Related Research Articles

A colony is a territory subject to a form of foreign rule. Though dominated by the foreign colonizers, the rule remains separate to the original country of the colonizers, the metropolitan state, which together have often been organized as colonial empires, particularly with the development of modern imperialism. This colonial administrative separation, though often blurred, makes colonies neither annexed or incorporated territories nor client states. Colonies contemporarily are identified and organized as not sufficiently self-governed dependent territories. Other past colonies have become either sufficiently incorporated and self-governed, or independent, with some to a varying degree dominated by remaining colonial settler societies or neocolonialism.

Puerto Rico, officially the Commonwealth of Puerto Rico, is a Caribbean island, Commonwealth, and unincorporated territory of the United States. It is located in the northeast Caribbean Sea, approximately 1,000 miles (1,600 km) southeast of Miami, Florida, between the Dominican Republic and the U.S. Virgin Islands, and includes the eponymous main island and several smaller islands, such as Mona, Culebra, and Vieques. With roughly 3.2 million residents, it is divided into 78 municipalities, of which the most populous is the capital municipality of San Juan. Spanish and English are the official languages of the executive branch of government, though Spanish predominates.

The United States Virgin Islands, officially the Virgin Islands of the United States, are a group of Caribbean islands and an unincorporated and organized territory of the United States. The islands are geographically part of the Virgin Islands archipelago and are located in the Leeward Islands of the Lesser Antilles.

Puerto Ricans, most commonly known as Boricuas, and also referred to as Borinqueños,Borincanos, or Puertorros, are the people of Puerto Rico, the inhabitants, and citizens of the Commonwealth of Puerto Rico and their descendants, including those in mainland United States.

José Luis Alberto Muñoz Marín was a Puerto Rican journalist, politician, statesman and was the first elected governor of Puerto Rico, regarded as the "Architect of the Puerto Rico Commonwealth."

Tourism in Puerto Rico attracts millions of visitors each year, with more than 5.1 million passengers arriving at the Luis Muñoz Marín International Airport in 2022, the main point of arrival into the island of Puerto Rico. With a $8.9 billion revenue in 2022, tourism has been a very important source of revenue for Puerto Rico for a number of decades given its favorable warm climate, beach destinations and its diversity of natural wonders, cultural and historical sites, festivals, concerts and sporting events. As Puerto Rico is an unincorporated territory of the United States, U.S. citizens do not need a passport to enter Puerto Rico, and the ease of travel attracts many tourists from the mainland U.S. each year.

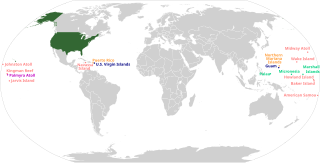

The federal government of the United States is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, five major self-governing territories, several island possessions, and the federal district and national capital of Washington, D.C., where most of the federal government is based.

The 51st state in American political discourse refers to the concept of granting statehood to one of the United States' territories, splitting one or more of the existing states up to form a new state, or granting statehood to the District of Columbia, thereby increasing the number of states in the Union from 50 to 51.

In the law of the United States, an insular area is a U.S.-associated jurisdiction that is not part of the several states or the District of Columbia.

Territories of the United States are sub-national administrative divisions overseen by the federal government of the United States. The various American territories differ from the U.S. states and Indian reservations as they are not sovereign entities. In contrast, each state has a sovereignty separate from that of the federal government and each federally recognized Native American tribe possesses limited tribal sovereignty as a "dependent sovereign nation." Territories are classified by incorporation and whether they have an "organized" government through an organic act passed by the Congress. American territories are under American sovereignty and, consequently, may be treated as part of the United States proper in some ways and not others. Unincorporated territories in particular are not considered to be integral parts of the United States, and the Constitution of the United States applies only partially in those territories.

The Insular Cases are a series of opinions by the Supreme Court of the United States in 1901 about the status of U.S. territories acquired in the Spanish–American War. Some scholars also include cases regarding territorial status decided up until 1914, and others include related cases as late as 1979. The term "insular" signifies that the territories were islands administered by the War Department's Bureau of Insular Affairs. Today, the categorizations and implications put forth by the Insular Cases still govern the United States' territories.

