A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a state or formal monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks.

Special drawing rights (SDRs) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). SDRs are units of account for the IMF, and not a currency per se. They represent a claim to currency held by IMF member countries for which they may be exchanged. SDRs were created in 1969 to supplement a shortfall of preferred foreign exchange reserve assets, namely gold and U.S. dollars. The ISO 4217 currency code for special drawing rights is XDR and the numeric code is 960.

Since independence, the economy of Uzbekistan continues to exist as a Soviet-style command economy, with a slow transformation to a market economy. The progress of governmental economic policy reforms has been cautious, but cumulatively Uzbekistan has shown respectable achievements. Its restrictive trade regime and generally interventionist policies continue to have a negative effect on the economy. Substantial structural reform is needed, particularly in these areas: improving the investment climate for foreign investors, strengthening the banking system, and freeing the agricultural sector from state control. Remaining restrictions on currency conversion capacity and other government measures to control economic activity, including the implementation of severe import restrictions and sporadic closures of Uzbekistan's borders with neighboring Kazakhstan, Kyrgyzstan, and Tajikistan have led international lending organizations to suspend or scale back credits.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold foreign central banks, effectively ending the Bretton Woods system. Many states still hold substantial gold reserves.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

In international economics, the balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

Foreign Exchange Reserves are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

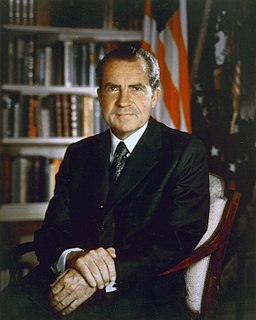

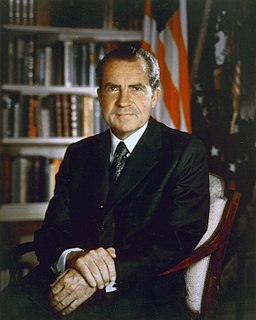

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

The Central Bank of Iran (CBI), also known as Bank Markazi, officially the Central Bank of the Islamic Republic of Iran is the central bank of Iran.

In international finance, a world currency, supranational currency, or global currency is a currency that would be transacted internationally, with no set borders.

The National Bank of the Kyrgyz Republic is the central bank of Kyrgyzstan and is primarily responsible for the strategic monetary policy planning of the country as well as the issuance of the national currency, the Som.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from the British pound sterling after the devastation of two world wars and the massive spending of Great Britain's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the U.S. dollar.

India has large foreign-exchange reserves; holdings of cash, bank deposits, bonds, and other financial assets denominated in currencies other than India's national currency, the Indian rupee. The reserves are managed by the Reserve Bank of India for the Indian government and the main component is foreign currency assets.