In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935, and the existing version of the Act, as amended, encompasses several social welfare and social insurance programs.

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system.

A welfare state is a form of government in which the state protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life.

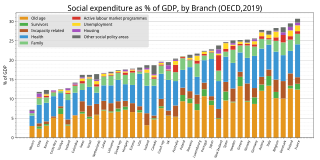

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

Welfare reforms are changes in the operation of a given welfare system aimed at improving the efficiency, equity and administration of government assistance programs. Reform programs may have a various aims, sometimes the focus is on reducing the number of individuals receiving government assistance and welfare system expenditure, at other times reforms may aim to ensure greater fairness, effectiveness and allocation of welfare for those in need. Classical liberals, libertarians, and conservatives generally argue that welfare and other tax-funded services reduce incentives to work, exacerbate the free-rider problem, and intensify poverty. On the other hand social democrats and socialists generally criticize welfare reforms that minimize the public safety net and strengthens the capitalist economic system. Welfare reform is constantly debated because of the varying opinions on a government's need to balance providing guaranteed welfare benefits and promoting self-sufficiency.

In macroeconomics and finance, a transfer payment is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These kind of payments are one-sided in nature, i.e. one party enjoys economic benefits from the other party. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses.

In the United States, the Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a federal government program that provides food-purchasing assistance for low- and no-income persons to help them maintain adequate nutrition and health. It is a federal aid program administered by the U.S. Department of Agriculture (USDA) under the Food and Nutrition Service (FNS), though benefits are distributed by specific departments of U.S. states.

Subsidized housing is government sponsored economic assistance aimed towards alleviating housing costs and expenses for impoverished people with low to moderate incomes. In the United States, subsidized housing is often called "affordable housing". Forms of subsidies include direct housing subsidies, non-profit housing, public housing, rent supplements/vouchers, and some forms of co-operative and private sector housing. According to some sources, increasing access to housing may contribute to lower poverty rates.

Social welfare, assistance for the ill or otherwise disabled and the old, has long been provided in Japan by both the government and private companies. Beginning in the 1920s, the Japanese government enacted a series of welfare programs, based mainly on European models, to provide medical care and financial support. During the post-war period, a comprehensive system of social security was gradually established. Universal health insurance and a pension system were established in 1960.

In France, taxation is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

Social welfare has long been an important part of New Zealand society and a significant political issue. It is concerned with the provision by the state of benefits and services. Together with fiscal welfare and occupational welfare, it makes up the social policy of New Zealand. Social welfare is mostly funded through general taxation. Since the 1980s welfare has been provided on the basis of need; the exception is universal superannuation.

Social programs in Canada include all Canadian government programs designed to give assistance to citizens outside of what the market provides. The Canadian social safety net includes a broad spectrum of programs, many of which are run by the provinces and territories. Canada also has a wide range of government transfer payments to individuals, which totaled $176.6 billion in 2009—this cost only includes social programs that administer funds to individuals; programs such as medicare and public education are additional costs.

Helvering v. Davis, 301 U.S. 619 (1937), was a decision by the U.S. Supreme Court that held that Social Security was constitutionally permissible as an exercise of the federal power to spend for the general welfare and so did not contravene the Tenth Amendment of the U.S. Constitution.

The European social model is a concept that emerged in the discussion of economic globalization and typically contrasts the degree of employment regulation and social protection in European countries to conditions in the United States. It is commonly cited in policy debates in the European Union, including by representatives of both labour unions and employers, to connote broadly "the conviction that economic progress and social progress are inseparable" and that "[c]ompetitiveness and solidarity have both been taken into account in building a successful Europe for the future".

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

In the United States, the federal and state social programs including cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometimes provided by the private sector either through policy mandates or on a voluntary basis. Employer-sponsored health insurance is an example of this.

Social security or welfare in Finland is very comprehensive compared to what almost all other countries provide. In the late 1980s, Finland had one of the world's most advanced welfare systems, which guaranteed decent living conditions to all Finns. Created almost entirely during the first three decades after World War II, the social security system was an outgrowth of the traditional Nordic belief that the state is not inherently hostile to the well-being of its citizens and can intervene benevolently on their behalf. According to some social historians, the basis of this belief was a relatively benign history that had allowed the gradual emergence of a free and independent peasantry in the Nordic countries and had curtailed the dominance of the nobility and the subsequent formation of a powerful right wing. Finland's history was harsher than the histories of the other Nordic countries but didn't prevent the country from following their path of social development.

Tax expenditures are government revenue losses from tax exclusions, exemptions, deductions, credits, deferrals, and preferential tax rates. They are a counterpart to direct expenditures, in that they both are forms of government spending.

In general, the United States federal income tax is progressive, as rates of tax generally increase as taxable income increases, at least with respect to individuals that earn wage income. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government.