Related Research Articles

The economy of Moldova is an emerging upper-middle income economy, with a high Human Development Index. Moldova is a landlocked Eastern European country, bordered by Ukraine on the East and Romania to the West. It is a former Soviet republic and today a candidate member to the European Union.

In accounting, fixed capital is any kind of real, physical asset that is used repeatedly in the production of a product. In economics, fixed capital is a type of capital good that as a real, physical asset is used as a means of production which is durable or isn't fully consumed in a single time period. It contrasts with circulating capital such as raw materials, operating expenses etc.

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year."

A foreign direct investment (FDI) refers to purchase of an asset in another country, such that it gives direct control to the purchaser over the asset. In other words, it is an investment in the form of a controlling ownership in a business, in real estate or in productive assets such as factories in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment or foreign indirect investment by a notion of direct control.

The economy of India has transitioned from a mixed planned economy to a mixed middle-income developing social market economy with notable state participation in strategic sectors and indicative planning. It is the world's fifth-largest economy by nominal GDP and the third-largest by purchasing power parity (PPP). According to the International Monetary Fund (IMF), on a per capita income basis, India ranked 139th by GDP (nominal) and 127th by GDP (PPP). From independence in 1947 until 1991, successive governments followed Soviet style planned economy and promoted protectionist economic policies, with extensive state intervention and economic regulation. This is characterised as dirigism, in the form of the Licence Raj. The end of the Cold War and an acute balance of payments crisis in 1991 led to the adoption of a broad economic liberalisation in India and indicative planning. Since the start of the 21st century, annual average GDP growth has been 6% to 7%. The economy of the Indian subcontinent was the largest in the world for most of recorded history up until the onset of colonialism in early 19th century. India account for 7.2% of global economy in 2022 in PPP terms, and around 3.4% in nominal terms in 2022.

In macroeconomics and international finance, the capital account, also known as the capital and financial account records the net flow of investment transaction into an economy. It is one of the two primary components of the balance of payments, the other being the current account. Whereas the current account reflects a nation's net income, the capital account reflects net change in ownership of national assets.

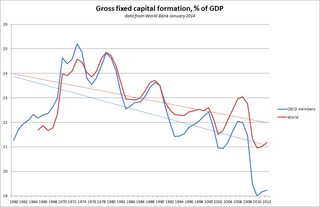

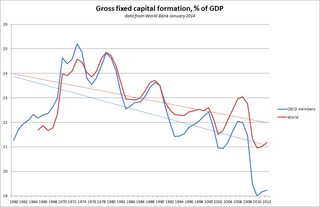

(GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets.

is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

Fictitious capital is a concept used by Karl Marx in his critique of political economy. It is introduced in chapter 25 of the third volume of Capital. Fictitious capital contrasts with what Marx calls "real capital", which is capital actually invested in physical means of production and workers, and "money capital", which is actual funds being held. The market value of fictitious capital assets varies according to the expected return or yield of those assets in the future, which Marx felt was only indirectly related to the growth of real production. Effectively, fictitious capital represents "accumulated claims, legal titles, to future production" and more specifically claims to the income generated by that production.

Đổi Mới is the name given to the economic reforms initiated in Vietnam in 1986 with the goal of creating a "socialist-oriented market economy". The term đổi mới itself is a general term with wide use in the Vietnamese language meaning "innovate" or "renovate". However, the Đổi Mới Policy refers specifically to these reforms that sought to transition Vietnam from a command economy to a socialist-oriented market economy.

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

Foreign affiliate trade statistics (FATS), also known as transnational corporation (TNC) data details the economic operations of foreign direct investment-based enterprises.

Foreign direct investment in Iran (FDI) has been hindered by unfavorable or complex operating requirements and by international sanctions, although in the early 2000s the Iranian government liberalized investment regulations. Iran ranks 62nd in the World Economic Forum's 2011 analysis of the global competitiveness of 142 countries. In 2010, Iran ranked sixth globally in attracting foreign investments.

In 2012, Romania's largest trading partner was Germany, followed by Italy. Romania's main exports to Germany were insulated wire, cars and vehicle parts, whereas its main German imports are cars and vehicle parts. The principal Italian imports to Romania include hides, footwear parts, medicaments, telephones and vehicle parts. Romania's chief exports to Italy included leather footwear, cars, telephones, tobacco, men's suits, seats and iron pipes.

Algeria's economy continued to recover in the first half of 2022, led by a return of oil production to pre-pandemic levels and a continued recovery of the service sector along with a more vigorous agricultural activity. The recovery should continue into 2023, supported by the nonhydrocarbon sector and public expenditure growth, according to the latest edition of the World Bank's Algeria Economic Update.

China has an upper middle income developing mixed socialist market economy that incorporates industrial policies and strategic five-year plans. It is the world's second largest economy by nominal GDP, behind the United States, and the world's largest economy since 2016 when measured by purchasing power parity (PPP). Due to a volatile currency exchange rate, China's GDP as measured in dollars fluctuates sharply. China accounted for 18.6% of global economy in 2022 in PPP terms, and around 18% in nominal terms in 2022. Historically, China was one of the world's foremost economic powers for most of the two millennia from the 1st until the 19th century. The economy consists of public sector enterprise, state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector and openness to foreign businesses in a system. It recently overtook the economy of the European Union in 2021. Private investment and exports are the main drivers of economic growth in China; but, in recent years, the Chinese government has been emphasising domestic consumption.

Globalization is a process that encompasses the causes, courses, and consequences of transnational and transcultural integration of human and non-human activities. India had the distinction of being the world's largest economy till the end of the Mughal era, as it accounted for about 32.9% share of world GDP and about 17% of the world population. The goods produced in India had long been exported to far off destinations across the world; the concept of globalization is hardly new to India.

The social dividend is the return on the natural resources and capital assets owned by society in a socialist economy. The concept notably appears as a key characteristic of market socialism, where it takes the form of a dividend payment to each citizen derived from the property income generated by publicly owned enterprises, representing the individual's share of the capital and natural resources owned by society.

NMB Bank Limited, previously known as National Merchant Bank of Zimbabwe Limited, is a commercial bank in Zimbabwe. It is licensed by the Reserve Bank of Zimbabwe, the central bank of that country and the national banking regulator.

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct control. Broadly, foreign direct investment includes "mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans". FDI is the sum of equity capital, long-term capital, and short-term capital as shown in the balance of payments. FDI usually involves participation in management, joint-venture, transfer of technology and expertise. Stock of FDI is the net cumulative FDI for any given period. Direct investment excludes investment through purchase of shares.