Finance is the management of money, particularly in relation to companies, organisations, or governments. Specifically, it deals with the questions of how and why an individual, company or government acquires the money needed - called capital in the company context - and how they spend or invest that money. Finance is then often split per the following major categories: corporate finance, personal finance and public finance.

In economics, an externality is the cost or benefit that affects a third party who did not choose to incur that cost or benefit. Externalities often occur when the production or consumption of a product or service's private price equilibrium cannot reflect the true costs or benefits of that product or service for society as a whole. This causes the externality competitive equilibrium to not be a Pareto optimality.

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where individuals' pursuit of pure self-interest leads to results that are not efficient– that can be improved upon from the societal point of view. The first known use of the term by economists was in 1958, but the concept has been traced back to the Victorian philosopher Henry Sidgwick. Market failures are often associated with public goods, time-inconsistent preferences, information asymmetries, non-competitive markets, principal–agent problems, or externalities.

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market.

In economics, moral hazard occurs when an entity has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place.

Benchmarking is the practice of comparing business processes and performance metrics to industry bests and best practices from other companies. Dimensions typically measured are quality, time and cost.

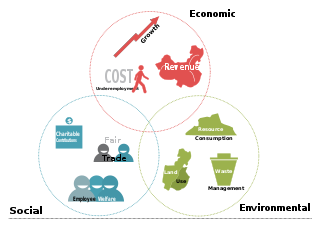

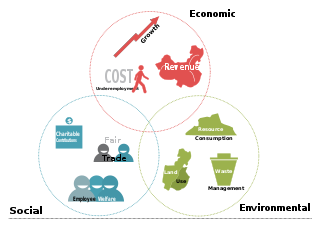

The triple bottom line is an accounting framework with three parts: social, environmental and financial. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value. Business writer John Elkington claims to have coined the phrase in 1994.

Shareholder value is a business term, sometimes phrased as shareholder value maximization or as the shareholder value model, which implies that the ultimate measure of a company's success is the extent to which it enriches shareholders. It became popular during the 1980s, and is particularly associated with former CEO of General Electric, Jack Welch.

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market.

Investment management is the professional asset management of various securities and other assets in order to meet specified investment goals for the benefit of the investors. Investors may be institutions or private investors.

Monetization or monetisation is, broadly speaking, the process of converting something into money. The term has a broad range of uses.

For the application of engineering economics in the practice of civil engineering see Engineering economics.

Business economics is a field in applied economics which uses economic theory and quantitative methods to analyze business enterprises and the factors contributing to the diversity of organizational structures and the relationships of firms with labour, capital and product markets. A professional focus of the journal Business Economics has been expressed as providing "practical information for people who apply economics in their jobs."

Wikinomics: How Mass Collaboration Changes Everything is a book by Don Tapscott and Anthony D. Williams, first published in December 2006. It explores how some companies in the early 21st century have used mass collaboration and open-source technology, such as wikis, to be successful.

In economics, profit in the accounting sense of the excess of revenue over cost is the sum of two components: normal profit and economic profit. Understanding profit can be broken down into three aspects: the size of profit, the portion of the total income, and the rate of profit. Normal profit is the profit that is necessary to just cover the opportunity costs of an owner-manager or of a firm's investors. In the absence of this profit, these parties would withdraw their time and funds from the firm and use them to better advantage elsewhere. In contrast, economic profit, sometimes called excess profit, is profit in excess of what is required to cover the opportunity costs.

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies. CVC is defined by the Business Dictionary as the "practice where a large firm takes an equity stake in a small but innovative or specialist firm, to which it may also provide management and marketing expertise; the objective is to gain a specific competitive advantage."

The technological innovation system is a concept developed within the scientific field of innovation studies which serves to explain the nature and rate of technological change. A Technological Innovation System can be defined as ‘a dynamic network of agents interacting in a specific economic/industrial area under a particular institutional infrastructure and involved in the generation, diffusion, and utilization of technology’.

Environmental, Social, and Governance (ESG) refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business.

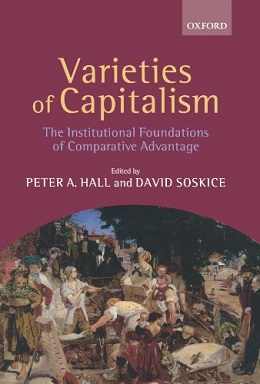

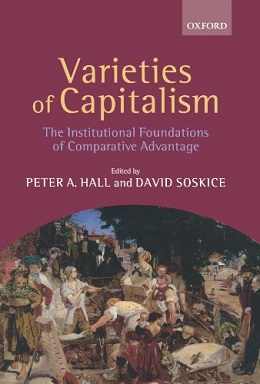

Varieties of Capitalism: The Institutional Foundations of Comparative Advantage is an influential 2001 volume on economics, political economy and comparative politics, edited by political economists Peter A. Hall and David Soskice.

The environmental sustainability problem has proven difficult to solve. The modern environmental movement has attempted to solve the problem in a large variety of ways. But little progress has been made, as shown by severe ecological footprint overshoot and lack of sufficient progress on the climate change problem. Something within the human system is preventing change to a sustainable mode of behavior. That system trait is systemic change resistance. Change resistance is also known as organizational resistance, barriers to change, or policy resistance.