Finance is a term for matters regarding the management, creation, and study of money and investments. Specifically, it deals with the questions of how and why an individual, company or government acquire the money needed – called capital in the company context – and how they spend or invest that money. Finance is then often split into the following major categories: corporate finance, personal finance and public finance.

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity.

Franco Modigliani was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon University, and MIT Sloan School of Management.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere.

Private equity (PE) typically refers to investment funds, generally organized as limited partnerships, that buy and restructure companies that are not publicly traded.

The Modigliani–Miller theorem is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how that firm is financed. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing stock or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle.

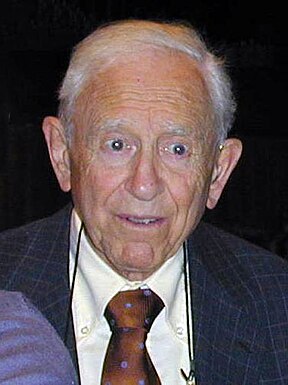

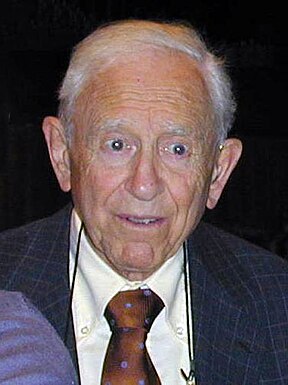

Merton Howard Miller was an American economist, and the co-author of the Modigliani–Miller theorem (1958), which proposed the irrelevance of debt-equity structure. He shared the Nobel Memorial Prize in Economic Sciences in 1990, along with Harry Markowitz and William F. Sharpe. Miller spent most of his academic career at the University of Chicago's Booth School of Business.

In economics and accounting, the cost of capital is the cost of a company's funds, or, from an investor's point of view "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet.

Capital structure in corporate finance is the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt, and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible.

In finance, leverage is any technique involving using debt rather than fresh equity in the purchase of an asset, with the expectation that the after-tax profit to equity holders from the transaction will exceed the borrowing cost, frequently by several multiples — hence the provenance of the word from the effect of a lever in physics, a simple machine which amplifies the application of a comparatively small input force into a correspondingly greater output force. Normally, the lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan.

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of equity for debt

The following outline is provided as an overview of and topical guide to finance:

The dividend puzzle is a concept in finance in which companies that pay dividends are rewarded by investors with higher valuations, even though, according to many economists, it should not matter to investors whether a firm pays dividends or not. The reasoning goes that dividends, from the investor’s point of view, should have no effect on the process of valuing equity because the investor already owns the firm and, thus, he/she should be indifferent to either getting the dividends or having them re-invested in the firm. Another reason for economists to be puzzled is that equity holders pay a higher tax rate on dividend payouts compared to capital gains from the firm repurchasing shares as an alternative payout policy.

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. For example, because interest on debt is a tax-deductible expense, taking on debt creates a tax shield. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation.

The trade-off theory of capital structure is the idea that a company chooses how much debt finance and how much equity finance to use by balancing the costs and benefits. The classical version of the hypothesis goes back to Kraus and Litzenberger who considered a balance between the dead-weight costs of bankruptcy and the tax saving benefits of debt. Often agency costs are also included in the balance. This theory is often set up as a competitor theory to the pecking order theory of capital structure. A review of the trade-off theory and its supporting evidence is provided by Ai, Frank, and Sanati.

Within the theory of corporate finance, bankruptcy costs of debt are the increased costs of financing with debt instead of equity that result from a higher probability of bankruptcy. The fact that bankruptcy is generally a costly process in itself and not only a transfer of ownership implies that these costs negatively affect the total value of the firm. These costs can be thought of as a financial cost, in the sense that the cost of financing increases because the probability of bankruptcy increases. One way to understand this is to realize that when a firm goes bankrupt investors holding its debt are likely to lose part or all of their investment, and therefore investors require a higher rate of return when investing in bonds of a firm that can easily go bankrupt. This implies that an increase in debt which ends up increasing a firm's bankruptcy probability causes an increase in these bankruptcy costs of debt.

In corporate finance, Hamada’s equation, named after Robert Hamada, is used to separate the financial risk of a levered firm from its business risk. The equation combines the Modigliani–Miller theorem with the capital asset pricing model. It is used to help determine the levered beta and, through this, the optimal capital structure of firms.

In finance, the capital structure substitution theory (CSS) describes the relationship between earnings, stock price and capital structure of public companies. The CSS theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share (EPS) are maximized. Managements have an incentive to do so because shareholders and analysts value EPS growth. The theory is used to explain trends in capital structure, stock market valuation, dividend policy, the monetary transmission mechanism, and stock volatility, and provides an alternative to the Modigliani–Miller theorem that has limited descriptive validity in real markets. The CSS theory is only applicable in markets where share repurchases are allowed. Investors can use the CSS theory to identify undervalued stocks.

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage. Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit and influenced by the company's long-term earning power. When cash surplus exists and is not needed by the firm, then management is expected to pay out some or all of those surplus earnings in the form of cash dividends or to repurchase the company's stock through a share buyback program.

Corporate finance is the area of finance that deals with sources of funding, the capital structure of corporations, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value.