Related Research Articles

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate.

The Low-Income Housing Tax Credit (LIHTC) is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent-restricted units for lower-income households. The program was created under the Tax Reform Act of 1986 (TRA86) to incentivize the use of private equity in developing affordable housing. Projects developed with LIHTC credits must maintain a certain percentage of affordable units for a set period of time, typically 30 years, though there is a "qualified contract" process that can allow property owners to opt out after 15 years. The maximum rent that can be charged for designated affordable units is based on Area Median Income (AMI); over 50% of residents in LIHTC properties are considered Extremely Low-Income. Less than 10% of current credit expenditures are claimed by individual investors.

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by only one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. When the number is used for identification rather than employment tax reporting, it is usually referred to as a Taxpayer Identification Number (TIN). When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be used for any other purpose. For example, an EIN should not be used in tax lien auction or sales, lotteries, or for any other purposes not related to tax administration.

A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation is not received in return."

An S corporation, for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Internal Revenue Service, Criminal Investigation (IRS-CI) is the United States federal law enforcement agency responsible for investigating potential criminal violations of the U.S. Internal Revenue Code and related financial crimes, such as money laundering, currency transaction violations, tax-related identity theft fraud and terrorist financing that adversely affect tax administration. While other federal agencies also have investigative jurisdiction for money laundering and some Bank Secrecy Act violations, IRS-CI is the only federal agency that can investigate potential criminal violations of the Internal Revenue Code, in a manner intended to foster confidence in the tax system and deter violations of tax law. Criminal Investigation is a division of the Internal Revenue Service, which in turn is a bureau within the United States Department of the Treasury.

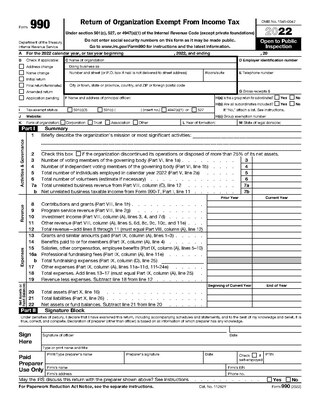

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

Within United States federal legislation, an empowerment zone is an economically distressed community eligible to receive tax incentives and grants from the United States federal government under the Empowerment Zones and Enterprise Communities Act of 1993.

Taxes in Indiana are almost entirely authorized at the state level, although the revenue is used to fund both local and state level government. The state of Indiana's income comes from four primary tax areas. Most state level income is from a sales tax of 7% and a flat state income tax of 3.23%. The state also collects an additional income tax for the 92 counties. Local governments are funded by a property tax that is the sum of rates set by local boards, but the total rate must be approved by the Indiana General Assembly before it can be imposed. Residential property tax rates are capped at maximum of 1% of property value. Excise tax is the fourth form of taxation and is charged on motor vehicles, alcohol, tobacco, gasoline, and certain other forms of movable property; most of the proceeds are used to fund state and local roads and health programs. The Indiana Department of Revenue collects all taxes and pays them out to the appropriate agencies and municipalities. The Indiana Tax Court deals with all tax disputes issues, but decisions can be appealed to the Indiana Supreme Court.

An economic development incentive can be strictly defined as “cash or near-cash assistance provided on a discretionary basis to attract or retain business operations. In practice, however, it is a broadly used term denoting an array of benefits designed to promote new business activity or to encourage business or job retention. These benefits principally encompass tax and economic incentives provided by federal, state or local governmental bodies. Other entities, such as utilities and non-profits, can also make incentives available for these purposes. They accord the recipient, in some manner, a monetary benefit or an in-kind benefit. Private enterprises, including individuals, are generally the ultimate beneficiary of economic development incentives. Depending on the incentive in question, other qualified parties are eligible to receive them, as in the case of municipalities, utilities, or economic development agencies.

The Community Renewal Tax Relief Act of 2000 is a bill that was introduced into the United States House of Representatives during the 106th United States Congress. The Act was eventually passed as part of the Consolidated Appropriations Act, 2001.

Statistics of Income (SOI) is a program and associated division of the Internal Revenue Service (IRS) in the United States to make statistics collected from income tax returns and information returns available to other government agencies and the general public. It fulfills an IRS function mandated by the Revenue Act of 1916.

Charles Paul Rettig is an American attorney who served as the United States Commissioner of Internal Revenue, the head of the U.S. Internal Revenue Service (IRS). On September 12, 2018, the United States Senate confirmed Rettig's nomination to be Commissioner for the term expiring November 12, 2022. Rettig was sworn in on October 1, 2018.

References

- ↑ Jim Landers and Dagney Faulk. "In the Zone: A Look at Indiana's Enterprise Zones". Indiana.edu. Retrieved 2012-11-23.

- ↑ State of Indiana. "Indiana Code 5-28-15: Enterprise Zones". www.in.gov. Retrieved 2012-11-23.

- ↑ Gary Urban Enterprise Association. "1985 Articles of Incorporation" (PDF). www.in.gov. Retrieved 2012-11-23.

- ↑ State Government. "Governor Bayh Proclamation". www.in.gov. Retrieved 2012-11-23.

- ↑ GUEA. "1997 Form 990 Tax Return" (PDF). www.irs.gov. Retrieved 2012-11-23.

- ↑ GUEA. "Investigation into the Financial Records of the GUEA" (PDF). www.irs.gov. Retrieved 2012-11-23.

- ↑ GUEA. "2003 Form 990 Tax Return" (PDF). www.irs.gov. Retrieved 2012-11-23.

- ↑ GUEA. "2003 Form 990 Tax Return" (PDF). www.irs.gov. Retrieved 2012-11-23.

- ↑ GUEA. "Investigation into the Financial Records of the GUEA" (PDF). www.irs.gov. Retrieved November 23, 2012.

- ↑ GUEA. "Investigation into the Financial Records of the GUEA" (PDF). www.irs.gov. Retrieved November 23, 2012.

- ↑ GUEA. "Investigation into the Financial Records of the GUEA" (PDF). www.irs.gov. Retrieved November 23, 2012.

- ↑ Elizabeth Theaken NW IN Times. "Ind. Gov't. - AG suing Gary Urban Enterprise Association to recover assets". Indianalawblog.com. Retrieved 2005-10-05.

- ↑ Jim Landers and Dagney Faulk. "In the Zone: A Look at Indiana's Enterprise Zones". Indiana.edu. Retrieved 2012-11-23.