Growth accounting is a procedure used in economics to measure the contribution of different factors to economic growth and to indirectly compute the rate of technological progress, measured as a residual, in an economy. Growth accounting decomposes the growth rate of an economy's total output into that which is due to increases in the contributing amount of the factors used—usually the increase in the amount of capital and labor—and that which cannot be accounted for by observable changes in factor utilization. The unexplained part of growth in GDP is then taken to represent increases in productivity or a measure of broadly defined technological progress.

In economics and econometrics, the Cobb–Douglas production function is a particular functional form of the production function, widely used to represent the technological relationship between the amounts of two or more inputs and the amount of output that can be produced by those inputs. The Cobb–Douglas form was developed and tested against statistical evidence by Charles Cobb and Paul Douglas between 1927–1947; according to Douglas, the functional form itself was developed earlier by Philip Wicksteed.

Endogenous growth theory holds that economic growth is primarily the result of endogenous and not external forces. Endogenous growth theory holds that investment in human capital, innovation, and knowledge are significant contributors to economic growth. The theory also focuses on positive externalities and spillover effects of a knowledge-based economy which will lead to economic development. The endogenous growth theory primarily holds that the long run growth rate of an economy depends on policy measures. For example, subsidies for research and development or education increase the growth rate in some endogenous growth models by increasing the incentive for innovation.

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

In economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input is the change in output resulting from employing one more unit of a particular input, assuming that the quantities of other inputs are kept constant.

In Keynesian economics, underemployment equilibrium is a situation with a persistent shortfall relative to full employment and potential output so that unemployment is higher than at the NAIRU or the "natural" rate of unemployment.

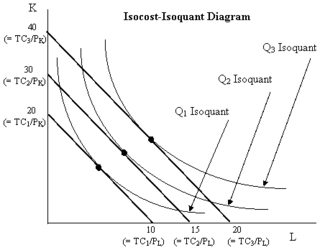

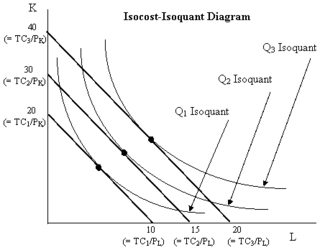

In economics, an isocost line shows all combinations of inputs which cost the same total amount. Although similar to the budget constraint in consumer theory, the use of the isocost line pertains to cost-minimization in production, as opposed to utility-maximization. For the two production inputs labour and capital, with fixed unit costs of the inputs, the equation of the isocost line is

The Heckscher–Ohlin model is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo's theory of comparative advantage by predicting patterns of commerce and production based on the factor endowments of a trading region. The model essentially says that countries export the products which use their relatively abundant and cheap factors of production, and import the products which use the countries' relatively scarce factors.

The Solow–Swan model or exogenous growth model is an economic model of long-run economic growth. It attempts to explain long-run economic growth by looking at capital accumulation, labor or population growth, and increases in productivity largely driven by technological progress. At its core, it is an aggregate production function, often specified to be of Cobb–Douglas type, which enables the model "to make contact with microeconomics". The model was developed independently by Robert Solow and Trevor Swan in 1956, and superseded the Keynesian Harrod–Domar model.

In economics, a conditional factor demand is the cost-minimizing level of an input such as labor or capital, required to produce a given level of output, for given unit input costs of the input factors. A conditional factor demand function expresses the conditional factor demand as a function of the output level and the input costs. The conditional portion of this phrase refers to the fact that this function is conditional on a given level of output, so output is one argument of the function. Typically this concept arises in a long run context in which both labor and capital usage are choosable by the firm, so a single optimization gives rise to conditional factor demands for each of labor and capital.

Constant elasticity of substitution (CES), in economics, is a property of some production functions and utility functions. Several economists have featured in the topic and have contributed in the final finding of the constant. They include Tom McKenzie, John Hicks and Joan Robinson. The vital economic element of the measure is that it provided the producer a clear picture of how to move between different modes or types of production.

Hotelling's lemma is a result in microeconomics that relates the supply of a good to the maximum profit of the producer. It was first shown by Harold Hotelling, and is widely used in the theory of the firm.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention.

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input.

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity.

Luigi L. Pasinetti is an Italian economist of the post-Keynesian school. Pasinetti is considered the heir of the "Cambridge Keynesians" and a student of Piero Sraffa and Richard Kahn. Along with them, as well as Joan Robinson, he was one of the prominent members on the "Cambridge, UK" side of the Cambridge capital controversy. His contributions to economics include developing the analytical foundations of neo-Ricardian economics, including the theory of value and distribution, as well as work in the line of Kaldorian theory of growth and income distribution. He has also developed the theory of structural change and economic growth, structural economic dynamics and uneven sectoral development.

In economics, factor payments are the income people receive for supplying the factors of production: land, labor, capital or entrepreneurship.

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function, and depends on the amounts of physical capital and labor already in use.

In economics, the labor demand of an employer is the number of labor-hours that the employer is willing to hire based on the various exogenous variables it is faced with, such as the wage rate, the unit cost of capital, the market-determined selling price of its output, etc. The function specifying the quantity of labor that would be demanded at any of various possible values of these exogenous variables is called the labor demand function. The sum of the labor-hours demanded by all employers in total is the market demand for labor.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.