JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City. JPMorgan Chase is incorporated in Delaware.

ICICI Bank Limited is a privately owned Indian development finance institution with its registered office in Vadodara, Gujarat, and corporate office in Mumbai, Maharashtra. It offers a wide range of banking products and financial services for corporate and retail customers through a variety of delivery channels and specialised subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management. The bank has a network of 5,275 branches and 15,589 ATMs across India and has a presence in 17 countries.

Navy Federal Credit Union is a global credit union headquartered in Vienna, Virginia, chartered and regulated under the authority of the National Credit Union Administration (NCUA). Navy Federal is the largest natural member credit union in the United States, both in asset size and in membership. As of March 2021, Navy Federal has US $138.6 billion in assets, and has 10.1 million members.

NETSCOUT Systems, Inc. is a provider of application and network performance management products. Headquartered in Westford, Massachusetts, NETSCOUT serves enterprises community, government agencies and telecommunications service providers.

Gemalto was an international digital security company providing software applications, secure personal devices such as smart cards and tokens, and managed services. Formed in June 2006 by the merger of two companies, Axalto and Gemplus International. Gemalto N.V.'s revenue in 2018 was €2.969 billion.

The HP Garage is a private museum where the company Hewlett-Packard (HP) was founded. It is located at 367 Addison Avenue in Palo Alto, California. It is considered to be the "Birthplace of Silicon Valley". In the 1930s, Stanford University and its Dean of Engineering Frederick Terman began encouraging faculty and graduates to stay in the area instead of leaving California, and develop a high-tech region. HP founders Bill Hewlett and David Packard are considered the first Stanford students who took Terman's advice.

Hudson Valley Credit Union is a credit union serving the New York counties of Dutchess, Orange, Ulster, Putnam, Rockland, Westchester, Greene, Columbia, Albany, Rensselaer, Schenectady, and Saratoga. Founded in 1963 in Poughkeepsie, New York, the institution has 287,000+ members and over 800 employees as of March 2017. HVCU is one of the largest credit unions in the United States with assets totaling more than $5.95 billion as of June 2020.

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices throughout the United States and overseas.

HNA Technology Investments Holdings Limited formerly known as Advanced Card Systems Holdings Limited is a Cayman Islands-incorporated offshore holding company. Its subsidiary, Advanced Card Systems Limited, was incorporated in British Hong Kong in 1995 by Denny Wong. In 2017, HNA Group, via HNA EcoTech Group and HNA EcoTech Group's subsidiary, acquired Advanced Card Systems Holdings as part of a reverse IPO.

Meridian Credit Union Ltd. is a Canadian credit union. It was formed April 1, 2005 through the merger of Niagara Credit Union and HEPCOE Credit Union. It is insured by the Financial Services Regulatory Authority of Ontario.

Altura Credit Union (Altura) is the largest credit union headquartered in Riverside County, California, with over 150,000 members and assets in excess of $2 billion. As a federally insured, state-chartered financial institution, Altura operates 19 full-service branches and its deposit assets are insured by the National Credit Union Share Insurance Fund (NCUSIF). Altura offers a wide range of financial products and services that include checking and savings accounts, new and used auto loans, commercial and residential mortgage loans, and wealth management services. Altura's banking platform includes online banking, mobile banking, web bill pay, and online/mobile loan applications. Altura also belongs to the CO-OP shared branching network, which provides its members with fee-free access to over 5,200 branches and more than 30,000 ATMs.

Stanford Federal Credit Union is a federally chartered credit union located in Palo Alto, California. It provides banking services to the Stanford community. Stanford FCU has over $3.3 billion in assets and serves over 74,000 members.

Firstmark Credit Union is a federally insured, state-chartered, member-owned, not-for-profit financial cooperative. The credit union was founded by educators in 1932, and changed its name to Firstmark Credit Union in October 2002. Serving over 100,000 members and managing assets of more than US $1 billion, the Credit Union is the fourth largest in San Antonio, Texas’. With eleven financial centers(including the acquisition of Southside Credit Union and St. Joseph's Credit Union), the Credit Union offers a full range of financial products and services, both personal and commercial. Firstmark Credit Union is community-chartered. Membership is open to anyone who lives, works, worships or attends school in include all counties contiguous to Bexar County and Gillespie County. Under new field of membership, Firstmark has grown full community membership from 8 counties to 21 counties; Kerr County, which is contiguous to Gillespie County, is being added as the one county where Firstmark did not previously have any field of membership included in its bylaws. These new membership qualifications make it easier for individuals in these communities to become members of Firstmark Credit Union.

UBS Group AG is a Swiss multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. UBS client services are known for their strict bank–client confidentiality and culture of banking secrecy. Because of the bank's large positions in the Americas, EMEA, and Asia Pacific markets, the Financial Stability Board considers it a global systemically important bank.

EVRY A/S was a Norwegian information technology company that supplies services relating to computing, including operation, outsourcing, and online banking. The company is headquartered in Oslo. It was established through a merger between EDB Business Partner and ErgoGroup in 2010 and has 10,000 employees at 135 offices in 16 countries.

2C2P is a Southeast Asia-based payments provider that works with global enterprises to accept payments across online, mobile and offline channels, as well as provide issuing, payouts, remittance and digital goods aggregation and reselling services. It is co-headquartered in Singapore and Bangkok and operates across Southeast Asia and Europe.

Caltech Employees Federal Credit Union (CEFCU) is a Credit Union for the California Institute of Technology family and its affiliate organizations. CEFCU is headquartered in La Cañada Flintridge and is the 25th largest credit union in the state of California. It is also the 156th largest credit union in the nation. The union's savings rates are 73% higher than the national average.

EyeVerify, Inc. is a biometric security technology company based in Kansas City, Missouri owned by Ant Group. Its chief product, Eyeprint ID, provides verification using eye veins and other micro-features in and around the eye. Images of the human eye are used to authenticate mobile device users. EyeVerify licenses its software for use in mobile banking applications, such as those offered by Tangerine Bank, NCR/Digital Insight and Wells Fargo.

Tech CU is a Silicon Valley-based credit union.

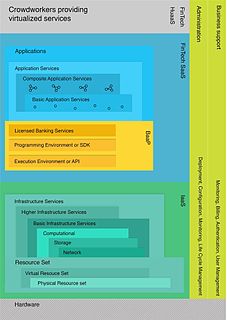

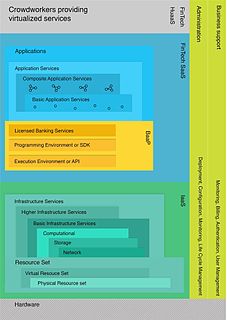

Banking as a service (BaaS) is an end-to-end process ensuring the overall execution of a financial service provided over the web. Such a digital banking service is available on-demand and operates within a set time-frame.