In economics and finance, arbitrage is the practice of taking advantage of a difference in prices in two or more markets – striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles.

In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.

Blockbuster is an American multimedia brand and former rental store chain. The business was founded by David Cook in 1985 as a single home video rental shop, but later became a public store chain featuring video game rentals, DVD-by-mail, streaming, video on demand, and cinema theater. The logo was designed by Lee Dean at the Rominger Agency. The company expanded internationally throughout the 1990s. At its peak in 2004, Blockbuster employed 84,300 people worldwide and operated 9,094 stores.

Black Monday was the global, severe and largely unexpected stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

The ex-dividend date is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. The opening price on the ex-dividend date, in comparison to the previous closing price, can be expected to decrease by the amount of the dividend, although this change may be obscured by other influences on the stock's value.

Stock Generation (SG) was a Ponzi scheme operated by SG Ltd. that operated on the Internet from 1998 to early 2000. Stock Generation allowed people to trade "virtual companies" using real money and promised unsustainably high returns on investment.

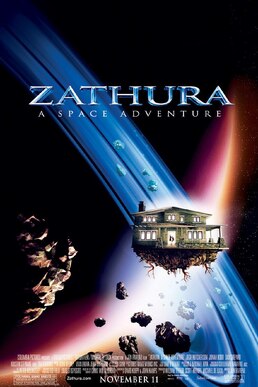

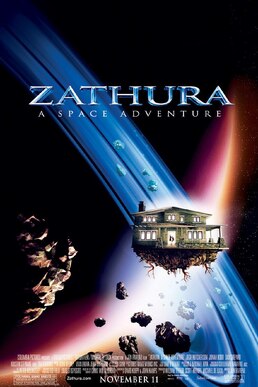

Zathura: A Space Adventure is a 2005 American science fiction action-adventure film directed by Jon Favreau. It is an adaptation of the 2002 children's book Zathura by Chris Van Allsburg, author of the 1981 children's book Jumanji. It is a standalone spin-off of the 1995 film Jumanji and the second installment of the Jumanji franchise. The film stars Josh Hutcherson, Jonah Bobo, Dax Shepard, Kristen Stewart, and Tim Robbins.

Ho Chi Minh Stock Exchange, formerly the HCMC Securities Trading Center (HoSTC), is a stock exchange in Ho Chi Minh City, Vietnam. It was established in 1998 under Decision No. 127/1998/QD-TTg of the Prime Minister of Vietnam. HCM Securities Trading Center officially opened on July 20, 2000, and had its first trading session on July 28, 2000, with two listed companies and six security company members.

A stock market simulator is computer software that reproduces behavior and features of a stock market, so that a user may practice trading stocks without financial risk. Paper trading, sometimes also called "virtual stock trading", is a simulated trading process in which would-be investors can practice investing without committing money.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option.

Popular Science Predictions Exchange (PPX) was an online virtual prediction market run as part of the Popular Science website. The application was designed by the same group behind the Hollywood Stock Exchange using their virtual specialist application. Users traded virtual currency, known as POP$, based on the likelihood of a certain event being realized by a given date. Stock prices would range between POP$0 and POP$100 and were intended to reflect the general confidence of the users about that event. A stock at price POP$95 would mean roughly that users believed there to be a 95% chance of the event happening. If an event was realized by the given date, the stock will pay out POP$100 per share. A stock that did not occur by the closing date was worth POP$0 per share.

Microcap stock fraud is a form of securities fraud involving stocks of "microcap" companies, generally defined in the United States as those with a market capitalization of under $250 million. Its prevalence has been estimated to run into the billions of dollars a year. Many microcap stocks are penny stocks, which the SEC defines as a security that trades at less than $5 per share, is not listed on a national exchange, and fails to meet other specific criteria.

The simExchange is a web-based prediction market in which players use virtual money to buy and sell stocks and futures contracts in upcoming video game properties. The main purpose of the web site is to predict trends in the video game industry, particularly how upcoming products will sell and how they will be received by the critics. For those who do not participate in the prediction market, the web site is a database of sales forecasts and game quality forecasts that are updated in real-time. The web site also features a number of "Wisdom of the crowd"-type content collaboration and aggregation tools, including means for sharing information, articles, images, and videos about the games.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis.

Timothy Maxwell Keiser is an American-Salvadoran broadcaster and film maker. He hosted Keiser Report, a financial program broadcast on RT that featured heterodox economics theories. Until November 2012, Keiser anchored On the Edge, a program of news and analysis hosted by Iran's Press TV. He hosted the New Year's Eve special The Keiser's Business Guide to 2010 for BBC Radio 5 Live. Keiser had presented a season of The Oracle with Max Keiser on BBC World News in 2009. He produced and appeared in the TV series People & Power on the Al-Jazeera English network.

In finance, box office futures is a type of futures contract in which investors speculate on upcoming movies based on their predicted performance.

John Antioco is an American businessman, known for being the former CEO of the now bankrupt Blockbuster Video who missed an opportunity to purchase Netflix before it became a multi-billion dollar streaming platform. He is now chairman of the board of directors at BRIX Holdings LLC and the Managing Partner of JAMCO Interests LLC.