In law, conveyancing is the transfer of legal title of real property from one person to another, or the granting of an encumbrance such as a mortgage or a lien. A typical conveyancing transaction has two major phases: the exchange of contracts and completion.

This aims to be a complete list of the articles on real estate.

A deed is a legal document that is signed and delivered, especially concerning the ownership of property or legal rights. Specifically, in common law, a deed is any legal instrument in writing which passes, affirms or confirms an interest, right, or property and that is signed, attested, delivered, and in some jurisdictions, sealed. It is commonly associated with transferring (conveyancing) title to property. The deed has a greater presumption of validity and is less rebuttable than an instrument signed by the party to the deed. A deed can be unilateral or bilateral. Deeds include conveyances, commissions, licenses, patents, diplomas, and conditionally powers of attorney if executed as deeds. The deed is the modern descendant of the medieval charter, and delivery is thought to symbolically replace the ancient ceremony of livery of seisin.

Title insurance is a form of indemnity insurance, predominantly found in the United States and Canada, that insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

An encumbrance is a third party's right to, interest in, or legal liability on property that does not prohibit the property's owner from transferring title. Encumbrances can be classified in several ways. They may be financial or non-financial. Alternatively, they may be divided into those that affect title or those that affect the use or physical condition of the encumbered property. Encumbrances include security interests, liens, servitudes, leases, restrictions, encroachments, and air and subsurface rights.

A real estate contract is a contract between parties for the purchase and sale, exchange, or other conveyance of real estate. The sale of land is governed by the laws and practices of the jurisdiction in which the land is located. Real estate called leasehold estate is actually a rental of real property such as an apartment, and leases cover such rentals since they typically do not result in recordable deeds. Freehold conveyances of real estate are covered by real estate contracts, including conveying fee simple title, life estates, remainder estates, and freehold easements. Real estate contracts are typically bilateral contracts and should have the legal requirements specified by contract law in general and should also be in writing to be enforceable.

Generally, a quitclaim is a formal renunciation of a legal claim against some other person, or of a right to land. A person who quitclaims renounces or relinquishes a claim to some legal right, or transfers a legal interest in land. Originally a common-law concept dating back to Medieval England, the expression is in modern times mostly restricted to North American law, where it often refers specifically to a transfer of ownership or some other interest in real property.

Closing costs are fees paid at the closing of a real estate transaction. This point in time called the closing is when the title to the property is conveyed (transferred) to the buyer. Closing costs are incurred by either the buyer or the seller.

In United States property law, a cloud on title or title defect is any irregularity in the chain of title of property that would give a reasonable person pause before accepting a conveyance of title. According to Investopedia, a cloud can be defined as: "Any document, claim, unreleased lien or encumbrance that might invalidate or impair the title to real property or make the title doubtful. Clouds on title are usually discovered during a title search." Clouded title can thus be contrasted with a clear title, which indicates that a property is unencumbered.

A warranty deed is a type of deed where the grantor (seller) guarantees that they hold clear title to a piece of real estate and has a right to sell it to the grantee (buyer), in contrast to a quitclaim deed, where the seller does not guarantee that they hold title to a piece of real estate. A general warranty deed protects the grantee against title defects arising at any point in time, extending back to the property's origins. A special warranty deed protects the grantee only against title defects arising from the actions or omissions of the grantor.

"As is" is a phrase used to indicate the existing condition of something without any modifications or improvements. The term is employed in legal, business, and consumer settings to establish that an item or property is being sold or provided in its current condition, with no warranties or guarantees regarding its quality.

In real estate business and law, a title search or property title search is the process of examining public records and retrieving documents on the history of a piece of real property to determine and confirm property's legal ownership, and find out what claims or liens are on the property. A title search is also performed when an owner wishes to sell mortgage property and the bank requires the owner to insure this transaction.

A land contract,, is a contract between the buyer and seller of real property in which the seller provides the buyer financing in the purchase, and the buyer repays the resulting loan in installments. Under a land contract, the seller retains the legal title to the property but permits the buyer to take possession of it for most purposes other than that of legal ownership. The sale price is typically paid in periodic installments, often with a balloon payment at the end to make the timelength of payments shorter than in the corresponding fully amortized loan. When the full purchase price has been paid including any interest, the seller is obligated to convey legal title to the property. An initial down payment from the buyer to the seller is usually also required.

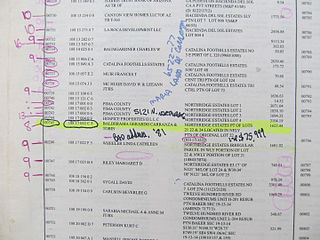

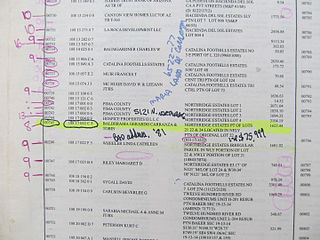

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

Marketable title is a title that a court of equity considers to be so free from defect that it will legally force its acceptance by a buyer. Marketable title does not assume that absolute absence of defect, but rather a title that a prudent, educated buyer in the reasonable course of business would accept. For real estate practitioners, the most complete reference to title issues is found in the preprinted wording contained within an agreement/contract. If you cannot produce a clear title of deed to the property then the prospective buyer should expect to lose in a specific performance action.

The sale and purchase of ship is an important aspect of the shipping industry. It may involve large amounts of money and requires brokers to possess knowledge of types of vessels and their function, knowledge of maritime law, as well experience in bargaining. To reduce the number of disputes and smoothen the sale and purchase procedure, normally the ship-owner (seller) and the buyer will appoint brokers as middlemen to handle the transaction. There are three main stages for the sale and purchase of a ship which include: (1) the negotiation and contract stage, (2) the inspections stage, and (3) the completion. From different stages, it includes different important issues and regulations.

A grant, in law, is a transfer of property, generally from a person or other entity giving the property to a person or entity receiving the property.

The vast majority of states in the United States employ a system of recording legal instruments that affect the title of real estate as the exclusive means for publicly documenting land titles and interests. The record title system differs significantly from land registration systems, such as the Torrens system, that have been adopted in a few states. The principal difference is that the recording system does not determine who owns the title or interest involved, which is ultimately established through litigation in the courts. The system provides a framework for determining who the law will protect in relation to those titles and interests when a dispute arises.

The missives of sale, in Scots property law, are a series of formal letters between the two parties, the Buyer and the Seller, containing the contract of sale for the transfer of corporeal heritable property (land) in Scotland. The term 'land' in this article includes buildings and other structures upon land.

A disposition in Scots law is a formal deed transferring ownership of corporeal heritable property. It acts as the conveyancing stage as the second of three stages required in order to voluntarily transfer ownership of land in Scotland. The three stages are:

- The Contractual Stage

- The Conveyancing Stage

- The Registration Stage