The Stamp Act of 1765 was an Act of the Parliament of Great Britain which imposed a direct tax on the British colonies in America and required that many printed materials in the colonies be produced on stamped paper produced in London, carrying an embossed revenue stamp. Printed materials included legal documents, magazines, playing cards, newspapers, and many other types of paper used throughout the colonies, and it had to be paid in British currency, not in colonial paper money.

The Inland Revenue was, until April 2005, a department of the British Government responsible for the collection of direct taxation, including income tax, national insurance contributions, capital gains tax, inheritance tax, corporation tax, petroleum revenue tax and stamp duty. More recently, the Inland Revenue also administered the Tax Credits schemes, whereby monies, such as Working Tax Credit (WTC) and Child Tax Credit (CTC), are paid by the Government into a recipient's bank account or as part of their wages. The Inland Revenue was also responsible for the payment of child benefit.

The Townshend Acts were a series of British acts of Parliament passed during 1767 and 1768 relating to the British colonies in America. They are named after Charles Townshend, the Chancellor of the Exchequer who proposed the program. Historians vary slightly as to which acts they include under the heading "Townshend Acts", but five are often listed:

A stamp act is any legislation that requires a tax to be paid on the transfer of certain documents. Those who pay the tax receive an official stamp on their documents, making them legal documents. A variety of products have been covered by stamp acts including playing cards, dice, patent medicines, cheques, mortgages, contracts, marriage licenses and newspapers. The items often have to be physically stamped at approved government offices following payment of the duty, although methods involving annual payment of a fixed sum or purchase of adhesive stamps are more practical and common.

State Street Bank and Trust Company v. Signature Financial Group, Inc., 149 F.3d 1368, also referred to as State Street or State Street Bank, was a 1998 decision of the United States Court of Appeals for the Federal Circuit concerning the patentability of business methods. State Street for a time established the principle that a claimed invention was eligible for protection by a patent in the United States if it involved some practical application and, in the words of the State Street opinion, "it produces a useful, concrete and tangible result."

A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to collect taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. In the United States it is also known as a Tax Identification Number or Federal Taxpayer Identification Number. A TIN may be assigned by the Social Security Administration or by the Internal Revenue Service (IRS).

An excise or excise tax is any duty on manufactured goods which is levied at the moment of manufacture, rather than at sale. Excises are often associated with customs duties ; customs are levied on goods which come into existence – as taxable items – at the border, while excise is levied on goods which came into existence inland.

Head v. Amoskeag Mfg. Co., 113 U.S. 9 (1885), was a U.S. Supreme Court case considering whether a dam constructed on privately owned land served a public purpose and whether having the owner of the dam compensate any adjacent landowner was a legal form of eminent domain.

A tax patent is a patent that discloses and claims a system or method for reducing or deferring taxes. Tax patents have been granted predominantly in the United States but can be granted in other countries as well. They are considered to be a form of business method patent. They are also called "tax planning patents", "tax strategy patents", and "tax shelter patents". In September 2011, President Barack Obama signed legislation passed by the U.S. Congress that effectively prohibits the granting of tax patents in general.

Lucas v. Earl, 281 U.S. 111 (1930), is a United States Supreme Court case concerning U.S. Federal income taxation, about a man who reported only half of his earnings for years 1920 and 1921. Earl C. Guy and his wife had entered into a contract that would potentially save a lot of tax. The contract specified that earnings were owned by the couple as joint tenants. It is unlikely that it was tax-motivated, since there was no income tax in 1901 when they executed the contract. Justice Oliver Wendell Holmes, Jr. delivered the Court’s opinion which generally stands for the proposition that income from services is taxed to the party who performed the services. The case is used to support the proposition that the substance of the transaction, rather than the form, is controlling for tax purposes.

United States v. Jordan, 113 U.S. 418 (1885), was a case regarding an Act of Congress that provided for the refunding to the persons therein named of the amount of taxes assessed upon and collected from them contrary to the provisions of the regulations therein mentioned. In other words, pay to each of such persons the sum set opposite his name, each of them is entitled to be paid the whole of that sum, and no discretion is vested in the Secretary of the Treasury or in any court to determine whether the sum specified was or was not the amount of a tax assessed contrary to the provisions of such regulations.

Prentice v. Stearns, 113 U.S. 435 (1885), was an action to recover possession of real estate and damages for its detention, the plaintiff in error being plaintiff below, and a citizen of Ohio, the defendant being a citizen of Minnesota, specifically recovery of real estate deeded from an Indian chief to A, in 1858, of a tract described by metes and bounds and further as:

being the land set off to the Indian Chief Buffalo at the Indian Treaty of September 30, 1854, and was afterwards disposed of by said Buffalo to said A, and is now recorded with the government documents

The American Brass Company was an American brass manufacturing company based in Connecticut and active from 1893 to 1960. The company's predecessors were the Wolcottville Brass Company and the Ansonia Brass and Battery Company. It was the first large brass manufacturing firm in the United States, and for much of its existence was the largest brass manufacturer in the country. It was purchased by the Anaconda Copper Company in 1922, and merged into Anaconda's other brass manufacturing concerns in 1960.

United States v. Indianapolis & St. Louis Railroad Co., 113 U.S. 711 (1885), regarded a suit that was brought to foreclose mortgages given to secure bonds issued by the Indianapolis and St. Louis Railroad Company. A final decree of foreclosure having been passed, the mortgaged property was sold, and the sale was confirmed by the court. The United States intervened by petition, and asked that certain sums, alleged to be due to the government on account of taxes, be first paid out of the proceeds.

The Braintree Instructions was a document sent on September 24, 1765 by the town meeting of Braintree, Massachusetts to the town's representative at the Massachusetts General Court, or legislature, which instructed the representative to oppose the Stamp Act, a tax regime which had recently been adopted by the British Parliament in London. The document is significant because, following the Virginia Resolves, it was among the earliest in British America to officially reject the authority of Parliament over the colonies in North America. The instructions were written by John Adams, who would ten years later become a key figure in the American Revolution and ultimately be elected the second President of the United States in 1796.

The first revenue stamps in the United States were used briefly during colonial times, among the most notable usage involved the Stamp Act. Long after independence, the first revenue stamps printed by the United States government were issued in the midst of the American Civil War, prompted by the urgent need to raise revenue to pay for the great costs it incurred. After the war ended however, revenue stamps and the taxes they represented still continued. Revenue stamps served to pay tax duties on items that came under two main categories, Proprietary and Documentary. Proprietary stamps paid tax duties on goods like alcohol and tobacco, and were also used for various services, while Documentary stamps paid duties on legal documents, mortgage deeds, stocks and a fair number of other legal dealings. Proprietary and Documentary stamps often bore these respective designations, while in several of the issues they shared the same designs, sometimes with minor variations. Beginning in 1862 the first revenue stamps were issued, and would continue to be used for another hundred years and more. For the first twelve years George Washington was the only subject featured on U.S. revenue stamps, when in 1875 an allegorical figure of Liberty finally appeared. Revenue stamps were printed in many varieties and denominations and are widely sought after by collectors and historians. Revenue stamps were finally discontinued on December 31, 1967.

The economics of science aims to understand the impact of science on the advance of technology, to explain the behavior of scientists, and to understand the efficiency or inefficiency of scientific institutions and markets.

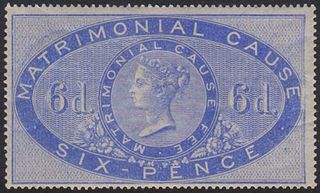

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

The Australian state of Western Australia issued revenue stamps from 1881 to 1973. There were various types for different taxes.