Related Research Articles

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being.

United States non-profit laws relate to taxation, the special problems of an organization which does not have profit as its primary motivation, and prevention of charitable fraud. Some non-profit organizations can broadly be described as "charities" — like the American Red Cross. Some are strictly for the private benefit of the members — like country clubs, or condominium associations. Others fall somewhere in between — like labor unions, chambers of commerce, or cooperative electric companies. Each presents unique legal issues.

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. When the number is used for identification rather than employment tax reporting, it is usually referred to as a Taxpayer Identification Number (TIN). When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be used for any other purpose. For example, an EIN should not be used in tax lien auction or sales, lotteries, or for any other purposes not related to tax administration.

A subordinate organization is one that is under control of the central organization.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code Section 501(c) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

A nonprofit corporation is any legal entity which has been incorporated under the law of its jurisdiction for purposes other than making profits for its owners or shareholders. Depending on the laws of the jurisdiction, a nonprofit corporation may seek official recognition as such, and may be taxed differently from for-profit corporations, and treated differently in other ways.

The Church of Spiritual Technology (CST) is a California 501(c)(3) non-profit corporation, incorporated in 1982, which owns all the copyrights of the estate of L. Ron Hubbard and licenses their use. CST does business as L. Ron Hubbard Library.

Bob Jones University v. Simon, 416 U.S. 725 (1974), is a decision by the Supreme Court of the United States holding that Bob Jones University, which had its 501(c)(3) status revoked by the Internal Revenue Service for practicing "racially discriminatory admissions policies" towards African-Americans, could not sue for an injunction to prevent losing its tax-exempt status. The question of Bob Jones University's tax-exempt status was ultimately resolved in Bob Jones University v. United States, in which the court ruled that the First Amendment did not protect discriminatory organizations from losing tax-exempt status.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

A religious corporation is a type of religious non-profit organization, which has been incorporated under the law. Often these types of corporations are recognized under the law on a subnational level, for instance by a state or province government. The government agency responsible for regulating such corporations is usually the official holder of records, for instance the Secretary of State. In the United States, religious corporations are formed like all other nonprofit corporations by filing articles of incorporation with the state. Religious corporation articles need to have the standard tax exempt language the IRS requires.

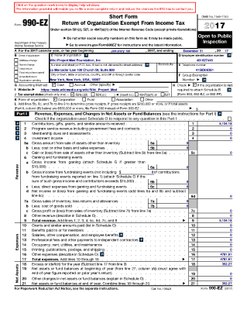

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

Regan v. Taxation with Representation of Washington, 461 U.S. 540 (1983), was a case in which the United States Supreme Court upheld lobbying restrictions imposed on tax-exempt non-profit corporations.

Nonpartisanism in the United States is organized under United States Internal Revenue Code that qualifies certain non-profit organizations for tax-exempt status because they refrain from engaging in certain prohibited political activities. The designation "nonpartisan" usually reflects a claim made by organizations about themselves, or by commentators, and not an official category per American law. Rather, certain types of nonprofit organizations are under varying requirements to refrain from election-related political activities, or may be taxed to the extent they engage in electoral politics, so the word affirms a legal requirement. In this context, "nonpartisan" means that the organization, by US tax law, is prohibited from supporting or opposing political candidates, parties, and in some cases other votes like propositions, directly or indirectly, but does not mean that the organization cannot take positions on political issues.

The Church of Scientology International, Inc. (CSI) is a California 501(c)(3) non-profit corporation. Within the worldwide network of Scientology corporations and entities, CSI is officially referred to as the "mother church" of the Church of Scientology.

In 2013, the United States Internal Revenue Service (IRS) revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the Treasury Department's Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny.

The bill H.Res. 565, official title "Calling on Attorney General Eric H. Holder, Jr., to appoint a special counsel to investigate the targeting of conservative nonprofit groups by the Internal Revenue Service," was passed by the United States House of Representatives during the 113th United States Congress. The simple resolution asks U.S. Attorney General Eric Holder to appoint a special counsel to investigate that 2013 IRS scandal. The Internal Revenue Service revealed in 2013 that it had selected political groups applying for tax-exempt status for closer scrutiny based on their names or political themes.

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status.

A 501(h) election or Conable election is a procedure in United States tax law that allows a 501(c)(3) non-profit organization to participate in lobbying limited only by the financial expenditure on that lobbying, regardless of its overall extent. This allows organizations taking the 501(h) election to potentially perform a large amount of lobbying if it is done using volunteer labor or through inexpensive means. The 501(h) election is available to most types of 501(c)(3) organizations that are not churches or private foundations. It was introduced by Representative Barber Conable as part of the Tax Reform Act of 1976 and codified as , and the corresponding Internal Revenue Service (IRS) regulations were finalized in 1990.

The tax status of the Church of Scientology in the United States has been the subject of decades of controversy and litigation. Although the Church of Scientology was initially partially exempted by the Internal Revenue Service (IRS) from paying federal income tax, its two principal entities in the United States lost this exemption in 1957 and 1968. This action was taken because of concerns that church funds were being used for the private gain of its founder L. Ron Hubbard or due to an international psychiatric conspiracy against Scientology.

References

- 1 2 "Group Exemptions. Tax Exempt and Government Entities Division" (PDF). IRS Publication 4573. Retrieved 9 January 2014.

- 1 2 "Group Exemption Letter" . Retrieved 9 January 2014.

- ↑ "Tax-Exempt. Status for Your. Organization" (PDF). IRS. Retrieved 9 January 2014.

- ↑ Internal Revenue Service, United States. Internal Revenue Service (2003). Business taxpayer information publications, Volume 1. The Service. p. 294.