The Reconstruction Finance Corporation was a government corporation administered by the United States Federal Government between 1932 and 1957 that provided financial support to state and local governments and made loans to banks, railroads, mortgage associations, and other businesses. Its purpose was to boost the country’s confidence and help banks resume daily functions after the start of the Great Depression. The RFC became more prominent under the New Deal and continued to operate through World War II. It was disbanded in 1957, when the US Federal Government concluded that it no longer needed to stimulate lending.

The Overseas Private Investment Corporation (OPIC) was the United States government's development finance institution until it merged with the Development Credit Authority (DCA) of the United States Agency for International Development (USAID) to form the U.S. International Development Finance Corporation (DFC). OPIC mobilized private capital to help solve critical development challenges and, in doing so, advanced the foreign policy of the United States and national security objectives.

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained its external exchange rates within 1 percent by tying its currency to gold and the ability of the International Monetary Fund (IMF) to bridge temporary imbalances of payments. Also, there was a need to address the lack of cooperation among other countries and to prevent competitive devaluation of the currencies as well.

The "Council for Mutual Economic Assistance" (Comecon) was an economic organization of communist states, created in 1949, and dissolved in 1991, with the collapse of the Soviet Union. International relations within Comecon is best discussed under three separate categories, as the nature of the relationships between the Soviet Union and its constituent members were not homogeneous.

The Export–Import Bank of the United States is the official export credit agency (ECA) of the United States federal government. Operating as a wholly owned federal government corporation, the Bank "assists in financing and facilitating U.S. exports of goods and services". EXIM intervenes when private sector lenders are unable or unwilling to provide financing, equipping American businesses with the financing tools necessary to compete for global sales. EXIM's aim is to promote U.S. goods and services at no cost to U.S. taxpayers, protecting “made in America” products against foreign competition in overseas markets and encouraging the creation of American jobs. Its most recent chairman and president, Kimberly A. Reed, was nominated by President Donald J. Trump on January 16, 2019, and sworn in on May 9, 2019. Her term expired on January 20, 2021 and her replacement has yet to be appointed.

The Argentine Currency Board pegged the Argentine peso to the U.S. dollar between 1991 and 2002 in an attempt to eliminate hyperinflation and stimulate economic growth. While it initially met with considerable success, the board's actions ultimately failed. In contrast to what most people think, this peg actually did not exist, except only in the first years of the plan. From then on, the government never needed to use the foreign exchange reserves of the country in the maintenance of the peg, except when the recession and the massive bank withdrawals started in 2000.

An export credit agency or investment insurance agency is a private or quasi-governmental institution that acts as an intermediary between national governments and exporters to issue export insurance solutions, guarantees for financing. The financing can take the form of credits or credit insurance and guarantees or both, depending on the mandate the ECA has been given by its government. ECAs can also offer credit or cover on their own account. This does not differ from normal banking activities. Some agencies are government-sponsored, others private, and others a combination of the two.

The Commodity Credit Corporation (CCC) is a wholly owned United States government corporation that was created in 1933 to "stabilize, support, and protect farm income and prices". The CCC is authorized to buy, sell, lend, make payments, and engage in other activities for the purpose of increasing production, stabilizing prices, assuring adequate supplies, and facilitating the efficient marketing of agricultural commodities.

The Japanese economic miracle is known as Japan's record period of economic growth between the post-World War II era to the end of the Cold War. During the economic boom, Japan rapidly became the world's second largest economy. By the 1990s, Japan's demographics began stagnating and the workforce was no longer expanding as it did in the previous decades, despite per-worker productivity remaining high.

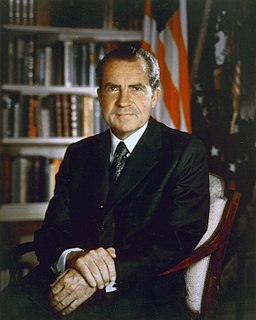

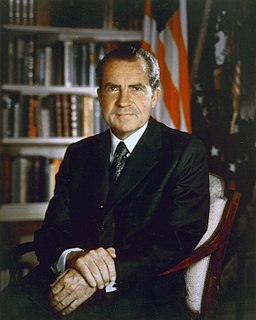

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

The Export–Import Bank of China is one of three institutional banks in China chartered to implement the state policies in industry, foreign trade, economy, and foreign aid to other developing countries, and provide policy financial support so as to promote the export of Chinese products and services. Established in 1994, the bank is subordinated to the State Council.

The Philippine Guarantee Corporation(PHILGUARANTEE) is a Government-owned and controlled corporation attached to the Department of Finance. Formerly known as the Philippine Export-Import Credit Agency or PhilEXIM, is the principal agency for State Guarantee Finance of the Philippines. The primary objective is to perform development financing role through the provision of credit guarantees in support of trade and investments, exports, infrastructure, energy, tourism, agricultural business/modernization, housing, MSMEs and other priority sectors of the economy, with the end in view of facilitating and promoting socio-economic and regional development.

Exim Bank or Export-Import Bank may refer to:

African Export–Import Bank, also referred to as Afreximbank, is a pan-African multilateral trade finance institution created in 1993 under the auspices of the African Development Bank. It is headquartered in Cairo, Egypt. Afreximbank's vision is to be the trade finance bank for Africa.

The Export–Import Bank of Korea, also commonly known as the Korea Eximbank (KEXIM), is the official export credit agency of South Korea.

The Foreign Military Sales Act of 1971, Pub.L. 91–672, 84 Stat. 2053, enacted January 12, 1971, was created as an amendment to the Foreign Military Sales Act of 1968. The Act of 1971 established declarations to promote international peace and national security for economic, political, and social progress. The declaration provided coordination for international armament appropriations meeting the objectives of the Nixon Administration's foreign policy.

The Export–Import Bank Reauthorization Act of 2012 amended the Export–Import Bank Act of 1945 to extend the termination of functions of the Export–Import Bank of the United States, which helps financing and insuring foreign purchases of United States goods for customers unable or unwilling to accept credit risk and to aid in creating and sustaining jobs in the United States by financing sales of U.S. produced exports to international buyers. The bill was signed into law on May 20, 2012 and moved the termination of the bank's functions date to September 30, 2014.

International Investment Bank is a multilateral development bank established in 1970 by Comecon in order to promote economic development and cooperation of the member states. The Bank carries out its activities based on an intergovernmental Agreement establishing the bank, registered with the United Nations Secretariat. The headquarters is located in Budapest, Hungary.

The Export–Import Bank of Thailand is a state-owned bank headquartered in Bangkok, Thailand.

The United States International Development Finance Corporation (DFC) is the development finance institution of the United States federal government, primarily responsible for providing and facilitating the financing of private development projects in lower- and middle-income countries. First authorized on 5 October 2018, the independent agency was formed 20 December 2019 by merging the Overseas Private Investment Corporation (OPIC) with the Development Credit Authority (DCA) of the United States Agency for International Development (USAID), as well as with several smaller offices and funds.