Related Research Articles

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures. A failure to pay, along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labour equivalent. The first known taxation took place in Ancient Egypt around 3000–2800 BC.

Conspicuous consumption is the spending of money on and the acquiring of luxury goods and services to publicly display the economic power of the income or of the accumulated wealth of the buyer. To the conspicuous consumer, such a public display of discretionary economic power is a means of either attaining or maintaining a given social status.

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate. In terms of individual income and wealth, a regressive tax imposes a greater burden on the poor than on the rich: there is an inverse relationship between the tax rate and the taxpayer's ability to pay, as measured by assets, consumption, or income. These taxes tend to reduce the tax burden of the people with a higher ability to pay, as they shift the relative burden increasingly to those with a lower ability to pay.

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels.

FairTax was a single rate tax proposal in 2005, 2008 and 2009 in the United States that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes, payroll taxes, gift taxes, and estate taxes, replacing them with a single consumption tax on retail sales.

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income. The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend more than the extra dollar.

Consumer spending, consumption, or consumption expenditure is the acquisition of goods and services by individuals or families. It is the largest part of aggregate demand at the macroeconomic level. There are two components of consumer spending: induced consumption and autonomous consumption.

A luxury tax is a tax on luxury goods: products not considered essential. A luxury tax may be modeled after a sales tax or VAT, charged as a percentage on all items of particular classes, except that it mainly affects the wealthy because the wealthy are the most likely to buy luxuries such as expensive cars, jewelry, etc. It may also be applied only to purchases over a certain amount; for instance, some U.S. states charge luxury tax on real estate transactions over a certain limit.

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax.

Positional goods are goods valued only by how they are distributed among the population, not by how many of them there are available in total. The source of greater worth of positional goods is their desirability as a status symbol, which usually results in them greatly exceeding the value of comparable goods.

A proportional tax is a tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. The amount of the tax is in proportion to the amount subject to taxation. "Proportional" describes a distribution effect on income or expenditure, referring to the way the rate remains consistent, where the marginal tax rate is equal to the average tax rate.

The Fair Tax Act is a bill in the United States Congress for changing tax laws to replace the Internal Revenue Service (IRS) and all federal income taxes, payroll taxes, corporate taxes, capital gains taxes, gift taxes, and estate taxes with a national retail sales tax, to be levied once at the point of purchase on all new goods and services. The proposal also calls for a monthly payment to households of citizens and legal resident aliens as an advance rebate of tax on purchases up to the poverty level. The impact of the FairTax on the distribution of the tax burden is a point of dispute. The plan's supporters argue that it would decrease tax burdens, broaden the tax base, be progressive, increase purchasing power, and tax wealth, while opponents argue that a national sales tax would be inherently regressive and would decrease tax burdens paid by high-income individuals.

Goods and Services Tax in Singapore is a broad-based value added tax levied on import of goods, as well as nearly all supplies of goods and services. The only exemptions are for the sales and leases of residential properties, importation and local supply of investment precious metals and most financial services. Export of goods and international services are zero-rated.

In economics, personal income refers to an individual's total earnings from wages, investment enterprises, and other ventures. It is the sum of all the incomes received by all the individuals or household during a given period. Personal income is that income which is received by the individuals or households in a country during the year from all sources. In general, it refers to all products and money that you receive.

Income inequality in the United States is the extent to which income is distributed in differing amounts among the American population. It has fluctuated considerably since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

James Stemble Duesenberry was an American economist. He made a significant contribution to the Keynesian analysis of income and employment with his 1949 doctoral thesis Income, Saving and the Theory of Consumer Behavior.

Income inequality in the Philippines is the extent to which income, most commonly measured by household or individual, is distributed in an uneven manner in the Philippines.

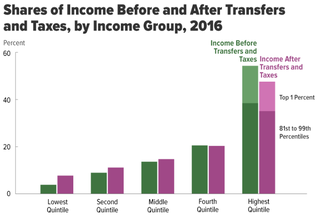

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

References

- ↑ Robert H. Frank (2008), "Taxation as Remedy for the U.S. Savings Shortfall", The economists' voice: top economists take on today's problems, ISBN 9780231143646

- ↑ Robert H. Frank (December 5, 2011). "Does Inequality Matter?". Slate .

- 1 2 Frank, Robert H.; Levine, Adam S. "Expenditure Cascades" (PDF). American Economic Association.

- 1 2 3 4 5 6 Frank, Robert H. (2003). "Are Positional Externalities Different From Other Externalities?" (PDF). Archived from the original (PDF) on 2008-05-17. Retrieved 2008-11-25.Cite journal requires

|journal=(help) - ↑ Ansell, Ben W. (2019-05-11). "The Politics of Housing". Annual Review of Political Science. 22 (1): 165–185. doi: 10.1146/annurev-polisci-050317-071146 . ISSN 1094-2939.

Frank, Robert E; Levine, Adam Seth; Dijk, Oege (2014). "Expenditure Cascades". Review of Behavioral Economics. 1 (1–2): 55–73. doi:10.1561/105.00000003. hdl: 2066/124064 .