Luis Guillermo Fortuño Burset is a Puerto Rican politician who served as the governor of Puerto Rico, an unincorporated territory of the United States, from 2009 to 2013.

The Jones–Shafroth Act – also known as the Jones Act of Puerto Rico, Jones Law of Puerto Rico, or as the Puerto Rican Federal Relations Act of 1917 – was an Act of the United States Congress, signed by President Woodrow Wilson on March 2, 1917. The act superseded the Foraker Act and granted U.S. citizenship to anyone born in Puerto Rico on or after April 11, 1899. It also created the Senate of Puerto Rico, established a bill of rights, and authorized the election of a Resident Commissioner to a four-year term. The act also exempted Puerto Rican bonds from federal, state, and local taxes regardless of where the bondholder resides.

The history of Puerto Rico began with the settlement of the Ortoiroid people between 430 BC and AD 1000. At the time of Christopher Columbus's arrival in the New World in 1493, the dominant indigenous culture was that of the Taínos. The Taíno people's numbers went dangerously low during the later half of the 16th century because of new infectious diseases carried by Europeans, exploitation by Spanish settlers, and warfare.

The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. The main drivers of Puerto Rico's economy are manufacturing, primarily pharmaceuticals, textiles, petrochemicals, and electronics; followed by the service industry, notably finance, insurance, real estate, and tourism. The geography of Puerto Rico and its political status are both determining factors on its economic prosperity, primarily due to its relatively small size as an island; its lack of natural resources used to produce raw materials, and, consequently, its dependence on imports; as well as its relationship with the United States federal government, which controls its foreign policies while exerting trading restrictions, particularly in its shipping industry.

Puerto Rico is an island in the Caribbean region in which inhabitants were Spanish nationals from 1508 until the Spanish–American War in 1898, from which point they derived their nationality from United States law. Nationality is the legal means by which inhabitants acquire formal membership in a nation without regard to its governance type. In addition to being United States nationals, persons are citizens of the United States and citizens of the Commonwealth of Puerto Rico within the context of United States Citizenship. Miriam J. Ramirez de Ferrer v. Juan Mari Brás. Citizenship, the rights and obligations that each owes the other, once one has become a member of a nation. Though the Constitution of the United States recognizes both national and state citizenship as a means of accessing rights, Puerto Rico's history as a territory has created both confusion over the status of its nationals and citizens and controversy because of distinctions between jurisdictions of the United States. These differences have created what political scientist Charles R. Venator-Santiago has called "separate and unequal" statuses.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

The political status of Puerto Rico is that of an unincorporated territory of the United States officially known as the Commonwealth of Puerto Rico. As such, the island of Puerto Rico is neither a sovereign nation nor a U.S. state.

The Puerto Rican government-debt crisis was a financial crisis affecting the government of Puerto Rico. The crisis began in 2014 when three major credit agencies downgraded several bond issues by Puerto Rico to "junk status" after the government was unable to demonstrate that it could pay its debt. The downgrading, in turn, prevented the government from selling more bonds in the open market. Unable to obtain the funding to cover its budget imbalance, the government began using its savings to pay its debt while warning that those savings would eventually be exhausted. To prevent such a scenario, the United States Congress enacted a law known as PROMESA, which appointed an oversight board with ultimate control over the Commonwealth's budget. As the PROMESA board began to exert that control, the Puerto Rican government sought to increase revenues and reduce its expenses by increasing taxes while curtailing public services and reducing government pensions. These measures provoked social distrust and unrest, further compounding the crisis. In August 2018, a debt investigation report of the Financial Oversight and management board for Puerto Rico reported the Commonwealth had $74 billion in bond debt and $49 billion in unfunded pension liabilities as of May 2017. Puerto Rico officially exited bankruptcy on March 15, 2022.

References

- ↑ Dick, Diane. "U.S. Tax Imperialism in Puerto Rico". American University Law Review. American University Law Review. Retrieved July 9, 2018.

- ↑ Denis, Nelson. "Tax All the Fat People: The History of Taxes in Puerto Rico". Latino Rebels. Retrieved July 9, 2018.