Related Research Articles

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world."

Special drawing rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). SDRs are units of account for the IMF, and not a currency per se. They represent a claim to currency held by IMF member countries for which they may be exchanged. SDRs were created in 1969 to supplement a shortfall of preferred foreign exchange reserve assets, namely gold and U.S. dollars. The ISO 4217 currency code for special drawing rights is XDR and the numeric code is 960.

Joseph Eugene Stiglitz is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is a former senior vice president and chief economist of the World Bank. He is also a former member and chairman of the US Council of Economic Advisers. He is known for his support for the Georgist public finance theory and for his critical view of the management of globalization, of laissez-faire economists, and of international institutions such as the International Monetary Fund and the World Bank.

Neoliberalism is both a political philosophy and a term used to signify the late-20th-century political reappearance of 19th-century ideas associated with free-market capitalism. The term has multiple, competing definitions, and is often used pejoratively. In scholarly use, the term is often left undefined or used to describe a multitude of phenomena; however, it is primarily employed to delineate the societal transformation resulting from market-based reforms.

The IMF and World Bank meet each autumn in what is officially known as the Annual Meetings of the International Monetary Fund and the World Bank Group and each spring in the Spring Meetings of the International Monetary Fund and the World Bank Group. Names of the two groups are alternated each year so a different one has top billing.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to regulate what would be the international monetary and financial order after the conclusion of World War II., likewise with adjusting its proponents.

The Washington Consensus is a set of ten economic policy prescriptions considered in the 1980s and 1990s to constitute the "standard" reform package promoted for crisis-wracked developing countries by the Washington, D.C.-based institutions the International Monetary Fund (IMF), World Bank and United States Department of the Treasury. The term was first used in 1989 by English economist John Williamson. The prescriptions encompassed free-market promoting policies such as trade liberalization, privatization and finance liberalization. They also entailed fiscal and monetary policies intended to minimize fiscal deficits and minimize inflation.

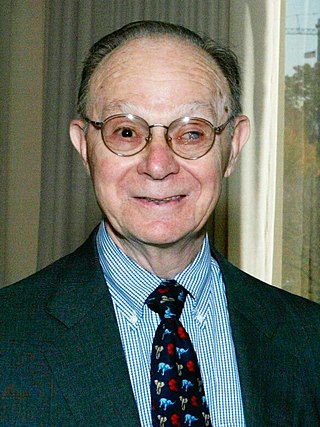

John Harold Williamson was a British-born economist who coined the term Washington Consensus. He served as a senior fellow at the Peterson Institute for International Economics from 1981 until his retirement in 2012. During that time, he was the project director for the United Nations High-Level Panel on Financing for Development in 2001. He was also on leave as chief economist for South Asia at the World Bank during 1996–99, adviser to the International Monetary Fund from 1972 to 1974, and an economic consultant to the UK Treasury from 1968 to 1970. He was also an economics professor at Pontifícia Universidade Católica do Rio de Janeiro (1978–81), University of Warwick (1970–77), Massachusetts Institute of Technology, University of York (1963–68) and Princeton University (1962–63).

Structural adjustment programs (SAPs) consist of loans provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their stated purpose is to adjust the country's economic structure, improve international competitiveness, and restore its balance of payments.

Mark Alan Weisbrot is an American economist and columnist. He is co-director with Dean Baker of the Center for Economic and Policy Research (CEPR) in Washington, D.C. Weisbrot is President of Just Foreign Policy, a non-governmental organization dedicated to reforming United States foreign policy.

David Woodward is a British economist and economic advisor.

Allan H. Meltzer was an American economist and Allan H. Meltzer Professor of Political Economy at Carnegie Mellon University's Tepper School of Business and Institute for Politics and Strategy in Pittsburgh, Pennsylvania. Meltzer specialized on studying monetary policy and the Federal Reserve System, and authored several academic papers and books on the development and applications of monetary policy, and about the history of central banking in the United States.

Profit Over People: Neoliberalism and Global Order is a 1999 book by Noam Chomsky, published by Seven Stories Press. It contains his critique of neoliberalism.

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

J. Richard Peet is a retired professor of human geography at the Graduate School of Geography at Clark University in Worcester MA, USA. Peet received a BSc (Economics) from the London School of Economics, an M.A. from the University of British Columbia, and moved to the USA in the mid-1960s to complete a PhD in Geography from the University of California, Berkeley. He began teaching at Clark University shortly after completing his PhD from Berkeley, remained there for over 50 years, with secondments in Australia, Sweden and New Zealand. He was 'forced' into retirement in 2019, when 79 years old.

The anti-globalization movement, or counter-globalization movement, is a social movement critical of economic globalization. The movement is also commonly referred to as the global justice movement, alter-globalization movement, anti-globalist movement, anti-corporate globalization movement, or movement against neoliberal globalization. There are many definitions of anti-globalization.

Adam Lerrick is an American economist and politician who served as Counselor to the Secretary of the Treasury, and was previously Donald Trump's nominee for Assistant Secretary of the Treasury for International Finance. Lerrick is also an economist at the American Enterprise Institute.

Czech Republic and the International Monetary Fund are the international relations between the Czech Republic and the International Monetary Fund (IMF). The Czech Republic became a member of the International Monetary Fund in January 1993. The Czech Republic has no outstanding loans after paying of all debts to the International Monetary Fund in 1994 and achieved proper currency convertibility in compliance with Article VIII of the Agreement on 1 October 1995.

References

- ↑ Soederberg, Susanne (2005). "Recasting Neoliberal Dominance in the Global South? A Critique of the Monterrey Consensus". Alternatives. 30 (3): 349. doi:10.1177/030437540503000304. S2CID 145322307.

- ↑ "Rescuing the World Bank".

- ↑ Soederberg, Susanne (2005). "Recasting Neoliberal Dominance in the Global South? A Critique of the Monterrey Consensus". Alternatives. 30 (3): 340. doi:10.1177/030437540503000304. S2CID 145322307.