Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient. ID Ghana is an example of a microfinance institution.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. The Commercial Finance Association is the leading trade association of the asset-based lending and factoring industries.

Asset-based lending is any kind of lending secured by an asset. This means, if the loan is not repaid, the asset is taken. In this sense, a mortgage is an example of an asset-based loan. More commonly however, the phrase is used to describe lending to business and large corporations using assets not normally used in other loans. Typically, the different types of asset-based loans include accounts receivable financing, inventory financing, equipment financing, or real estate financing. Asset-based lending in this more specific sense is possible only in certain countries whose legal systems allow borrowers to pledge such assets to lenders as collateral for loans.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment banks known as lead arrangers.

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized by a specified pool of underlying assets.

The W Holding Company was a financial holding corporation located in Mayagüez, Puerto Rico. On April 30, 2010, Westernbank, its wholly owned bank subsidiary, failed and its deposits and assets were seized by the Federal Deposit Insurance Corporation and subsequently sold to Banco Popular de Puerto Rico.

Stifel Financial Corp. is an American multinational independent investment bank and financial services company created under the Stifel name in July 1983 and listed on the New York Stock Exchange on November 24, 1986. Its predecessor company was founded in 1890 as the Altheimer and Rawlings Investment Company and is headquartered in downtown St. Louis, Missouri.

A structured investment vehicle (SIV) is a non-bank financial institution established to earn a credit spread between the longer-term assets held in its portfolio and the shorter-term liabilities it issues. They are simple credit spread lenders, frequently "lending" by investing in securitizations, but also by investing in corporate bonds and funding by issuing commercial paper and medium term notes, which were usually rated AAA until the onset of the financial crisis. They did not expose themselves to either interest rate or currency risk and typically held asset to maturity. SIVs differ from asset-backed securities and collateralized debt obligations in that they are permanently capitalized and have an active management team.

SME finance is the funding of small and medium-sized enterprises, and represents a major function of the general business finance market – in which capital for different types of firms are supplied, acquired, and costed or priced. Capital is supplied through the business finance market in the form of bank loans and overdrafts; leasing and hire-purchase arrangements; equity/corporate bond issues; venture capital or private equity; asset-based finance such as factoring and invoice discounting, and government funding in the form of grants or loans.

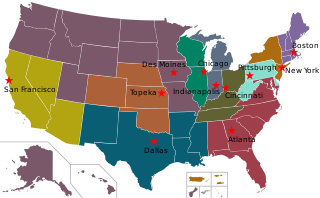

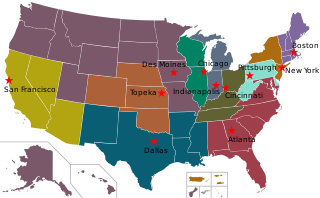

LendingClub is a financial services company headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. At its height, LendingClub was the world's largest peer-to-peer lending platform. The company reported that $15.98 billion in loans had been originated through its platform up to December 31, 2015.

Venture debt or venture lending is a type of debt financing provided to venture-backed companies by specialized banks or non-bank lenders to fund working capital or capital expenses, such as purchasing equipment. Venture debt can complement venture capital and provide value to fast growing companies and their investors. Unlike traditional bank lending, venture debt is available to startups and growth companies that do not have positive cash flows or significant assets to give as collateral. Venture debt providers combine their loans with warrants, or rights to purchase equity, to compensate for the higher risk of default, although this is not always the case.

The U.S. central banking system, the Federal Reserve, in partnership with central banks around the world, took several steps to address the subprime mortgage crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: "Broadly, the Federal Reserve’s response has followed two tracks: efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy." A 2011 study by the Government Accountability Office found that "on numerous occasions in 2008 and 2009, the Federal Reserve Board invoked emergency authority under the Federal Reserve Act of 1913 to authorize new broad-based programs and financial assistance to individual institutions to stabilize financial markets. Loans outstanding for the emergency programs peaked at more than $1 trillion in late 2008."

Walter E. Heller (1891–1969) was a US financier and philanthropist, who founded Walter E. Heller and Company, Inc., Chicago, Illinois with money borrowed from his father in 1919. He originally started the company to do "automobile financing" as autos became more popular in the 1920s. The firm developed into a highly successful, multi-faceted international financial company that was a leader in various fields of finance, particularly in factoring.

A merchant cash advance(MCA) was originally structured as a lump sum payment to a business in exchange for an agreed-upon percentage of future credit card and/or debit card sales. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 24 months) and small regular payments (typically paid each business day) as opposed to the larger monthly payments and longer payment terms associated with traditional bank loans. The term "merchant cash advance" may be used to describe purchases of future credit card sales receivables or short-term business loans.

eCapital is an international provider of Invoice and Freight Factoring and Asset-based lending services headquartered in Miami, Florida with operations in the United States, Canada, and the United Kingdom. Marius Silvasan is the current chief executive officer of the company.

OneMain Holdings, Inc. is an American financial services holding company headquartered in Evansville, Indiana, with central offices throughout the United States. The company wholly owns OneMain Finance Corporation and its subsidiaries, through which it operates in the consumer finance and insurance industries as OneMain Financial. Its business primarily focuses on providing personal loans and optional insurance products to customers with limited access to traditional lenders, such as banks and credit card companies.

source of business financing refers to the means by which an aspiring or current business owner obtains money to start a new small business, purchase an existing small business or bring money into an existing small business to finance current or future business activity. There are many ways to finance a new or existing business, each of which features its own benefits and limitations. In the wake of the financial crisis of 2007–08, the availability of traditional types of small business financing dramatically decreased. At the same time, alternative types of small business financing have emerged. In this context, it is instructive to divide the types of small business financing into the two broad categories of traditional and alternative small business financing options.

A business loan is a loan specifically intended for business purposes. As with all loans, it involves the creation of a debt, which will be repaid with added interest. There are a number of different types of business loans, including bank loans, mezzanine financing, asset-based financing, invoice financing, microloans, business cash advances and cash flow loans.

Utah-based Lendio, founded in 2011 by Brock Blake and Trent Miskin, is a free online loan marketplace in the U.S. targeting small business owners.