Related Research Articles

Kevin David Mitnick was an American computer security consultant, author, and convicted hacker. He is best known for his high-profile 1995 arrest and five years in prison for various computer and communications-related crimes. Mitnick's pursuit, arrest, trial, and sentence along with the associated journalism, books, and films were all controversial. After his release from prison, he ran his own security firm, Mitnick Security Consulting, LLC, and was also involved with other computer security businesses.

Barry Jay Minkow is a former American businessman, pastor, and convicted felon. While still in high school, Minkow founded ZZZZ Best, which appeared to be an immensely successful carpet-cleaning and restoration company. However, it was actually a front to attract investment for a massive Ponzi scheme. ZZZZ Best collapsed in 1987, costing investors and lenders $100 million in one of the largest investment frauds ever perpetrated by a single person, as well as one of the largest accounting frauds in history. The scheme is often used as a case study of accounting fraud.

A guest ranch, also known as a dude ranch, is a type of ranch oriented towards visitors or tourism. It is considered a form of agrotourism.

Cattle drives were a major economic activity in the 19th and early 20th century American West, particularly between 1850s and 1910s. In this period, 27 million cattle were driven from Texas to railheads in Kansas, for shipment to stockyards in St. Louis and points east, and direct to Chicago. The long distances covered, the need for periodic rests by riders and animals, and the establishment of railheads led to the development of "cow towns" across the frontier.

The Bayou Hedge Fund Group (1996-2006) was a group of companies and hedge funds founded and headed by Samuel Israel III. Approximately $450m was raised by the group from investors, who were defrauded from nearly the start with funds being misappropriated for personal use.

Sholam Weiss is an American convicted fraudster.

Jack Kachkar is an entrepreneur and business man.

In 1978 and 1979, lawyer and First Lady of Arkansas Hillary Rodham Clinton engaged in a series of trades of cattle futures contracts. Her initial $1,000 investment had generated nearly $100,000, when she stopped trading after ten months. In 1994, after Clinton had become First Lady of the United States, the trading became the subject of considerable controversy regarding the likelihood of such a spectacular rate of return, possible conflict of interest, and allegations of disguised bribery. It was suspected by commentators that the profits were in fact allocations to her of profits from unrelated large block trades managed by her investment advisor James Blair, outside counsel to Tyson Foods, Arkansas' largest employer, in an attempt to gain influence with her husband Bill Clinton, then Attorney General of Arkansas.

Ricky Dale Fenney is a former professional American football running back in the National Football League (NFL). Selected in the eighth round of the 1987 NFL Draft, he played five seasons for the Minnesota Vikings (1987–1991).

Joel Nathan Ward is a former foreign currency trader, who has confessed to fraud and money laundering and was sentenced to nine years in Federal prison, plus three years of supervised release.

The United States Penitentiary, Lompoc is a medium-security United States federal prison for male inmates in Lompoc, California. It is part of the Lompoc Federal Correctional Complex and is operated by the Federal Bureau of Prisons, a division of the United States Department of Justice. The facility also has a satellite prison camp for minimum-security male inmates. It was formerly a military disciplinary barracks on Camp Cooke.

Charlene Shuler Corley is a former defense contractor who was convicted in 2007 on two counts of conspiracy. Over the course of nine years leading up to September 2006, the company owned by Corley and her sister was found to have received over US$21.5 million from the United States Department of Defense for fraudulent shipping costs; in one instance, the company was paid US$998,798 for shipping two 19-cent washers. In 2009, Corley was sentenced to 78 months in prison and ordered to pay US$15.5 million in restitution.

American Prairie is a prairie-based nature reserve in Central Montana, United States, on a mixed grass prairie ecosystem with migration corridors and native wildlife. This wildlife conservation area is being developed as a private project of the American Prairie Foundation (APF). This independent non-profit organization aims to include over 3 million acres (12,000 km2) through a combination of both private and public lands.

International Investment Group (IIG) is an American financial institution that specializes in short-term trade finance and commercial finance with a focus on emerging markets. Through its affiliate IIG Capital it provides financing to small and medium-sized merchants, traders and processors with a need for supply chain financing.

