions after the United States dollar.

The economy of Malta is a highly industrialised, service-based economy. It is classified as an advanced economy by the International Monetary Fund and is considered a high-income country by the World Bank and an innovation-driven economy by the World Economic Forum. It is a member of the European Union and of the eurozone, having formally adopted the euro on 1 January 2008.

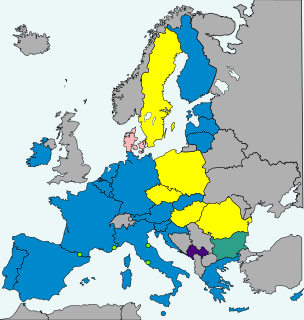

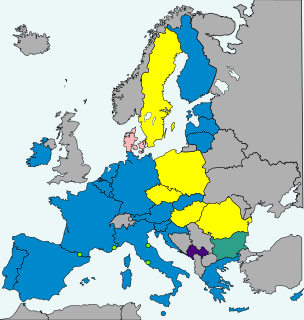

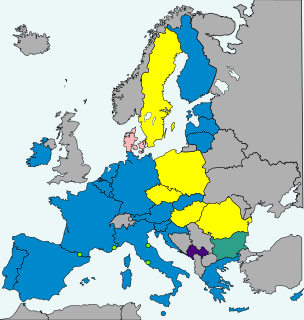

The eurozone, officially called the euro area, is a monetary union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender. The monetary authority of the eurozone is the Eurosystem. Eight members of the European Union continue to use their own national currencies, although most of them will be obliged to adopt the euro in the future.

Martin Stuart Feldstein was an American economist. He was the George F. Baker Professor of Economics at Harvard University and the president emeritus of the National Bureau of Economic Research (NBER). He served as president and chief executive officer of the NBER from 1978 to 2008. From 1982 to 1984, Feldstein served as chairman of the Council of Economic Advisers and as chief economic advisor to President Ronald Reagan. Feldstein was also a member of the Washington-based financial advisory body the Group of Thirty from 2003.

Ricardo A. M. R. Reis is a Portuguese economist and the A. W. Phillips professor of economics at the London School of Economics. In a 2013 ranking of young economists by Glenn Ellison, Reis was considered the top economist with a PhD between 1996 and 2004., and in 2016 he won the Germán Bernácer Prize for top European-born economist researching macroeconomics and finance. He writes a weekly op-ed for the Portuguese newspaper Jornal de Notícias and Expresso, and participates frequently in economic debates in Portugal.

In economics, an optimum currency area (OCA) or optimal currency region (OCR) is a geographical region in which it would maximize economic efficiency to have the entire region share a single currency.

Romania's current national currency is the leu. However, being bound by its EU accession agreement, Romania has to replace the leu with the euro, as soon as Romania will fulfil all of the four nominal euro convergence criteria as stated in the Treaty of Functioning the European Union in article 140. As of 2022, the only currency on the market is leu, euro is not yet used in shops. The Romanian leu is not part of the European Exchange Rate Mechanism, although the Romanian authorities are working to prepare the changeover to the euro. In order to achieve the change of the currency, Romania is required to undergo at least two years of stability within the limits of the convergence criteria. The current Romanian Government in addition established a self-imposed criterion to reach a certain level of real convergence, as a steering anchor to decide the appropriate target year for ERM II membership and euro adoption. As of March 2018, the scheduled date for euro adoption in Romania was 2024, according to the National Plan to Changeover to the Euro. Nevertheless, in early 2021, this date was delayed again to 2027 or 2028, and once again to 2029 in late 2021.

Denmark uses the krone as its currency and does not use the euro, having negotiated the right to opt out from participation under the Maastricht Treaty of 1992. In 2000, the government held a referendum on introducing the euro, which was defeated with 46.8% voting yes and 53.2% voting no. The Danish krone is part of the ERM II mechanism, so its exchange rate is tied to within 2.25% of the euro.

The Executive Vice President of the European Commission for An Economy that Works for People is the member of the European Commission responsible for economic and financial affairs. The position was previously titled Commissioner for Economic and Monetary Affairs and the Euro and European Vice President for the Euro and Social Dialogue from 2014 to 2019. The current Executive Vice President is Valdis Dombrovskis (EPP).

Eurobonds or stability bonds were proposed government bonds to be issued in euros jointly by the European Union's 19 eurozone states. The idea was first raised by the Barroso European Commission in 2011 during the 2009–2012 European sovereign debt crisis. Eurobonds would be debt investments whereby an investor loans a certain amount of money, for a certain amount of time, with a certain interest rate, to the eurozone bloc altogether, which then forwards the money to individual governments. The proposal was floated again in 2020 as a potential response to the impacts of the COVID-19 pandemic in Europe, leading such debt issue to be dubbed "corona bonds".

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948) dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s 1960s, and 1970s.

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that has been taking place in the European Union (EU) since the end of 2009. Several eurozone member states were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

The Economic and Monetary Union (EMU) is an umbrella term for the group of policies aimed at converging the economies of member states of the European Union at three stages. The policies cover the 19 eurozone states, as well as non-euro European Union states.

Fiscal union is the integration of the fiscal policy of nations or states. Under fiscal union decisions about the collection and expenditure of taxes are taken by common institutions, shared by the participating governments. A fiscal union does not imply the centralisation of spending and tax decisions at the supranational level. Centralisation of these decisions would open up not only the possibility of inherent risk sharing through the supranational tax and transfer system but also economic stabilisation through debt management at the supranational level. Proper management would reduce the effects of asymmetric shocks that would be shared both with other countries and with future generations. Fiscal union also implies that the debt would be financed not by individual countries but by a common bond.

William Francis Mitchell is a professor of economics at the University of Newcastle, New South Wales, Australia and Docent Professor of Global Political Economy at the University of Helsinki, Finland. He is one of the founding developers of Modern Monetary Theory.

The EU economic governance, Sixpack describes a set of European legislative measures to reform the Stability and Growth Pact and introduces greater macroeconomic surveillance, in response to the European debt crisis of 2009. These measures were bundled into a "six pack" of regulations, introduced in September 2010 in two versions respectively by the European Commission and a European Council task force. In March 2011, the ECOFIN council reached a preliminary agreement for the content of the Sixpack with the commission, and negotiations for endorsement by the European Parliament then started. Ultimately it entered into force 13 December 2011, after one year of preceding negotiations. The six regulations aim at strengthening the procedures to reduce public deficits and address macroeconomic imbalances.

The banking union of the European Union is the transfer of responsibility for banking policy from the national to the EU level in several EU member states, initiated in 2012 as a response to the Eurozone crisis. The motivation for banking union was the fragility of numerous banks in the Eurozone, and the identification of vicious circle between credit conditions for these banks and the sovereign credit of their respective home countries. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. Conversely, weakness in sovereign credit resulted in deterioration of the balance sheet position of the banking sector, not least because of high domestic sovereign exposures of the banks.

Heiner Flassbeck is a German economist and public intellectual. From 1998 to 1999 he was a State Secretary in the German Federal Ministry of Finance where he also advised former finance minister Oskar Lafontaine on a reform of the European Monetary System. He became the Chief of Macroeconomics and Development of the United Nations Conference on Trade and Development (UNCTAD) in Geneva in January 2003, a position that he held until resigning at the end of 2012 due to his age.

Withdrawal from the Eurozone denotes the process whereby a Eurozone member-state, whether voluntarily or forcibly, stops using the euro as its national currency and leaves the Eurozone. As of September 2021, no country has withdrawn from the Eurozone.