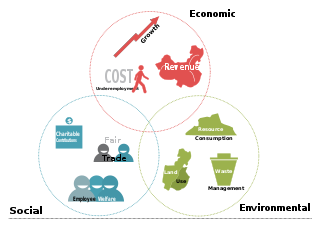

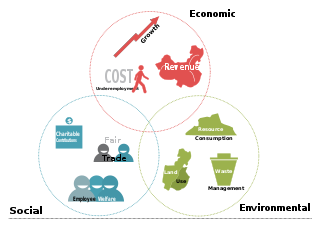

The triple bottom line is an accounting framework with three parts: social, environmental and economic. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value. Business writer John Elkington claims to have coined the phrase in 1994.

Corporate social responsibility (CSR) or corporate social impact is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable nature by engaging in, with, or supporting professional service volunteering through pro bono programs, community development, administering monetary grants to non-profit organizations for the public benefit, or to conduct ethically oriented business and investment practices. While once it was possible to describe CSR as an internal organizational policy or a corporate ethic strategy similar to what is now known today as Environmental, Social, Governance (ESG); that time has passed as various companies have pledged to go beyond that or have been mandated or incentivized by governments to have a better impact on the surrounding community. In addition, national and international standards, laws, and business models have been developed to facilitate and incentivize this phenomenon. Various organizations have used their authority to push it beyond individual or industry-wide initiatives. In contrast, it has been considered a form of corporate self-regulation for some time, over the last decade or so it has moved considerably from voluntary decisions at the level of individual organizations to mandatory schemes at regional, national, and international levels. Moreover, scholars and firms are using the term "creating shared value", an extension of corporate social responsibility, to explain ways of doing business in a socially responsible way while making profits.

Ethical consumerism is a type of consumer activism based on the concept of dollar voting. People practice it by buying ethically made products that support small-scale manufacturers or local artisans and protect animals and the environment, while boycotting products that exploit children as workers, are tested on animals, or damage the environment.

A green economy is an economy that aims at reducing environmental risks and ecological scarcities, and that aims for sustainable development without degrading the environment. It is closely related with ecological economics, but has a more politically applied focus. The 2011 UNEP Green Economy Report argues "that to be green, an economy must not only be efficient, but also fair. Fairness implies recognizing global and country level equity dimensions, particularly in assuring a Just Transition to an economy that is low-carbon, resource efficient, and socially inclusive."

Johannes Daniel Dahm is a German geographer, ecologist, activist, consultant and entrepreneur.

An ethical bank, also known as a social, alternative, civic, or sustainable bank, is a bank concerned with the social and environmental impacts of its investments and loans. The ethical banking movement includes: ethical investment, impact investment, socially responsible investment, corporate social responsibility, and is also related to such movements as the fair trade movement, ethical consumerism, and social enterprise.

Socially responsible investing (SRI) is any investment strategy which seeks to consider financial return alongside ethical, social or environmental goals. The areas of concern recognized by SRI practitioners are often linked to environmental, social and governance (ESG) topics. Impact investing can be considered a subset of SRI that is generally more proactive and focused on the conscious creation of social or environmental impact through investment. Eco-investing is SRI with a focus on environmentalism.

Gerhard Scherhorn was a German Professor and economist.

Corporate sustainability is an approach aiming to create long-term stakeholder value through the implementation of a business strategy that focuses on the ethical, social, environmental, cultural, and economic dimensions of doing business. The strategies created are intended to foster longevity, transparency, and proper employee development within business organizations. Firms will often express their commitment to corporate sustainability through a statement of Corporate Sustainability Standards (CSS), which are usually policies and measures that aim to meet, or exceed, minimum regulatory requirements.

The SRI Conference is the annual national conference of the sustainable and responsible investing (SRI) industry. The conference was founded in 1990 by George R. Gay, and has grown from 45 to over 1,200 participants. Attendees include investment professionals in the SRI industry: licensed investment professionals, SRI mutual fund companies, asset managers, community development financial institutions, social research and proxy voting organizations, faith-based institutional investors, and social change non-profits.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

Environmental, social, and governance (ESG), is a set of aspects, including environmental issues, social issues and corporate governance that can be considered in investing. Investing with ESG considerations is sometimes referred to as responsible investing or, in more proactive cases, impact investing.

Eco-investing or green investing is a form of socially responsible investing where investments are made in companies that support or provide environmentally friendly products and practices. These companies encourage new technologies that support the transition from carbon dependence to more sustainable alternatives. Green finance is "any structured financial activity that has been created to ensure a better environmental outcome."

Institutional Shareholder Services Inc. (ISS) is a proxy advisory firm. Hedge funds, mutual funds and similar organizations that own shares of multiple companies pay ISS to advise regarding share holder votes. As the leading firm in the industry, ISS commands a 48 percent market share as of 2021, with its nearest rival, Glass Lewis, holding a 42 percent market share.

RepRisk AG is an environmental, social, and corporate governance (ESG) data science company based in Zurich, Switzerland, specializing in ESG and business-conduct risk research, and quantitative solutions.

Werner Doppler (born December 15, 1941, in Oberlustadt, Germany is an Agricultural Economist. His areas of teaching and research have been Farming Systems, Rural Development and Socioeconomics in the Tropics and Subtropics. He was Dean of Faculty at the University of Hohenheim.

Vereinigung für Ökologische Ökonomie (VÖÖ) is a German scientific society promoting ecological principles in the global economy.

The Steyler Bank is a German ethical-ecological bank using Christian finance principles that following the Steyler Missionare. It was founded in 1964 in Sankt Augustin, where it still has its headquarters, and creates funds from an ethical point of view. The Steyler Bank also has a branch in Austria.

Growth imperative is a term in economic theory regarding a possible necessity of economic growth. On the micro level, it describes mechanisms that force firms or consumers (households) to increase revenues or consumption to not endanger their income. On the macro level, a political growth imperative exists if economic growth is necessary to avoid economic and social instability or to retain democratic legitimacy, so that other political goals such as climate change mitigation or a reduction of inequality are subordinated to growth policies.

Veronika Bennholdt-Thomsen is a German ethnologist and sociologist. She has also lived in Mexico since 1966, first for study, then for research.