Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

In law and insurance, a proximate cause is an event sufficiently related to an injury that the courts deem the event to be the cause of that injury. There are two types of causation in the law: cause-in-fact, and proximate cause. Cause-in-fact is determined by the "but for" test: But for the action, the result would not have happened. The action is a necessary condition, but may not be a sufficient condition, for the resulting injury. A few circumstances exist where the but-for test is ineffective. Since but-for causation is very easy to show, a second test is used to determine if an action is close enough to a harm in a "chain of events" to be legally valid. This test is called proximate cause. Proximate cause is a key principle of insurance and is concerned with how the loss or damage actually occurred. There are several competing theories of proximate cause. For an act to be deemed to cause a harm, both tests must be met; proximate cause is a legal limitation on cause-in-fact.

A tort is a civil wrong, other than breach of contract, that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishable by the state. While criminal law aims to punish individuals who commit crimes, tort law aims to compensate individuals who suffer harm as a result of the actions of others. Some wrongful acts, such as assault and battery, can result in both a civil lawsuit and a criminal prosecution in countries where the civil and criminal legal systems are separate. Tort law may also be contrasted with contract law, which provides civil remedies after breach of a duty that arises from a contract. Obligations in both tort and criminal law are more fundamental and are imposed regardless of whether the parties have a contract.

The tobacco industry comprises those persons and companies who are engaged in the growth, preparation for sale, shipment, advertisement, and distribution of tobacco and tobacco-related products. It is a global industry; tobacco can grow in any warm, moist environment, which means it can be farmed on all continents except Antarctica.

A lawsuit is a proceeding by one or more parties against one or more parties in a civil court of law. The archaic term "suit in law" is found in only a small number of laws still in effect today. The term "lawsuit" is used with respect to a civil action brought by a plaintiff who requests a legal remedy or equitable remedy from a court. The defendant is required to respond to the plaintiff's complaint or else risk default judgment. If the plaintiff is successful, judgment is entered in favor of the plaintiff, and the Court may impose the legal and/or equitable remedies available against the defendant (respondent). A variety of court orders may be issued in connection with or as part of the judgment to enforce a right, award damages or restitution, or impose a temporary or permanent injunction to prevent an act or compel an act. A declaratory judgment may be issued to prevent future legal disputes.

In a civil proceeding or criminal prosecution under the common law or under statute, a defendant may raise a defense in an effort to avert civil liability or criminal conviction. A defense is put forward by a party to defeat a suit or action brought against the party, and may be based on legal grounds or on factual claims.

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is referred to as the "ceding company" or "cedent". The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes or wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes.

In law, liable means "responsible or answerable in law; legally obligated". Legal liability concerns both civil law and criminal law and can arise from various areas of law, such as contracts, torts, taxes, or fines given by government agencies. The claimant is the one who seeks to establish, or prove, liability.

Deep pocket is an American slang term; it usually means "extensive financial wealth or resources". It is typically used in reference to big companies or organizations, although it can be used in reference to wealthy individuals.

Liability insurance is a part of the general insurance system of risk financing to protect the purchaser from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy.

English tort law concerns the compensation for harm to people's rights to health and safety, a clean environment, property, their economic interests, or their reputations. A "tort" is a wrong in civil law, rather than criminal law, that usually requires a payment of money to make up for damage that is caused. Alongside contracts and unjust enrichment, tort law is usually seen as forming one of the three main pillars of the law of obligations.

Directors and officers liability insurance is liability insurance payable to the directors and officers of a company, or to the organization itself, as indemnification (reimbursement) for losses or advancement of defense costs in the event an insured suffers such a loss as a result of a legal action brought for alleged wrongful acts in their capacity as directors and officers. Such coverage may extend to defense costs arising from criminal and regulatory investigations or trials as well; in fact, often civil and criminal actions are brought against directors and officers simultaneously. Intentional illegal acts, however, are typically not covered under D&O policies.

Personal injury is a legal term for an injury to the body, mind, or emotions, as opposed to an injury to property. In common law jurisdictions the term is most commonly used to refer to a type of tort lawsuit in which the person bringing the suit has suffered harm to their body or mind. Personal injury lawsuits are filed against the person or entity that caused the harm through negligence, gross negligence, reckless conduct, or intentional misconduct, and in some cases on the basis of strict liability. Different jurisdictions describe the damages in different ways, but damages typically include the injured person's medical bills, pain and suffering, and diminished quality of life.

