The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1929, its initial purpose was to oversee the settlement of World War I war reparations.

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered.

The chairman of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

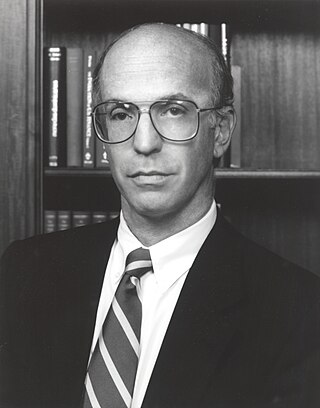

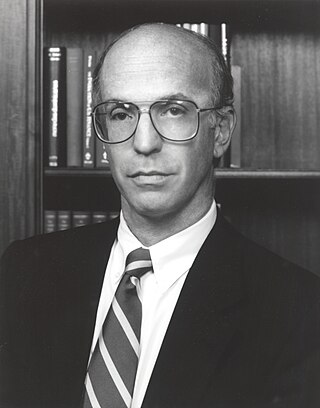

Paul Adolph Volcker Jr. was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s, with measures known as the Volcker shock. He previously served as the president of the Federal Reserve Bank of New York from 1975 to 1979.

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System that is charged under United States law with overseeing the nation's open market operations. This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks was authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC.

George William Miller was an American businessman and investment banker who served as the 65th United States secretary of the treasury from 1979 to 1981. A member of the Democratic Party, he also served as the 11th chairman of the Federal Reserve from 1978 to 1979. Miller was the first person to hold both of those posts.

The Bank of Korea is the central bank of the Republic of Korea and issuer of South Korean won. It was established on 12 June 1950 in Seoul, South Korea.

Alan Stuart Blinder is an American economics professor at Princeton University and is listed among the most influential economists in the world according to IDEAS/RePEc. He is a leading macro-economist, politically liberal, and a champion of Keynesian economics and policies.

The Federal Reserve System, commonly known as "the Fed," has faced various criticisms since its establishment in 1913. Critics have questioned its effectiveness in managing inflation, regulating the banking system, and stabilizing the economy. Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression. More recently, former Congressman Ron Paul has advocated for the abolition of the Fed and a return to a gold standard.

The Banking Act of 1933 was a statute enacted by the United States Congress that established the Federal Deposit Insurance Corporation (FDIC) and imposed various other banking reforms. The entire law is often referred to as the Glass–Steagall Act, after its Congressional sponsors, Senator Carter Glass (D) of Virginia, and Representative Henry B. Steagall (D) of Alabama. The term "Glass–Steagall Act", however, is most often used to refer to four provisions of the Banking Act of 1933 that limited commercial bank securities activities and affiliations between commercial banks and securities firms. That limited meaning of the term is described in the article on Glass–Steagall Legislation.

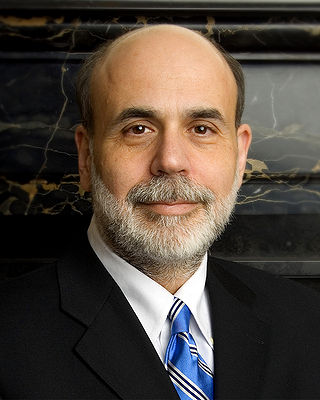

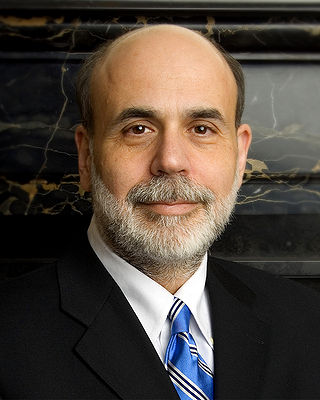

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks.

William Joseph McDonough was a former vice chairman and special advisor to the chairman at Merrill Lynch & Co. Inc., responsible for assisting senior management in the company's business development efforts with governments and financial institutions. He retired in 2009.

Axel Alfred Weber is a German economist, professor, and banker. He is currently a board member and chairman of Swiss investment bank and financial services company, UBS Group AG, and has announced his resignation effective 7 April 2022.

Kevin Maxwell Warsh is an American financier and bank executive who served as a member of the Federal Reserve Board of Governors from 2006 to 2011.

Randall S. Kroszner is an American economist who served as a member of the Federal Reserve Board of Governors from 2006 to 2009. Kroszner chaired Fed's board Committee on Supervision and Regulation of Banking Institutions during the global financial crisis. He has been professor of economics at the University of Chicago since the 1990s, with various leaves, and named Norman R. Bobins Professor of Economics at the University of Chicago Booth School of Business in 2009, and serves as a senior advisor for Patomak Partners.

John Carroll Williams is the president and chief executive officer of the Federal Reserve Bank of New York, having also served as president of Federal Reserve Bank of San Francisco from 2011 to 2018. He is currently serving as vice chairman of the Federal Open Market Committee.

Urjit Patel is a Kenyan-born Indian economist, who formerly served as the 24th Governor of the Reserve Bank of India and also Deputy Governor of Reserve Bank of India, looking after monetary policy, economic research, financial markets, statistics and information management. He resigned from his post on 10 December 2018, being the first RBI governor to state personal reasons as a driving factor for resigning.

David I. Meiselman was an American economist. Among his contributions to the field of economics are his work on the term structure of interest rates, the foundation today of the implementation of monetary policy by major central banks, and his work with Milton Friedman on the impact of monetary policy on the performance of the economy and inflation.