A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Flipping is a term used to describe purchasing a revenue-generating asset and quickly reselling it for profit.

Taxes in New Zealand are collected at a national level by the Inland Revenue Department (IRD) on behalf of the Government of New Zealand. National taxes are levied on personal and business income, and on the supply of goods and services. Capital gains tax applies in limited situations, such as the sale of some rental properties within 10 years of purchase. Some "gains" such as profits on the sale of patent rights are deemed to be income – income tax does apply to property transactions in certain circumstances, particularly speculation. There are currently no land taxes, but local property taxes (rates) are managed and collected by local authorities. Some goods and services carry a specific tax, referred to as an excise or a duty, such as alcohol excise or gaming duty. These are collected by a range of government agencies such as the New Zealand Customs Service. There is no social security (payroll) tax.

Droit de suite (French for "right to follow") or Artist's Resale Right (ARR) is a right granted to artists or their heirs, in some jurisdictions, to receive a fee on the resale of their works of art. This should be contrasted with policies such as the American first-sale doctrine, where artists do not have the right to control or profit from subsequent sales.

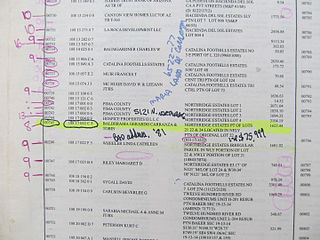

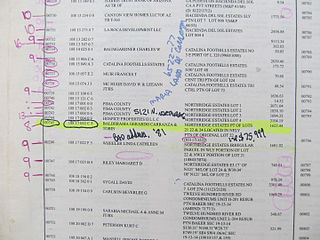

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

The Dun Mountain Railway was a privately owned and operated 3 ft narrow gauge, 21.5 km (13.4 mi) long horse-drawn tramway from chromite mines in the vicinity of Duppa Lode on the eastern slopes of Wooded Peak to Nelson port in the Tasman District of New Zealand's South Island. It operated from 3 February 1862 to 30 May 1901, with the last mineral traffic on the incline section operated in January 1866.

Royscot Trust Ltd v Rogerson[1991] EWCA Civ 12 is an English contract law case on misrepresentation. It examines the Misrepresentation Act 1967 and addresses the extent of damages available under s 2(1) for negligent misrepresentation.

DHN Food Distributors Ltd v Tower Hamlets London Borough Council [1976] 1 WLR 852 is a UK company law case where, on the basis that a company should be compensated for loss of its business under a compulsory acquisition order, a group was recognised as a single economic entity. It stands as a liberal example of when UK courts may lift the veil of incorporation of a company.

Carter v. Burr, 113 U.S. 737 (1885), was a case regarding a promissory note that was held by the appellee which secured by mortgage of premises in the City of Washington, DC to the appellant, to decide whether other transactions regarding the property would pay this note, or if it would instead remain in force, along with the right to participate in the proceeds arising from a sale under the mortgage.

Vasco Dry Cleaners v Twycross is a classic case in South African property law, and illustrative of the courts' treatment of simulated transactions. It was heard in the Appellate Division on 28 August 1978, with judgment handed down on 16 November.

Kragga Kamma Estates CC and Another v Flanagan is an important case in the South African law of contract, an appeal from a decision in the South Eastern Cape Local Division by Jansen J. It was heard in the Appellate Division on August 19, 1994, with judgement handed down on September 29. The presiding officers were EM Grosskopf JA, Nestadt JA, Kumleben JA, Howie JA and Nicholas AJA. The appellants' attorneys were Tobie Oosthuizen, Port Elizabeth, and Webbers, Bloemfontein. The respondent's attorneys were Jankelowitz, Kerbel & Schärges, Port Elizabeth, and Lovius-Block, Bloemfontein. HJ van der Linde appeared for the appellants; JRG Buchanan SC for the respondent.

Couch v Branch Investments (1969) Limited [1980] 2 NZLR 314 is an often cited case regarding the temporary forbearance of taking legal action on enforcing a debt as being consideration to enter into a new contract with the creditor. It reinforces the English case of Callisher v Bischoffsheim (1870) LR 5 QB 449.

New Zealand Tenancy Bonds Ltd v Mooney [1986] 1 NZLR 280 is an often cited case regarding misrepresentation and whether the misrepresentation was "essential" in order for a party to be able to cancel the contract under the Contractual Remedies Act 1979.

Powierza v Daley [1985] 1 NZLR 558 is an important New Zealand case involving where an inquiry about an offer, is just that, or whether instead it is a counteroffer. The legal distinction between the two is important, as an "inquiry" still leaves the original offer live, whereas a "counteroffer" cancels the previous offer.

Field v Fitton [1988] 1 NZLR 482 is a cited New Zealand case regarding privity of contract.

Pendergrast v Chapman [1988] 2 NZLR 177 is a cited case in New Zealand regarding the consequences of cancellation of a contract under the Contractual Remedies Act 1979.

Worsdale v Polglase [1981] 1 NZLR 722 is a cited case in New Zealand regarding relief under the Contractual Remedies Act 1979 where a contract is repudiated by one of the parties.

Simanke v Liu (1994) 2 NZ ConvC 191,888 is a cited case in New Zealand regarding cancellation of a contract under the Contractual Remedies Act. It held that any deposit in excess of a customary deposit, in this case 10%, is refundable to the purchaser.

Jolly v Palmer [1985] 1 NZLR 658 is a cited case in New Zealand regarding the legal enforceability of a contract where there is a breach of a stipulation.

MacIndoe v Mainzeal Group Ltd [1991] 3 NZLR 273 is a cited case in New Zealand regarding the legal enforceability of a contract where there is a breach of a stipulation.