Conflict of laws in the United States is the field of procedural law dealing with choice of law rules when a legal action implicates the substantive laws of more than one jurisdiction and a court must determine which law is most appropriate to resolve the action. In the United States, the rules governing these matters have diverged from the traditional rules applied internationally. The outcome of this process may require a court in one jurisdiction to apply the law of a different jurisdiction.

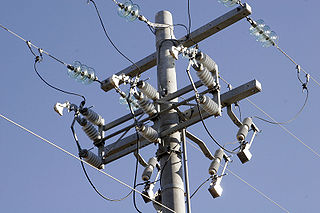

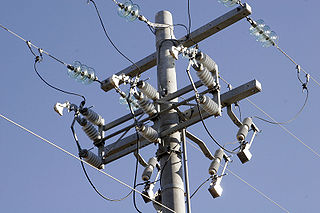

Forensic electrical engineering is a branch of forensic engineering, and is concerned with investigating electrical failures and accidents in a legal context. Many forensic electrical engineering investigations apply to fires suspected to be caused by electrical failures. Forensic electrical engineers are most commonly retained by insurance companies or attorneys representing insurance companies, or by manufacturers or contractors defending themselves against subrogation by insurance companies. Other areas of investigation include accident investigation involving electrocution, and intellectual property disputes such as patent actions. Additionally, since electrical fires are most often cited as the cause for "suspect" fires an electrical engineer is often employed to evaluate the electrical equipment and systems to determine whether the cause of the fire was electrical in nature.

Tort reform consists of changes in the civil justice system in common law countries that aim to reduce the ability of plaintiffs to bring tort litigation or to reduce damages they can receive. Such changes are generally justified under the grounds that litigation is an inefficient means to compensate plaintiffs; that tort law permits frivolous or otherwise undesirable litigation to crowd the court system; or that the fear of litigation can serve to curtail innovation, raise the cost of consumer goods or insurance premiums for suppliers of services, and increase legal costs for businesses. Tort reform has primarily been prominent in common law jurisdictions, where criticism of judge-made rules regarding tort actions manifests in calls for statutory reform by the legislature.

Professional liability insurance (PLI), also called professional indemnity insurance (PII) but more commonly known as errors & omissions (E&O) in the US, is a form of liability insurance which helps protect professional advising, consulting, and service-providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client in a civil lawsuit. The coverage focuses on alleged failure to perform on the part of, financial loss caused by, and error or omission in the service or product sold by the policyholder. These are causes for legal action that would not be covered by a more general liability insurance policy which addresses more direct forms of harm. Professional liability insurance may take on different forms and names depending on the profession, especially medical and legal, and is sometimes required under contract by other businesses that are the beneficiaries of the advice or service.

In insurance policies, an additional insured is a person or organization who enjoys the benefits of being insured under an insurance policy, in addition to whoever originally purchased the insurance policy. The term generally applies within liability insurance and property insurance, but is an element of other policies as well. Most often it applies where the original named insured needs to provide insurance coverage to additional parties so that they enjoy protection from a new risk that arises out of the original named insured's conduct or operations. An additional insured often gains this status by means of an endorsement added to the policy which either identifies the additional party by name or by a general description contained in a "blanket additional insured endorsement".

Chandler v Cape plc [2012] EWCA Civ 525 is a decision of the Court of Appeal which addresses the availability of damages for a tort victim from a parent company, in circumstances where the victim suffered industrial injury during employment by a subsidiary company.

Increases in the use of autonomous car technologies are causing incremental shifts in the responsibility of driving, with the primary motivation of reducing the frequency of traffic collisions. Liability for incidents involving self-driving cars is a developing area of law and policy that will determine who is liable when a car causes physical damage to persons or property. As autonomous cars shift the responsibility of driving from humans to autonomous car technology, there is a need for existing liability laws to evolve to reasonably identify the appropriate remedies for damage and injury. As higher levels of autonomy are commercially introduced, the insurance industry stands to see higher proportions of commercial and product liability lines of business, while the personal automobile insurance line of business shrinks.