Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by a country or countries. GDP is most often used by the government of a single country to measure its economic health. Due to its complex and subjective nature, this measure is often revised before being considered a reliable indicator.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income. All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

In economics, a country's current account records the value of exports and imports of both goods and services and international transfers of capital. It is one of the two components of its balance of payments, the other being the capital account. Current account measures the nation's earnings and spendings abroad and it consists of the balance of trade, net primary income or factor income and net unilateral transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade. A current account surplus indicates that the value of a country's net foreign assets grew over the period in question, and a current account deficit indicates that it shrank. Both government and private payments are included in the calculation. It is called the current account because goods and services are generally consumed in the current period.

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

Consumer spending is the total money spent on final goods and services by individuals and households.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

The national income and product accounts (NIPA) are part of the national accounts of the United States. They are produced by the Bureau of Economic Analysis of the Department of Commerce. They are one of the main sources of data on general economic activity in the United States.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI. In 2017, Irish GDP was 162% of Irish Modified GNI.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

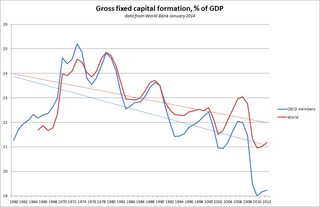

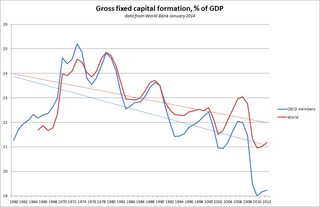

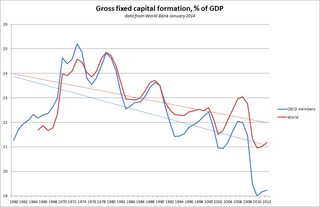

(GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets.

is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

Inventory investment is a component of gross domestic product (GDP). What is produced in a certain country is naturally also sold eventually, but some of the goods produced in a given year may be sold in a later year rather than in the year they were produced. Conversely, some of the goods sold in a given year might have been produced in an earlier year. The difference between goods produced (production) and goods sold (sales) in a given year is called inventory investment. The concept can be applied to the economy as a whole or to an individual firm, however this concept is generally applied in macroeconomics. Unintended unsold stock of goods increases inventory investment.

Aggregate income is the total of all incomes in an economy without adjustments for inflation, taxation, or types of double counting. Aggregate income is a form of GDP that is equal to Consumption expenditure plus net profits. 'Aggregate income' in economics is a broad conceptual term. It may express the proceeds from total output in the economy for producers of that output. There are a number of ways to measure aggregate income, but GDP is one of the best known and most widely used.

In accounting, finance and economics, an accounting identity is an equality that must be true regardless of the value of its variables, or a statement that by definition must be true. Where an accounting identity applies, any deviation from numerical equality signifies an error in formulation, calculation or measurement.

The Keynesian cross diagram is a formulation of the central ideas in Keynes' General Theory of Employment, Interest and Money. It first appeared as a central component of macroeconomic theory as it was taught by Paul Samuelson in his textbook, Economics: An Introductory Analysis. The Keynesian cross plots aggregate income and planned total spending or aggregate expenditure.

The annual United Kingdom National Accounts records and describes economic activity in the United Kingdom and as such is used by government, banks, academics and industries to formulate the economic and social policies and monitor the economic progress of the United Kingdom. It also allows international comparisons to be made. The Blue Book is published by the UK Office for National Statistics alongside the United Kingdom Balance of Payments – The Pink Book.

The sectoral balances are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley.

In macroeconomics, investment "consists of the additions to the nation's capital stock of buildings, equipment, software, and inventories during a year" or, alternatively, investment spending — "spending on productive physical capital such as machinery and construction of buildings, and on changes to inventories — as part of total spending" on goods and services per year.