Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.

The Otto Group is a German retail company based in Hamburg that operates companies worldwide in the retail, e-commerce, financing, logistics and mail order sectors. In 2023, the Group generated sales of €16.2 billion and had around 41,186 employees.

Commerzbank AG is a global German universal bank headquartered at Commerzbank Tower in Frankfurt. The bank was founded in Hamburg in 1870 and is today among the largest credit institutions in Germany, with total assets of €534 billion as of the end of September 2022. With over 15 percent ownership the Government of Germany is the bank's biggest shareholder.

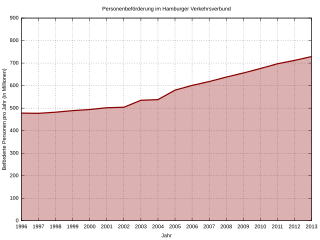

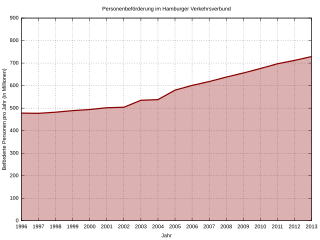

The Hamburger Verkehrsverbund (HVV) is a transport association coordinating public transport in and around Hamburg, Germany. Its main objectives are to provide a unified fare system, requiring only a single ticket for journeys with transfers between different operating companies, and to facilitate and speed up travel by harmonising the individual companies' schedules. At its inception in 1965, the HVV was the first organisation of its kind worldwide.

Andrew Seth Kahr is an American mathematician and financial consultant. He was the founder and CEO of First Deposit Corp., which was later acquired by Providian.

Advanta was an American banking company. It controlled two banks, Advanta Bank Corp and Advanta National Bank.

First National Bank Omaha is a bank headquartered in Omaha, Nebraska. The namesake and leading subsidiary of First National of Nebraska, it is the third largest privately held bank subsidiary in the United States with $17 billion in assets and 4320 employees.

Advanzia Bank is a European digital bank based in Munsbach, Luxembourg. It offers no-fee credit cards and deposit accounts for private customers. Its service portfolio also contains co-branded credit cards and charge cards for business partners and other financial institutions, an area in which it is one of the largest actors in the market. Advanzia Bank is subject to the supervision of Luxembourg’s national financial supervisory authority.

CashPool is a cooperation of a multitude of smaller or virtual German private banks, in which they mutually waive ATM usage fees for their customers. It is not an interbank network but uses the pre-existing German ATM or Maestro/Cirrus networks. With more than 3200 ATMs, the cooperating banks' ATM networks form the smallest ATM group in Germany.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Bank of Ayudhya Public Company Limited, branded and commonly referred to as Krungsri, is the fifth largest bank in Thailand in terms of assets, loans, and deposits. Through its branches and service outlets are in Thailand and abroad, the company provides banking, consumer finance, investment, asset management, and other financial products and services to small and medium enterprises, large corporations and individual customers.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Hamburger Sparkasse AG (Haspa) is one of 5 free public savings banks in Germany based in Hamburg. With a balance sheet total of around 41.9 billion euros and about 5,000 employees, it is the largest savings bank in Germany. It was founded in 1827 in the legal form of the old Hamburg law. In 2003 the bank was separated to a stock corporation and the original Hamburger Sparkasse changed its name to Haspa Finanzholding.

Hoerner BankAG is a German private bank founded in 1849 and based in Heilbronn (Baden-Württemberg). In addition to asset management and private banking its specialty is the handling of international estate matters. In 2021, the bank was named one of the best asset managers in Germany by WirtschaftsWoche for the third time in a row.

The GEFA Bank GmbH is a financial services provider specialising in independent manufacturer sales and investment financing of mobile assets. The company, founded in 1949 as subsidiary of the Deutsche Bank, and is based in Wuppertal headquarters at the Robert-Daum-Platz. It employs over 500 personnel in seven branches nationwide.

The BMW Bank GmbH is a finance service and a company of the BMW Group. The company known under BMW Group Financial Services was founded in 1971 in Munich, Germany. In 1973, the BMW Leasing GmbH was added – also situated in Munich. The fabricated products are BMW, MINI and Rolls-Royce Motor Cars. Worldwide BMW Group Financial Services are represented in 53 countries with 26 companies and 27 corporations.

The EOS Group is a holding company that operates financial services companies with locations in Europe, the United States and Canada. Its core activity is receivables management including receivables purchasing and debt collection. The group, which has its headquarters in Hamburg, is part of the Otto Group.

The Norisbank GmbH is a German bank with headquarters in Bonn. Since 2 November 2006, it has been a subsidiary of Deutsche Bank and since 27 July 2012 purely a direct bank.

The Santander Consumer Bank AG is a German Credit Institution in the legal form of a corporation with headquarters in Mönchengladbach. It is a wholly owned subsidiary of the Spanish Banco Santander S.A.