Russell R. Wasendorf Sr. is the former chairman and chief executive officer of Peregrine Financial Group, also known as PFGBEST, a futures commission merchant that filed for bankruptcy protection in Chicago in July 2012.

United States v. Hammond was a court case in Oregon, United States, culminating from 20-year-long legal disputes between Harney County ranchers Dwight Lincoln Hammond Jr., 73, his son Steven Dwight Hammond, 46, and federal officials. In 2012, both Hammonds were charged with several counts in relation to two fires in 2001 and 2006, and eventually convicted of two counts of arson on federal land. Knowing they would face the statutory minimum of five years, the men waived their right to appeal these convictions in exchange for dismissal of several unresolved charges. After this mid-trial agreement was entered, the Hammonds were sentenced to a few months in jail, which they served. In 2015, the United States Court of Appeals for the Ninth Circuit vacated these sentences because they were shorter than the statutory mandatory minimum. The Ninth Circuit remanded to the district court for resentencing. The district court subsequently re-sentenced both Hammonds to the mandatory minimum of five years in prison, with credit for time served.

Ramesh "Sunny" Balwani is a businessman, former president and chief operating officer of Theranos, which was a privately held health technology company founded by his then-girlfriend Elizabeth Holmes. He and Holmes fraudulently represented that they had devised a revolutionary blood test that required only small amounts of blood, such as from a fingerstick. Both Balwani and Holmes were convicted of fraud. The consequences of the fraud led to the collapse of Theranos and the loss of billions of dollars to investors.

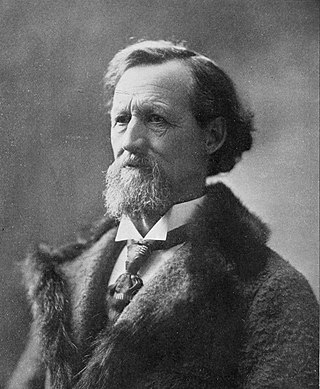

Charles Jesse Jones, known as "Buffalo Jones", was an American frontiersman, farmer, rancher, hunter, and conservationist. He cofounded Garden City, Kansas. He has been cited by the National Archives as one of the "preservers of the American bison".

United States v. Elizabeth A. Holmes, et al., was a United States federal criminal fraud case against the founder of now-defunct corporation Theranos, Elizabeth Holmes, and its former president and COO, Ramesh Balwani. The case alleged that Holmes and Balwani perpetrated multi-million dollar wire-fraud schemes against investors and patients. Holmes and Balwani each had their own jury trial.

References

- ↑ "WA rancher behind $244M 'ghost cattle' fraud sentenced to prison". Seattle Times. October 5, 2022. Retrieved January 12, 2023.

- 1 2 3 Friedman, Mark (May 6, 2021). "Tyson didn't spot growing 'ghost cattle' herd for years". Journal of Business. 36 (10): A5, A18. ISSN 1075-6124.

- 1 2 3 4 van der Voo, Lee (March 3, 2022). "Eastern Washington ranching mogul Cody Easterday wagered hundreds of millions of dollars on the price of beef. He lost". Inlander. Retrieved January 12, 2023.

- ↑ "'Ghost cattle' rancher sentenced in fraud". The Des Moines Register. October 9, 2022. p. D1.

- 1 2 McCoy, Cory (September 28, 2022). "Lawyers ask judge to consider sentencing in Easterday case". Tri-City Herald. pp. A1, A4.

- ↑ Hill, Jeremy (April 6, 2021). "Non-Existent Cattle Cost Tyson $200 Million at Bankrupt Ranch". BNN. Retrieved January 12, 2023.

- 1 2 3 Hill, Kip. "Easterday gets 11 years in prison, for $244M 'ghost cattle' fraud". the Spokesman-Review. pp. A1, A9.

- ↑ McCoy, Cory (December 19, 2022). "Cody Easterday is now in prison. Why did he file a new suit against Tyson Foods?". Spokesman.com. Retrieved January 12, 2023.

- ↑ "CFTC fines CHS Hedging $6.5M in Easterday Ranches-related cattle fraud case". Michigan Farm News. January 4, 2023. Retrieved January 12, 2023.