A medication is a drug used to diagnose, cure, treat, or prevent disease. Drug therapy (pharmacotherapy) is an important part of the medical field and relies on the science of pharmacology for continual advancement and on pharmacy for appropriate management.

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescription. In many countries, OTC drugs are selected by a regulatory agency to ensure that they contain ingredients that are safe and effective when used without a physician's care. OTC drugs are usually regulated according to their active pharmaceutical ingredient (API) rather than final products. By regulating APIs instead of specific drug formulations, governments allow manufacturers the freedom to formulate ingredients, or combinations of ingredients, into proprietary mixtures.

Cold medicines are a group of medications taken individually or in combination as a treatment for the symptoms of the common cold and similar conditions of the upper respiratory tract. The term encompasses a broad array of drugs, including analgesics, antihistamines and decongestants, among many others. It also includes drugs which are marketed as cough suppressants or antitussives, but their effectiveness in reducing cough symptoms is unclear or minimal.

A prescription drug is a pharmaceutical drug that legally requires a medical prescription to be dispensed. In contrast, over-the-counter drugs can be obtained without a prescription. The reason for this difference in substance control is the potential scope of misuse, from drug abuse to practicing medicine without a license and without sufficient education. Different jurisdictions have different definitions of what constitutes a prescription drug.

The Pharmaceutical Benefits Scheme (PBS) is a program of the Australian Government that subsidises prescription medication for Australian citizens and permanent residents, as well as international visitors covered by a reciprocal health care agreement. The PBS is separate to the Medicare Benefits Schedule, a list of health care services that can be claimed under Medicare, Australia's universal health care insurance scheme.

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either high-deductible health plans or standard health plans.

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $550 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits.

Dihydrocodeine is a semi-synthetic opioid analgesic prescribed for pain or severe dyspnea, or as an antitussive, either alone or compounded with paracetamol (acetaminophen) or aspirin. It was developed in Germany in 1908 and first marketed in 1911.

Excedrin is an over-the-counter headache pain reliever, typically in the form of tablets or caplets. It contains paracetamol (acetaminophen), aspirin, and caffeine. It was manufactured by Bristol-Myers Squibb until it was purchased by Novartis in July, 2005 along with other products from BMS's over-the-counter business. As of March 2015, GSK holds majority ownership of Excedrin through a joint venture transaction with Novartis. On 18 July 2022, GSK spun off its consumer healthcare business to Haleon.

Vicks is an American brand of over-the-counter medications owned by the American companies Procter & Gamble and Helen of Troy Limited. Vicks manufactures NyQuil and its sister medication, DayQuil. The Vicks brand also produces formula 44 cough medicines, cough drops, Vicks VapoRub, and a number of inhaled breathing treatments. For much of its history, Vicks products were manufactured by the family-owned company Richardson-Vicks, Inc., based in Greensboro, North Carolina. Richardson-Vicks, Inc., was eventually sold to Procter & Gamble in 1985. Procter & Gamble divested the Vicks VapoSteam U.S. liquid inhalant business and sold it to Helen of Troy in 2015.

Phenylephrine is a medication primarily used as a decongestant, to dilate the pupil, to increase blood pressure, and to relieve hemorrhoids. It was long maintained that when taken orally as a decongestant, it relieves nasal congestion due to colds and hay fever. Phenylephrine can be taken by mouth, as a nasal spray, given by injection into a vein or muscle, or applied to the skin.

Fluticasone propionate, sold under the brand names Flovent and Flonase among others, is a steroid medication. When inhaled it is used for the long term management of asthma and COPD. In the nose it is used for hay fever and nasal polyps. It can also be used for mouth ulcers.

Ear drops are a form of topical medication for the ears used to treat infection, inflammation, impacted ear wax and local anesthesia. They are commonly used for short-term treatment and can be purchased with or without a prescription. Before using ear drops, refer to the package insert or consult a health professional for the amount of drops to use and the duration of treatment.

A FSA Debit Card is a type of debit card issued in the United States. It can access tax-favored spending accounts such as flexible spending accounts (FSA) and health reimbursement accounts (HRA), and sometimes health savings accounts (HSA) as well.

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest such plans that allowed employees to choose between different types of benefits, similar to the ability of a customer to choose among available items in a cafeteria. Qualified cafeteria plans are excluded from gross income. To qualify, a cafeteria plan must allow employees to choose from two or more benefits consisting of cash or qualified benefit plans. The Internal Revenue Code explicitly excludes deferred compensation plans from qualifying as a cafeteria plan subject to a gross income exemption. Section 125 also provides two exceptions.

The Inventory Information Approval System, or IIAS, is a point-of-sale technology used by retailers that accept FSA debit cards, which are issued for use with medical flexible spending accounts (FSAs), health reimbursement accounts (HRAs), and some health savings accounts (HSAs) in the United States.

A combination drug or a fixed-dose combination (FDC) is a medicine that includes two or more active ingredients combined in a single dosage form. Terms like "combination drug" or "combination drug product" can be common shorthand for a FDC product, although the latter is more precise if in fact referring to a mass-produced product having a predetermined combination of drugs and respective dosages. And it should also be distinguished from the term "combination product" in medical contexts, which without further specification can refer to products that combine different types of medical products—such as device/drug combinations as opposed to drug/drug combinations. Note that when a combination drug product is a "pill", then it is also a kind of "polypill" or combopill.

Hydrocodone/paracetamol is the combination of the pain medications hydrocodone and paracetamol (acetaminophen). It is used to treat moderate to severe pain. It is taken by mouth. Recreational use is common in the United States.

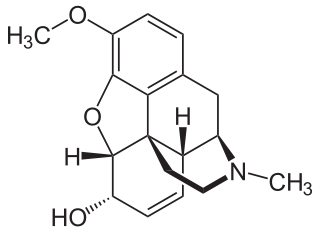

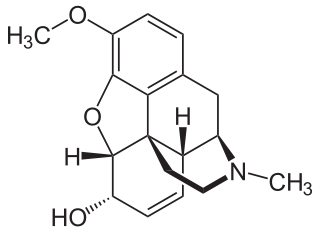

Codeine is an opiate and prodrug of morphine mainly used to treat pain, coughing, and diarrhea. It is also commonly used as a recreational drug. It is found naturally in the sap of the opium poppy, Papaver somniferum. It is typically used to treat mild to moderate degrees of pain. Greater benefit may occur when combined with paracetamol (acetaminophen) or a nonsteroidal anti-inflammatory drug (NSAID) such as aspirin or ibuprofen. Evidence does not support its use for acute cough suppression in children or adults. In Europe, it is not recommended as a cough medicine in those under 12 years of age. It is generally taken by mouth. It typically starts working after half an hour, with maximum effect at two hours. Its effects last for about four to six hours. Codeine exhibits abuse potential similar to other opioid medications.