EF Hutton was an American stock brokerage firm founded in 1904 by Edward Francis Hutton and his brother, Franklyn Laws Hutton. Later, it was led by well known Wall Street trader Gerald M. Loeb. Under their leadership, EF Hutton became one of the most respected financial firms in the United States and for several decades was the second largest brokerage firm in the country.

American Express Company (Amex) is an American bank holding company and multinational financial services corporation that specializes in payment cards. It is headquartered at 200 Vesey Street, also known as American Express Tower, in the Battery Park City neighborhood of Lower Manhattan. Amex is the fourth-largest card network globally based on purchase volume, behind China UnionPay, Visa, and Mastercard. 133.3 million Amex cards were in force worldwide as of December 31, 2022, with an average annual spend per card member of US$23,496. That year, Amex handled over 1.6 trillion in purchase volume on its network. Amex is one of the largest US banks, and is ranked 77th on the Fortune 500 and 28th on the list of the most valuable brands by Forbes. In 2023, it was ranked 63rd in the Forbes Global 2000. Amex also owns a direct bank.

Sanford I. "Sandy" Weill is an American banker, financier and philanthropist. He is a former chief executive and chairman of Citigroup. He served in those positions from 1998 until October 1, 2003, and April 18, 2006, respectively.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Kuhn, Loeb & Co. was an American multinational investment bank founded in 1867 by Abraham Kuhn and his brother-in-law Solomon Loeb. Under the leadership of Jacob H. Schiff, Loeb's son-in-law, it grew to be one of the most influential investment banks in the late 19th and early 20th centuries, financing America's expanding railways and growth companies, including Western Union and Westinghouse, and thereby becoming the principal rival of J.P. Morgan & Co.

Nomura Securities Co., Ltd. is a Japanese financial services company and a wholly owned subsidiary of Nomura Holdings, Inc. (NHI), which forms part of the Nomura Group. It plays a central role in the securities business, the group's core business. Nomura is a financial services group and global investment bank. Based in Tokyo, Japan, with regional headquarters in Hong Kong, London, and New York, Nomura employs about 26,000 staff worldwide; it is known as Nomura Securities International in the US, and Nomura International plc. in EMEA. It operates through five business divisions: retail, global markets, investment banking, merchant banking, and asset management.

A. G. Becker & Co. was an investment bank based in Chicago, Illinois, United States.

Wasserstein Perella & Co. was a boutique investment bank established by Bruce Wasserstein, Joseph R. Perella, Bill Lambert, and Charles Ward in 1988, former bankers at First Boston Corp., until its eventual sale to Dresdner Bank in 2000 for some $1.4 billion in stock. The private equity business of the investment firm was not included in the sale and was to be sold off to existing Wasserstein shareholders.

TD Cowen, is an American multinational investment bank and financial services division of TD Securities that operates through two business segments: a broker-dealer and an investment management division. The company's broker-dealer division offers investment banking services, equity and credit research, sales and trading, global prime brokerage, outsourced trading, global clearing and commission management services. Cowen's investment management segment offers actively managed alternative investment products. Founded in 1918, the firm is headquartered in New York and has offices worldwide. Cowen claims it is known for successfully identifying emerging industries early on, especially the emerging cannabis industry.

Marvin Traub was an American businessman and writer. He was a prominent business executive in the retail sector known for his impact on merchandising and marketing. Traub was CEO and President of Bloomingdale's for twenty-two years leaving in 1992 to found his own consulting firm, Marvin Traub Associates. Between 1994 and 2000, Marvin Traub Associates participated in a joint venture with retail-focused investment banking firm, Financo, Inc.

Evercore Inc., formerly known as Evercore Partners, is a global independent investment banking advisory firm founded in 1995 by Roger Altman, David Offensend, and Austin Beutner. The firm has advised on over $4.7 trillion of merger, acquisition, and restructuring transactions since its founding. Evercore is widely considered one of the most prestigious and elite investment banking advisory firms.

L.F. Rothschild was a merchant and investment banking firm based in the United States and founded in 1899. The firm collapsed following the 1987 stock market crash.

Shearson was the name of a series of investment banking and retail brokerage firms from 1902 until 1994, named for Edward Shearson and the firm he founded, Shearson Hammill & Co. Among Shearson's most notable incarnations were Shearson / American Express, Shearson Lehman / American Express, Shearson Lehman Brothers, Shearson Lehman Hutton and finally Smith Barney Shearson.

Shearson, Hammill & Co. was a Wall Street brokerage and investment banking firm founded in 1902 by Edward Shearson and Caleb Wild Hammill. The firm originally built its business as a stock broker as well as a broker of various commodities, particularly grain and cotton. The firm was a member of the New York Stock Exchange, the Chicago Stock Exchange and the Chicago Mercantile Exchange.

Cogan, Berlind, Weill & Levitt, originally Carter, Berlind, Potoma & Weill, was an American investment banking and brokerage firm founded in 1960 and acquired by American Express in 1981. In its two decades as an independent firm, Cogan, Berlind, Weill & Levitt served as a vehicle for the rollup of more than a dozen brokerage and securities firms led by Sanford I. Weill that culminated in the formation of Shearson Loeb Rhoades.

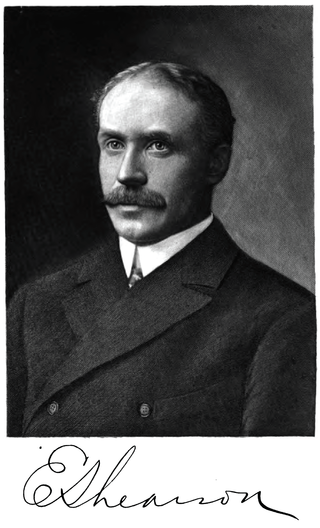

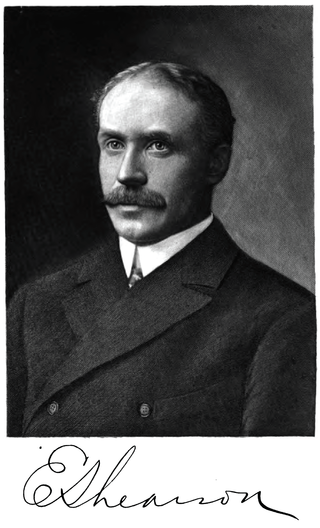

Edward Shearson was a banker, millionaire and founder of Shearson, Hammill & Co., which was among the largest brokerage and investment banking firms in the United States.

Peter A. Cohen is the chairman and CEO of Andover National Corporation, a public holding company. He was formerly the chairman and CEO of Cowen Inc., also known as Cowen & Company now TD Cowen. Prior to his current role, Cohen founded Ramius Capital Management in 1994, a $13 billion investment firm, which he merged with Cowen Inc. in 2009. Prior to this, Cohen was the chairman and chief executive officer of Shearson Lehman American Express from 1983 through 1991.

Peter J. Solomon is an American investment banker and the founder and chairman of Solomon Partners, one of the country's first independent investment banks. He is also a former New York City Deputy Mayor for Economic Policy and Development.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

Alvarez & Marsal Holdings, LLC(A&M) is a global professional services firm notable for its work in turnaround management and performance improvement of a number of large, high-profile businesses both in the US and abroad such as Lehman Brothers, HealthSouth, Tribune Company, Warnaco, Interstate Bakeries, Target, Darden Restaurants and Arthur Andersen.